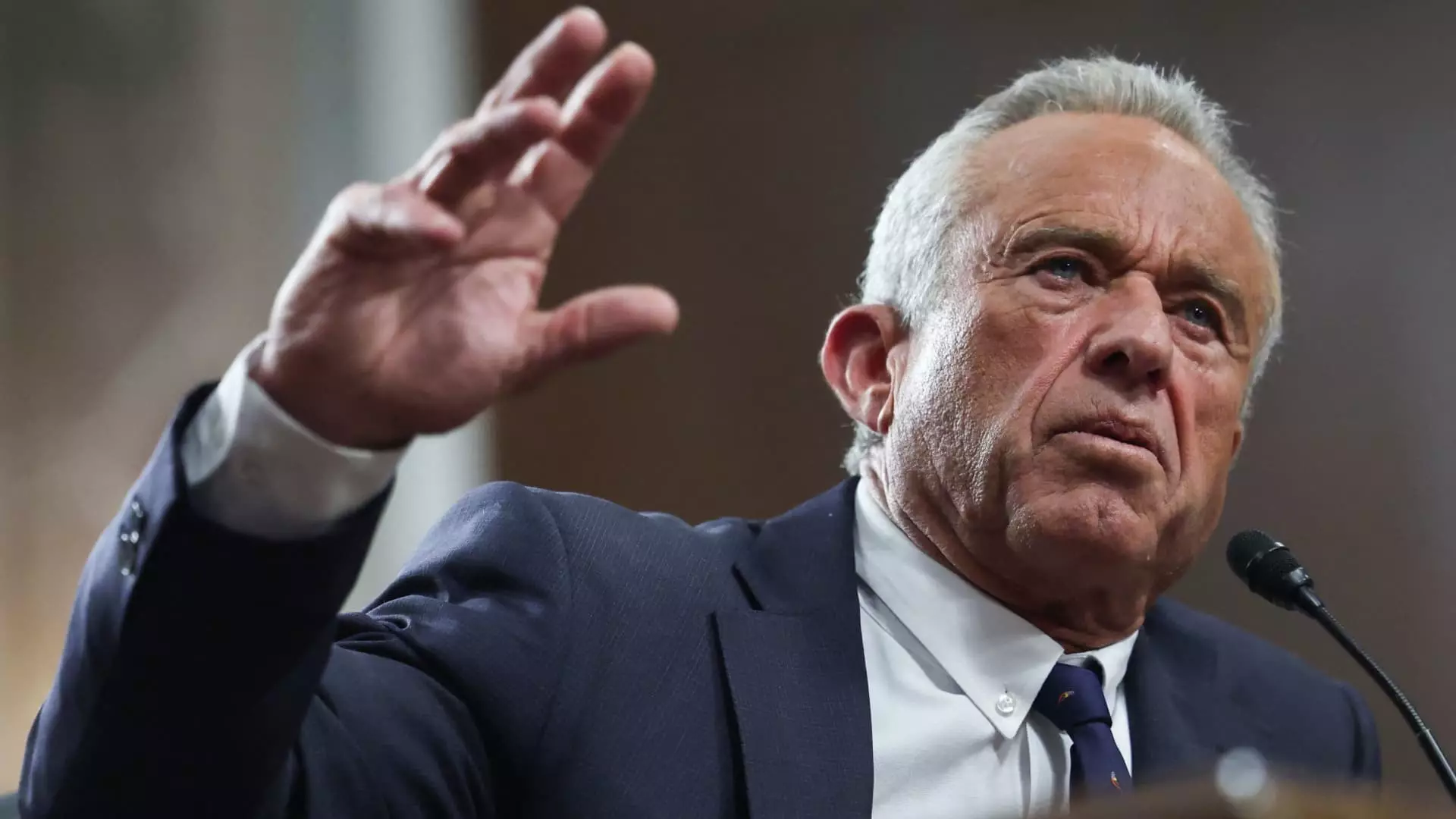

In 2024, America has witnessed a significant escalation in credit card balances, reaching a staggering $1.17 trillion. This unmanageable figure serves as a stark reminder of the financial challenges faced by consumers across the nation, cutting through socio-economic divides. Even those categorized as wealthy, like Robert F. Kennedy Jr., who has a net worth estimated at $30 million, are caught in this web of debt. His recent financial disclosures revealed that he carries between $610,000 and $1.2 million in credit card debt, a situation that raises fundamental questions about financially responsible behavior among affluent individuals.

Credit card debt has recently garnered attention not just for its numbers but for the implications it holds for individual financial health and the broader economy. Numerous financial professionals have pointed out that such high levels of debt are atypical, particularly for someone of Kennedy’s affluence. Ted Rossman, a senior industry analyst, remarked that to hold such a vast amount of credit card debt is indeed remarkable.

As the economy faces persistent inflation, the consequences on personal finances can be significant. Many consumers find themselves relying on credit cards as a de facto emergency fund, pushing their balances higher as everyday expenses swell. Matt Schulz, the chief credit analyst at LendingTree, notes that inflation has squeezed financial flexibility to the extent that traditional savings appear less viable for many households. Faced with soaring living costs, credit cards have become not just a payment method but an essential tool for survival.

The high-interest rates associated with credit cards—hovering around 23% for Kennedy’s accounts—compound the problem. If consumers choose to pay only the minimum due, the total cost of debt could skyrocket alarmingly. The interest accrued on Kennedy’s balances could reach as much as $434,000 if he opts to pay $50,000 monthly toward his highest balance. This scenario highlights a concerning trend where credit card dependence leads to financial entrapment, especially when unmanageable interest amounts accumulate.

The situation is not unique to the wealthy. The average American also grapples with mounting credit card debt, with the average borrower carrying a staggering $6,380. Additionally, as noted by Money Management International, unsecured debt rose to an average of $29,364 in 2024, which further complicates the financial landscape for everyday consumers. With interest rates averaging 20.13%, the urgency for debt repayment cannot be overstated; financial experts advise prioritizing the reduction of high-interest debt over saving or investing.

The pursuit of financial stability should start with the acknowledgment that carrying such debt often leads to more significant, long-term consequences. For many, the prospect of making a large purchase without liquid funds may appear daunting, forcing individuals into exacerbating debt cycles.

Interestingly, the profile of credit card users is shifting. According to Bankrate’s research, high-income individuals now demonstrate a higher prevalence of long-term credit card debt, with some 59% of those earning over $100,000 being in debt for a year or longer. Often, these affluent borrowers tempt fate with higher credit limits, ultimately leading them to riskier financial behaviors and a greater accumulation of debt.

Credit cards also lure high-income consumers with their attractive perks, such as travel benefits and rewards, which can make debt repayment less appealing. The elite American Express Centurion Card, for instance, comes with significant fees but offers an array of luxurious services. Such incentives can lead wealthier individuals to rely more heavily on credit cards, potentially reinforcing a cycle of debt that contradicts their overall financial standing.

For both the average consumer and the wealthy, the common thread lies in understanding the implications of credit card debt. Financial planners suggest that to manage substantial credit card liabilities effectively, individuals should not only prioritize debt repayment but also consider alternative forms of credit, such as lines of credit, which usually come without ongoing fees. Charlie Douglas, a certified financial planner for ultra-high net worth individuals, emphasizes the importance of having liquid cash reserves to mitigate the pressures of unplanned expenses.

As the nation grapples with increasing credit card debts, the focus must shift from remedial expenses to proactive financial planning aimed at encouraging budgetary discipline, prudent spending, and informed borrowing. Ultimately, whether rich or poor, individuals must strive for financial wellness, marking a clear departure from the reliance on high-interest debt in pursuit of financial stability.