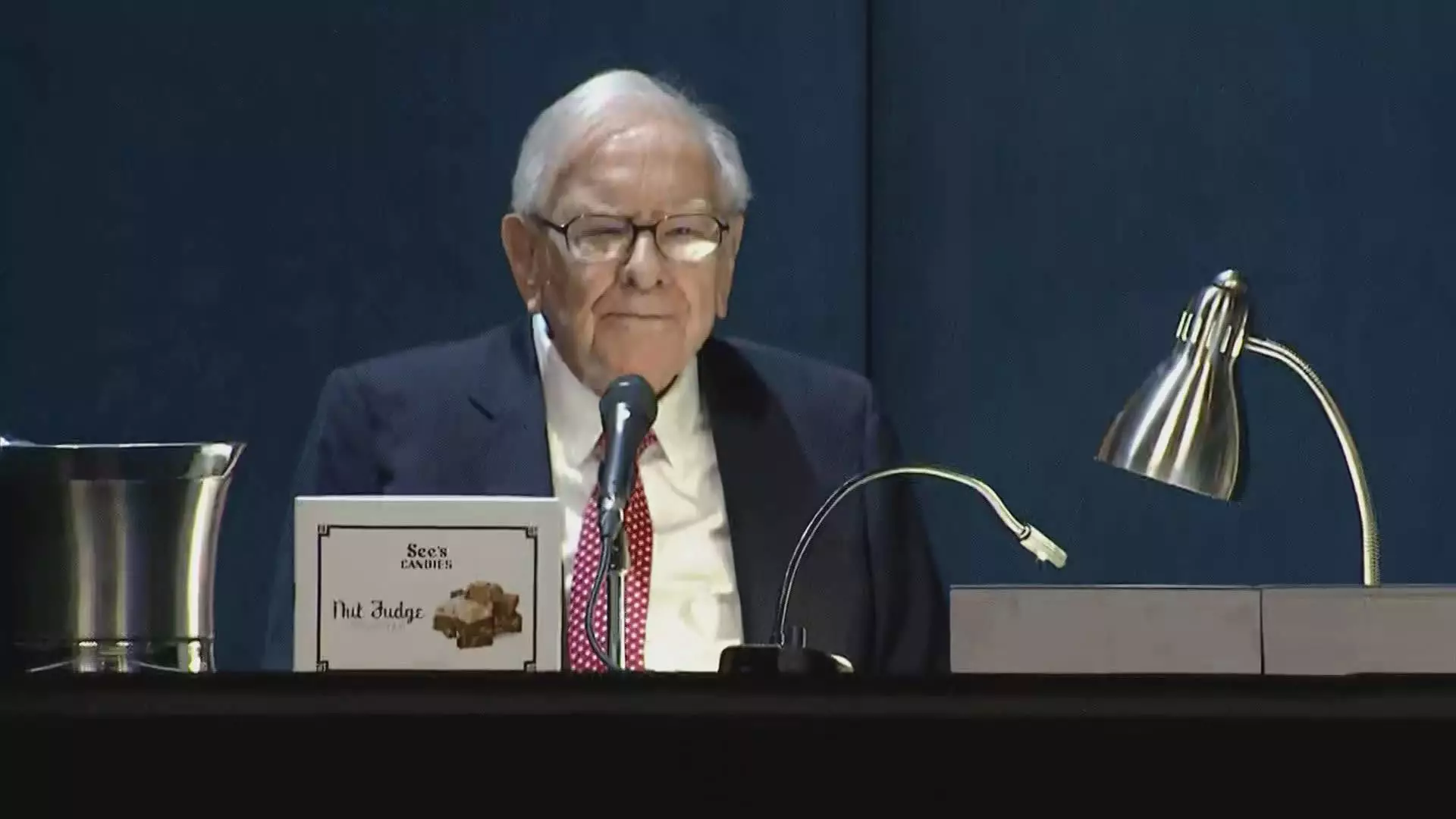

In a notable shift in investment strategy, Warren Buffett has been systematically reducing Berkshire Hathaway’s stake in Apple Inc., the conglomerate’s largest equity holding. The decision to trim this vital investment, now for the fourth consecutive quarter, underscores a significant change in Buffett’s approach to portfolio management and market conditions. The latest earnings report reveals that by the end of September, Berkshire’s Apple shares were valued at approximately $69.9 billion, reflecting a drastic reduction that indicates Buffett offloaded around a quarter of his holdings.

Berkshire Hathaway’s stakes in Apple have dwindled by an astounding 67.2% compared to a year earlier. This substantial decrease raises questions about the factors influencing such a pivotal decision. Initially, Buffett began offloading Apple stocks in late 2023, with a significant acceleration occurring in the second quarter of 2024, when he divested nearly half of the previously acquired shares. With around 300 million shares remaining in its portfolio, it’s apparent that Buffett’s long-standing love affair with Apple is undergoing a considerable reevaluation.

While the exact reasons for this strategic retreat remain somewhat nebulous, a few possibilities have emerged from analyst discussions and shareholder sentiments. One prevalent theory is the concern regarding Apple’s high valuation in an ever-changing market landscape. Buffett had articulated potential tax implications for capital gains under a future U.S. government dealing with fiscal challenges, suggesting that tax strategy might play a role in his decision.

Nevertheless, the sheer volume of the sales has led many to speculate that Buffett’s motivations extend beyond mere tax-saving maneuvers. The substantial size of Berkshire’s previous Apple holdings—once dominating fifty percent of its equity portfolio—has likely triggered a reevaluation of risk, leading Buffett to adopt a more diversified investment approach.

Buffett’s initial foray into technology stocks was a significant departure from his traditional investment philosophy. Historically, he had avoided tech companies, citing a lack of expertise in that sector. However, under the persuasion of key investment partners Ted Weschler and Todd Combs, Buffett embraced Apple, captivated by its robust customer loyalty and the stickiness of its products, particularly the iPhone. Over time, Apple transitioned from a significant investment to being viewed as nearly indispensable in Berkshire’s portfolio, even considered the second-most crucial business after its insurance operations.

As the divestment continues, it’s noteworthy that Berkshire Hathaway’s cash reserves have accrued to an impressive $325.2 billion—setting a record for the conglomerate. This financial cushion allows Buffett flexibility for future investments, signaling he may be positioning Berkshire to capitalize on emerging opportunities rather than being tied down by a single overvalued asset.

The Apple stock has shown resilience, gaining 16% this year, yet it still trails behind the S&P 500’s 20% uptick. This context raises further questions about the risks associated with heavy exposure to Apple and indicates that diversification may be a prudent strategy moving forward.

Warren Buffett’s ongoing divestiture from Apple illustrates a remarkable evolution in his investment strategy—one rooted in caution and pragmatism, striving for equilibrium in an unpredictable market. As he navigates these waters, the investment community watches closely, keenly aware that Buffett’s decisions often set the tone for broader market movements.