MongoDB experienced a significant surge in its shares, rising by a remarkable 16% in after-hours trading following the announcement of its healthy fiscal second-quarter earnings. The company exceeded expectations with earnings per share coming in at 70 cents adjusted, compared to the anticipated 49 cents. In terms of revenue, MongoDB reported $478.1 million, surpassing the projected $464.1 million. This impressive financial performance showcases the company’s resilience and growth in the database software industry.

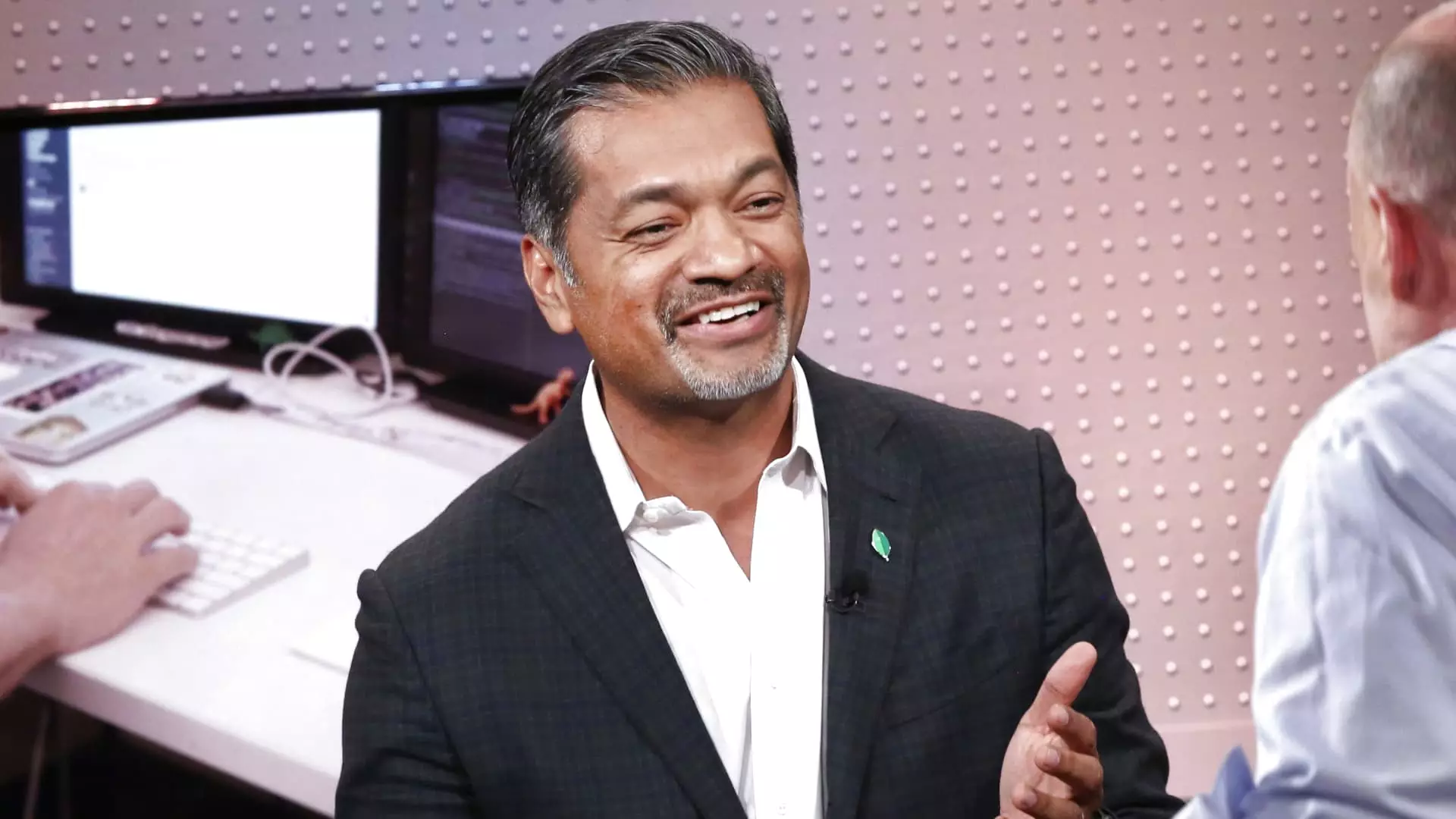

CEO Dev Ittycheria expressed confidence in MongoDB’s future prospects, stating, “We believe we are incredibly well positioned to help customers incorporate generative AI into their business and modernize their legacy application estate.” This strategic vision highlights the company’s commitment to innovation and staying ahead of industry trends. Additionally, Ittycheria emphasized the success of the Atlas cloud database service, which exceeded consumption expectations. This indicates MongoDB’s ability to adapt to changing market conditions and meet the evolving needs of its clients.

During the earnings call, Ittycheria discussed the competitive dynamics in the market, particularly referencing Elastic, a search software maker. While MongoDB witnessed strong performance, Elastic faced challenges with client commitments in its fiscal first quarter, resulting in a significant drop in its stock price. MongoDB’s ability to navigate these competitive pressures and continue to attract new business showcases its resilience and differentiation in the industry.

Looking ahead, MongoDB raised its full-year guidance, signaling confidence in its growth trajectory. The company now expects fiscal third-quarter adjusted earnings of 65 to 68 cents per share, with revenue projected to be between $493.0 million and $497.0 million. Furthermore, MongoDB increased its fiscal 2025 forecast, anticipating adjusted earnings per share in the range of $2.33 to $2.47 and revenue between $1.92 billion and $1.93 billion. These revised projections indicate the company’s optimistic outlook and strong performance moving forward.

Despite the positive earnings report, MongoDB shares had experienced a decline of nearly 40% year-to-date, in contrast to the S&P 500 index, which had gained 17% over the same period. This disparity highlights the volatility and competitive nature of the market, where companies like MongoDB must continue to demonstrate resilience, innovation, and strategic foresight to maintain a competitive edge.

MongoDB’s second-quarter earnings showcase the company’s strong financial performance, strategic positioning, and resilience in a competitive market landscape. By exceeding expectations, raising guidance, and demonstrating adaptability, MongoDB has positioned itself for continued success in the evolving database software industry.