Cody Gude, a 35-year-old social media consultant from Tampa, Florida, was eagerly anticipating a reduction in his student loan payments from $200 to $100. However, his hopes were dashed upon hearing the news that major parts of the Saving on a Valuable Education, or SAVE, plan were on hold. The temporary injunctions issued by federal judges in Kansas and Missouri have left millions of borrowers like Gude feeling disappointed and uncertain about the future.

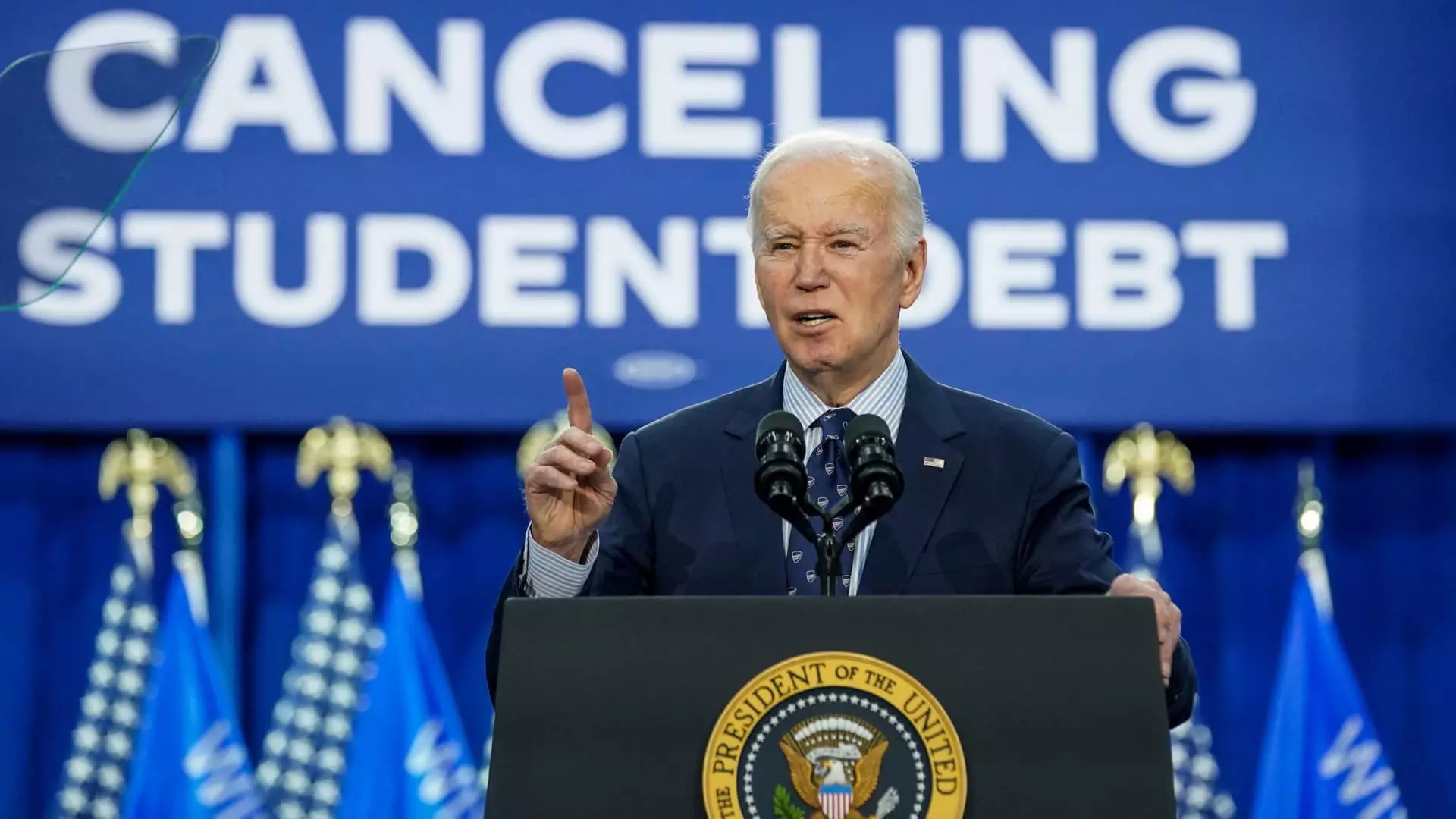

President Joe Biden introduced the SAVE plan last summer as a more affordable alternative to existing student loan repayment options. Under this plan, borrowers pay just 5% of their discretionary income towards their debt each month, as opposed to the previous 10% requirement. The plan also offers loan forgiveness after a shorter period, with some borrowers eligible for forgiveness in as little as 10 years. These generous terms have made the SAVE plan a popular choice among borrowers, with approximately 8 million individuals enrolling in the program so far.

Despite its popularity, the SAVE plan has faced legal challenges from several Republican-led states, including Florida, Arkansas, and Missouri. These states argue that the Biden administration exceeded its authority with the SAVE plan and sought to implement student debt forgiveness through regulatory changes rather than proper congressional authorization. The federal judges presiding over the cases have issued preliminary injunctions to pause certain aspects of the plan, citing concerns about the significant cost implications of the SAVE program compared to its predecessor.

Impact on Borrowers

The uncertainty surrounding the legal challenges to the SAVE plan has left borrowers in limbo. While some have already benefited from lower monthly payments under the program, others are unsure about whether these changes will be reversed. Borrowers like Gude have been left in the dark, unsure of what their future payments will look like and whether they will be subject to retroactive adjustments.

The legal battle over the SAVE plan is expected to be a lengthy process, with experts predicting that the cases may not be resolved until well past the upcoming election. The cases are likely to make their way to the Supreme Court, further delaying a final resolution. In the meantime, borrowers are advised to stay enrolled in the SAVE plan and prepare for the possibility of their payments reverting back to pre-SAVE levels.

The uncertainty surrounding the SAVE plan and the legal challenges it faces have created a sense of unease among student loan borrowers. While the program offers significant benefits, including lower monthly payments and faster loan forgiveness, the legal hurdles it currently faces have cast a shadow of doubt over its future. Borrowers like Cody Gude are left wondering whether they will ever see the relief they were promised under the SAVE plan. As the cases make their way through the legal system, borrowers can only wait and hope for a resolution that will provide them with the financial stability they seek.