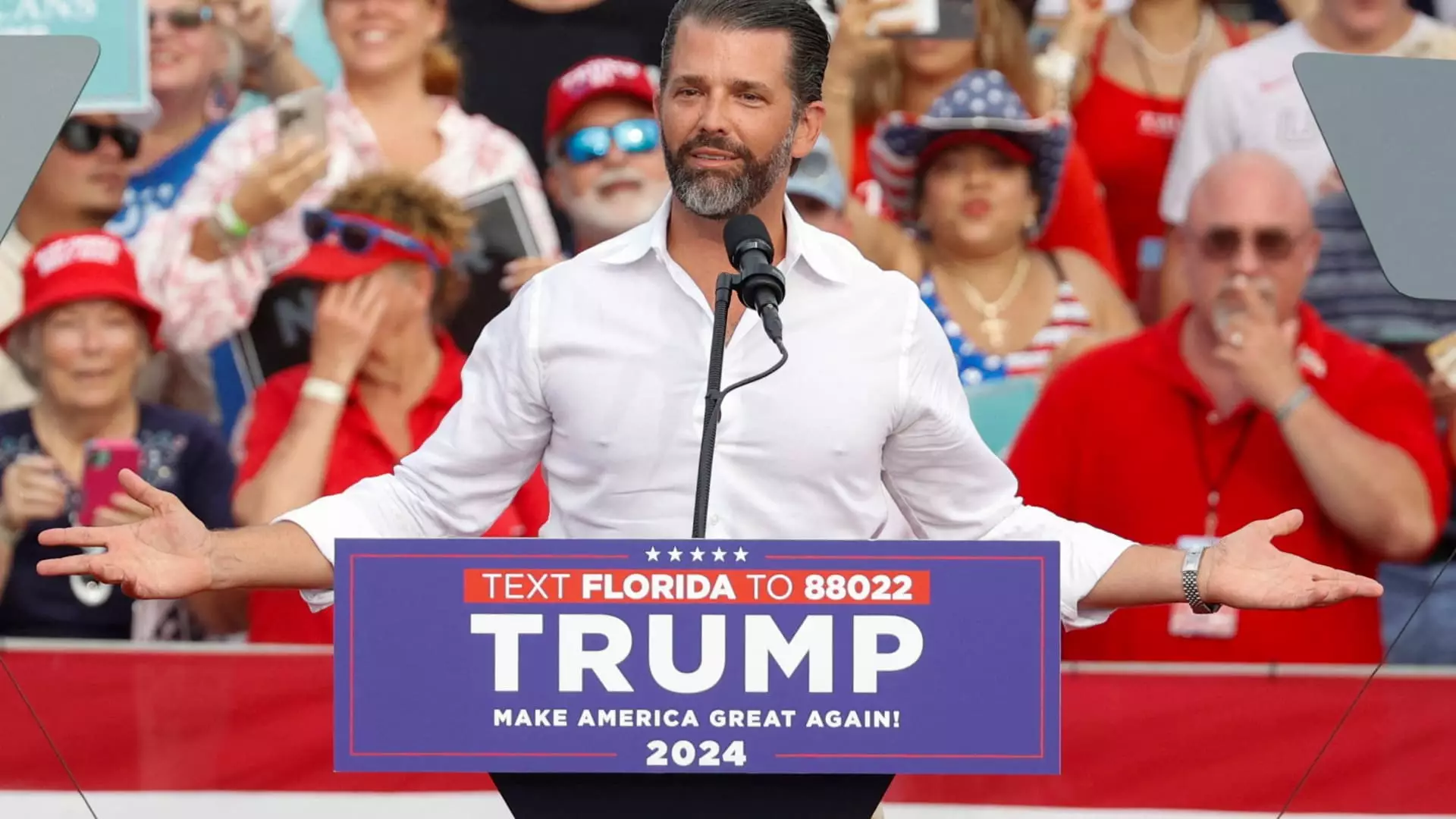

The announcement of Donald Trump Jr. taking a seat on the board of PublicSquare, the owner of PSQ Holdings, has triggered notable movement in the company’s stock price, illustrating the increasing interest from investors. The shares soared by an impressive 185% during afternoon trading, a testament to the potential impact of high-profile individuals in shaping market dynamics. This surge indicates a blend of political allegiance and investment strategy at play, as both Donald Trump Jr. and PublicSquare share a commitment to a market steeped in themes of personal liberty and conservative values.

As a microcap stock, PublicSquare’s market capitalization, which sat at approximately $72 million before the spike, reflects its status in the financial sector, often identified as high-risk but also potentially high-reward. The company focuses on an online marketplace centered around values such as “life, family, and liberty,” which resonates strongly with a specific consumer demographic seeking alternatives to mainstream platforms. Statements from CEO Michael Seifert convey confidence in Trump Jr.’s capacity to guide the company, emphasizing his prior investments and fervor for a “cancel-proof” economy, a phrase that signifies the growing trend of consumer resistance against companies perceived to have liberal biases.

While the excitement surrounding Trump Jr.’s appointment is palpable, it is essential to delve into the financial realities of PublicSquare. The recent quarterly earnings revealed net revenues of $6.5 million juxtaposed against operating losses surpassing $14 million—an alarming disparity that raises questions about the company’s sustainability. The sharp increase in stock price may provide a short-term boost, but for long-term investors, profitability remains paramount. This dichotomy indicates that the allure of an influential board member may not be enough to alter the company’s underlying operational challenges.

Broader Implications of Board Member Choices

PublicSquare is not alone in seeking the advantages that come with connecting to prominent figures in conservative circles. Just a week prior, Trump Jr. influenced the stock price of Unusual Machines, a drone manufacturing firm, illustrating a strategic pattern in his corporate engagements. This trend not only enhances the visibility of the companies he joins but also emphasizes the growing convergence of politics and business in a climate where consumer preferences are increasingly polarized.

The recent developments at PublicSquare serve as a microcosm of a broader shift in the marketplace, one where business decisions and political affiliations intertwine more deeply than ever. Kelly Loeffler’s notable stake in PublicSquare serves as an additional signal of confidence, suggesting that other investors are closely watching the unfolding scenario. As the company positions itself at the confluence of commerce and conservative ideology, its ability to convert the enthusiasm generated by board appointments into sustainable growth will be critical. The coming months will reveal whether the initial euphoria translates into genuine success or if the volatility of the market curtails what was once a promising economic narrative.