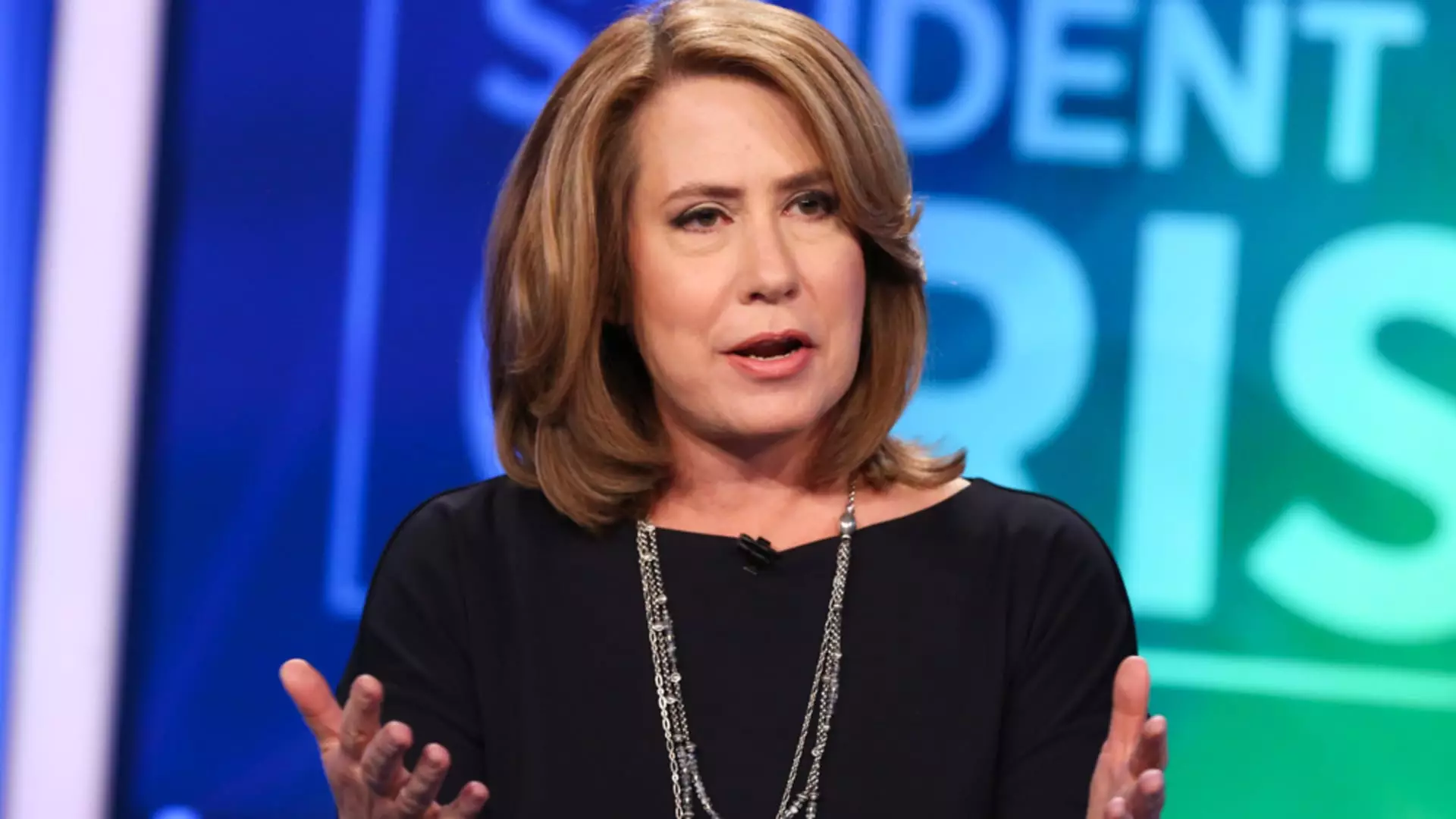

Sheila Bair, the former chair of the U.S. Federal Deposit Insurance Corp, is raising red flags about the upcoming regional bank earnings reports. She expressed her worries about certain regional banks being overly reliant on industry deposits, having concentrated commercial real estate exposure, and facing potential instability with uninsured deposits. Bair’s concerns stem from the unresolved issues that regional banks faced in 2023, and she is calling for Congress to reinstate the FDIC’s transaction account guarantee authority to stabilize these deposits. The fear of another bank failure looms large over the regional banking sector.

The SPDR S&P Regional Bank ETF (KRE) has experienced a downward trend in 2024, with only four of its members showing positive numbers. New York Community Bancorp has taken the biggest hit with a 71% decline, while other banks like Metropolitan Bank Holding Corp., Kearny Financial, Columbia Banking System, and Valley National Bancorp are down more than 30%. The main concern for Bair is the potential shock to uninsured deposits in case of a bank failure, posing a major challenge for regional banks.

The benchmark 10-year Treasury note yield has risen to over 4.6%, adding to the woes of regional banks. Higher yields could put additional stress on commercial real estate borrowers, a sector where regional banks have significant exposure. The upcoming wave of refinancing in commercial real estate coupled with rising interest rates may lead to more distress among borrowers struggling to make payments. This combination of factors further complicates the situation for regional banks.

Despite the challenges faced by regional banks, there may be a silver lining for larger institutions. Bair points out that the distress in regional banks could potentially benefit big money-center banks. As regional banks grapple with their vulnerabilities, larger institutions may see an influx of business and clients seeking stability and reliability. This shift in the banking landscape could result in a redistribution of power and influence within the financial sector.

The regional bank earnings reports are expected to reveal critical weaknesses within the sector. The concerns raised by Sheila Bair highlight the need for a comprehensive reassessment of the regional banking system to address these vulnerabilities and ensure financial stability moving forward. As the industry grapples with challenges such as commercial real estate exposure and uninsured deposits, it is imperative for regulators and policymakers to take proactive measures to safeguard the banking sector against potential crises.