The year 2025 is already shaping up to be an exciting one for traders and investors alike, as speculative trading is once again taking center stage. Following a robust two-year run for the S&P 500—its best performance since 1998—many sectors of the market are experiencing sudden surges. Among the most notable components of this trading craze are cryptocurrencies, which are witnessing a resurgence that breathes new life into numerous aligned equities.

Earlier in the week, Bitcoin’s value climbed back into the six-figure territory, peaking above $96,000 and sending ripple effects through stocks correlated with the digital asset. As a result, companies like MicroStrategy, which had already exhibited staggering growth in 2024 with a rise of more than 360%, jumped another 3% on Thursday. This trend isn’t restricted to heavyweight entities; even smaller firms like Coinbase, Robinhood, Marathon Holdings (Mara), and Riot Platforms saw their shares climb significantly due to heightened investor enthusiasm for the crypto market.

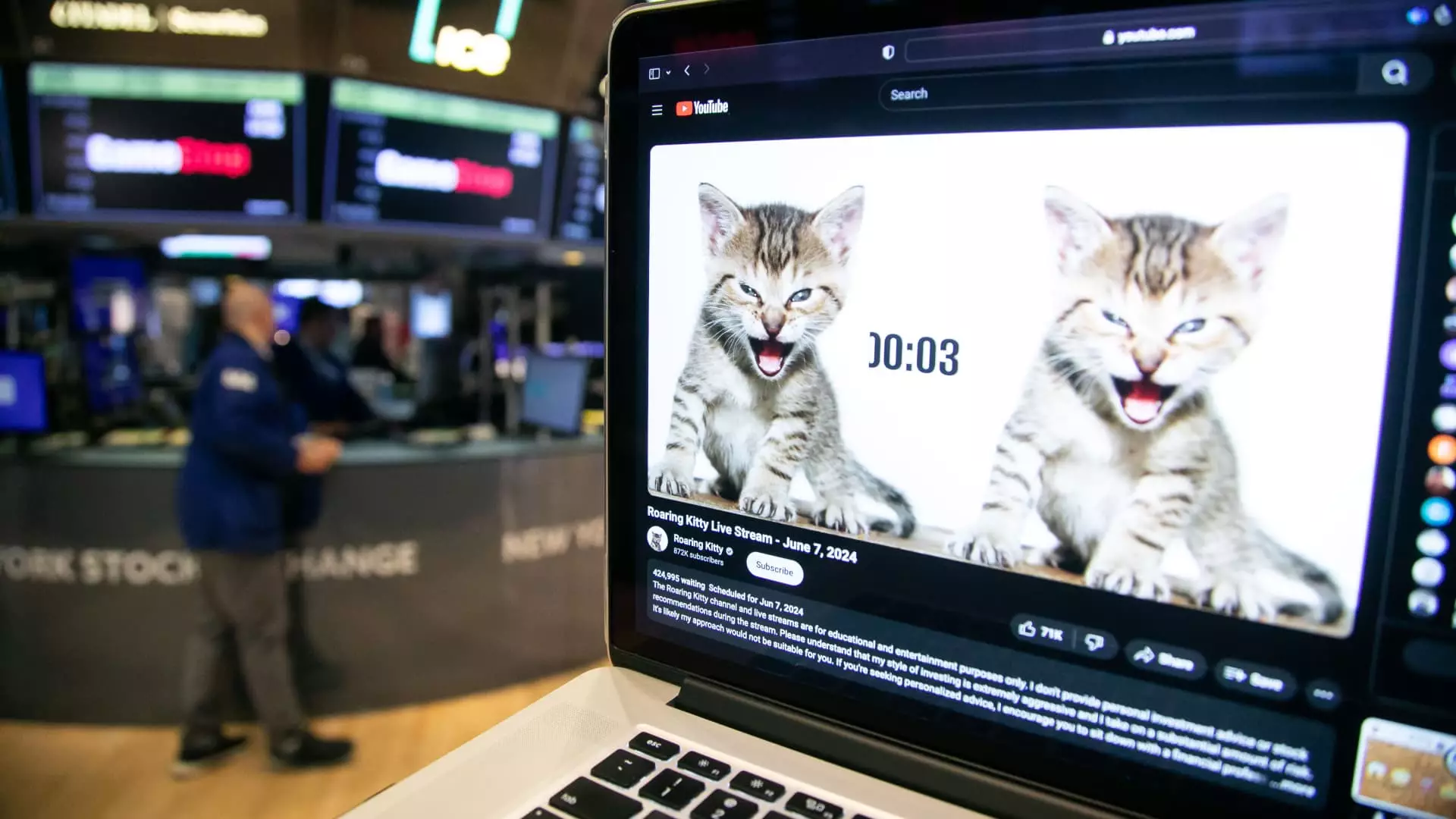

Integral to this renewed momentum in trading is the dynamic role of social media and online personalities. Retail traders are often swayed by the movements and cryptic messages from influential figures. For instance, the popular pseudonym “Roaring Kitty,” also known as Keith Gill, has a track record of galvanizing meme stocks. His recent posts on social media, including a short clip featuring the musician Rick James, have rekindled speculation among users. This has led to significant stock movements, notably an 11% rise in Unity Software and resurgent interest in GameStop.

The meme stock phenomenon embodies a shift in market psychology, where collective enthusiasm can influence trading outcomes in ways beyond traditional fundamentals. Such moves are propelling retail investors to rally behind stocks with rapidly changing narratives, capturing the imagination of a broader audience.

With 2024’s biggest players in the semiconductor sector continuing their dominance, the growth in tech-oriented stocks is noteworthy. Companies like Broadcom and Nvidia are seeing consistent gains, despite a cooling off of the artificial intelligence hype towards the end of the previous year. Broadcom rose 2% in Thursday trading, while Nvidia increased by 1.6%, showing that investor appetite for tech advancements, particularly in semiconductors, persists.

In stark contrast to the tech sector, more traditional consumer brands such as Topgolf Callaway Brands are also benefitting from renewed investor interest. An 8.5% spike following a favorable upgrade from Jefferies amplifies the idea that market optimism extends beyond tech, reflecting a broadening investment thesis.

Across the board, major stock indices displayed robust performance upon market opening. The Dow Jones Industrial Average saw a promising increase of up to 300 points before losing momentum. The S&P 500 and Nasdaq both experienced slight upticks of 0.4%, reflecting an underlying positivity among investors. However, this upward movement doesn’t arrive without apprehension; the decline in momentum with preceding gains in 2024 yields questions regarding the sustainability of the current rally.

Concerns about incoming administration policies and their potential to instigate inflation or supply chain disruptions loom. Lisa Shalett, chief investment officer of Morgan Stanley Wealth Management, highlighted that many investors are banking on deregulation to ignite economic growth. While optimism prevails, the delicate balance of navigating government policies, interest rate adjustments, and public sentiment remains a persistent challenge for market players.

The early days of trading in 2025 are characterized by a palpable sense of speculation and opportunity. The interplay of cryptocurrencies, meme stocks driven by social media influence, and robust sector performances highlights a market ripe with possibility. Yet, despite this initial excitement, the lingering uncertainty surrounding economic policies and market stability invites a cautious approach. As investors navigate this thrilling yet volatile terrain, it remains essential to maintain a discerning eye on both emerging trends and the broader economic landscape to effectively exploit the opportunities that lie ahead.