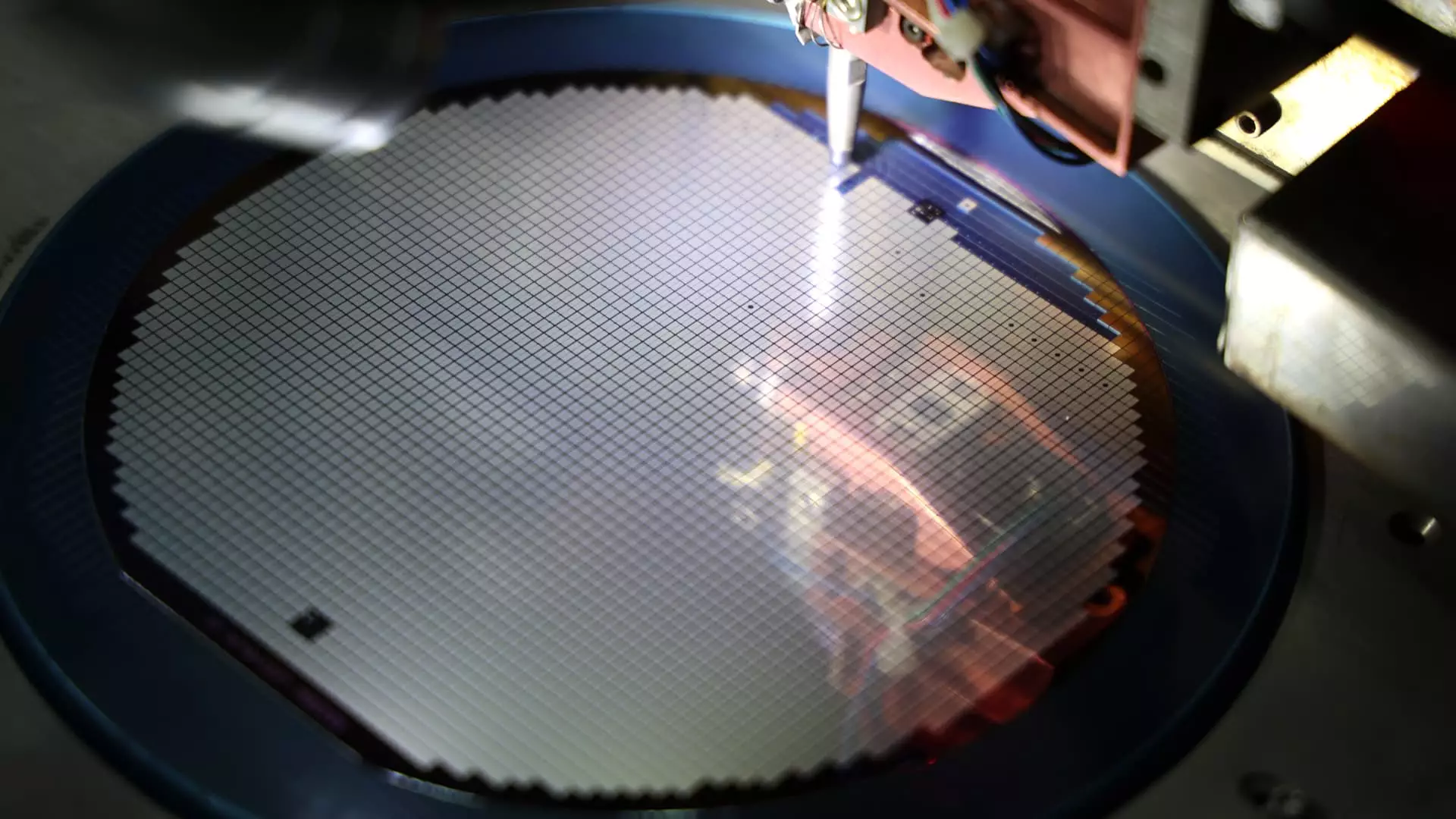

In a recent report by Bank of America analysts, it was highlighted that four of the world’s largest semiconductor equipment manufacturers, including ASML, have experienced a significant increase in their China revenue. Since late 2022, these companies have seen their share of China revenue more than double, reaching 41% in the first quarter of 2024 from 17% in the fourth quarter of 2022. This surge in revenue can be attributed to China’s accelerated purchase of semiconductor manufacturing equipment following tighter export restrictions imposed by the U.S.

The report emphasized that the semiconductor industry, especially in the field of semiconductors, has become a focal point of trade tensions between the U.S. and China. With the U.S. implementing stricter export controls on advanced semiconductors and related manufacturing equipment to China, the landscape of the industry has been significantly altered. Moreover, the possibility of further escalation in tensions could pose additional risks to the tech sector.

Amidst the growing trade tensions and export restrictions, Beijing has been actively working towards enhancing its tech self-sufficiency. Recent policy meetings have reaffirmed China’s commitment to developing its own semiconductor manufacturing capabilities. This strategic move aims to reduce dependence on foreign technology and bolster the country’s position in the global tech industry.

The VanEck Semiconductor ETF (SMH), which tracks U.S.-listed chip companies, has exhibited a mixed response to the evolving dynamics in the semiconductor industry. Despite a recent decline, the ETF maintains gains of nearly 46% for the year. This fluctuation reflects the uncertainties and challenges faced by the semiconductor market as it navigates through geopolitical tensions and changing consumer demands.

The rise in China’s semiconductor equipment purchases signifies a shifting landscape in the global tech industry. As trade tensions persist and countries strive for self-sufficiency, semiconductor manufacturers must adapt to the changing environment to remain competitive and resilient in the face of evolving challenges.