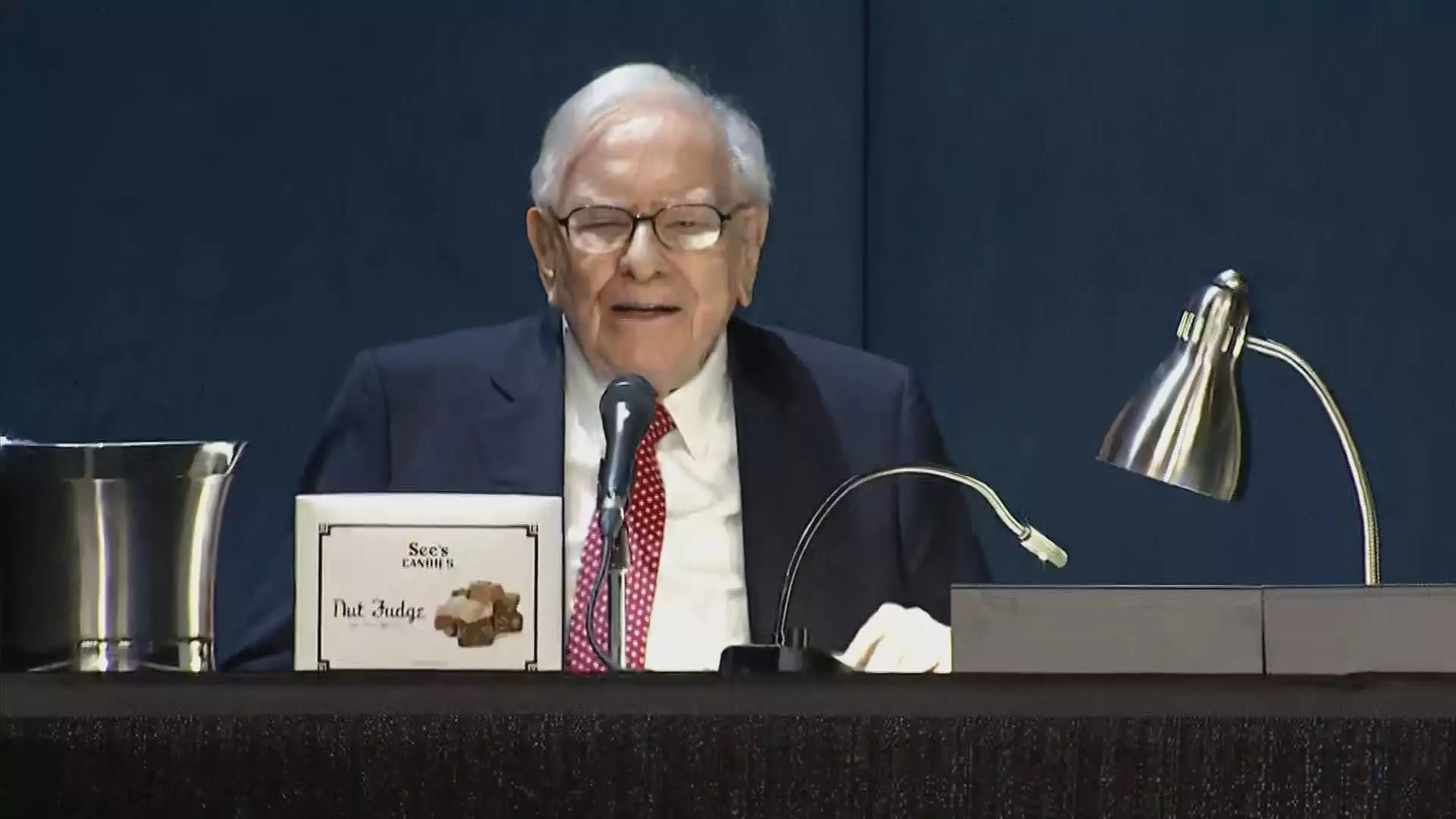

The financial markets are often influenced by the strategic decisions of major players, and few figures loom larger than Warren Buffett, the Chairman and CEO of Berkshire Hathaway. Recently, Buffett’s conglomerate has made headlines with the significant divestiture of shares in Bank of America (BofA), prompting discussions about the implications of such actions not just for the companies involved, but for the broader market and investment community.

Berkshire Hathaway has a longstanding association with Bank of America. Back in 2011, Buffett made headlines when he invested $5 billion into the bank in the form of preferred stock and warrants, during a tumultuous period marked by the financial crisis. This crucial investment not only enabled Bank of America to regain its footing but also cemented Buffett’s reputation as a savvy investor capable of identifying opportunities amidst chaos.

However, the recent trend of selling BofA shares marks a dramatic shift in strategy. By divesting over $7 billion since mid-July, Buffett has reduced Berkshire’s stake in BofA to 11%. This selling spree has been characterized by a consistent offloading of shares over twelve consecutive trading sessions, a notable strategy given Buffett’s typically long-term approach to investments. As of now, BofA ranks third on Berkshire’s list of major holdings, overtaken by Apple and American Express, which raises questions regarding the future trajectory of this partnership.

Despite Buffett’s strategic exits, the performance of Bank of America stock reveals a mildly positive trajectory. Since the outset of July, shares have only decreased by about 1%, and they have significantly outperformed the S&P 500 this year with an increase of 16.7%. While Buffett’s sales might imply a lack of confidence in BofA’s prospects, the reality is that the market appears to be absorbing the shares without dramatic fallout. Moreover, BofA shareholders and investors alike may recall that Buffett’s hefty investment not only stabilized the bank during critical times but also provided a solid foundation for the company’s recovery.

During a recent conference, BofA CEO Brian Moynihan commented on Buffett’s sale, revealing his lack of insight into Buffett’s motivations. This opaque communication raises an important point: how much influence does an investor like Buffett have on market perceptions and the behavior of a stock’s price? While Moynihan assured stakeholders that the market was healthy enough to withstand the fluctuations from Buffett’s sales, the sentiment among investors remained cautious, reflecting the uncertainty these moves injected into the dialogue surrounding BofA’s future.

Buffett’s actions go beyond the mere sale of shares; they represent a shift in investment strategy that might resonate with many institutional investors keeping a close watch on his movements. The increasingly cautious approach highlights the evolving dynamics of effective portfolio management and risk assessment in today’s fluctuating economic landscape.

Furthermore, the strategic precedent set by Buffett’s divestment raises crucial conversations around the importance of flexibility in investment strategies. The seemingly abrupt sales may encourage other investors to rethink their positions in traditional banking stocks, especially in the wake of potential economic downturns that could affect profitability and stock performance. Those looking to replicate Buffett’s investment acumen may need to consider a similar balance of courage and caution.

In the world of finance, Warren Buffett’s decisions carry weight, prompting reflection on market strategies and investment philosophies. The recent sale of Bank of America shares marks a pivotal moment in Buffett’s investment history, transforming expectations for stakeholders in the industry. As BofA navigates its path forward, the ramifications of Buffett’s maneuvers will likely endure, becoming the linchpin for investors seeking solace in a landscape rife with uncertainty. For followers of the Oracle of Omaha, these strategic decisions offer invaluable lessons in both the art of patience and the necessity of adaptability.