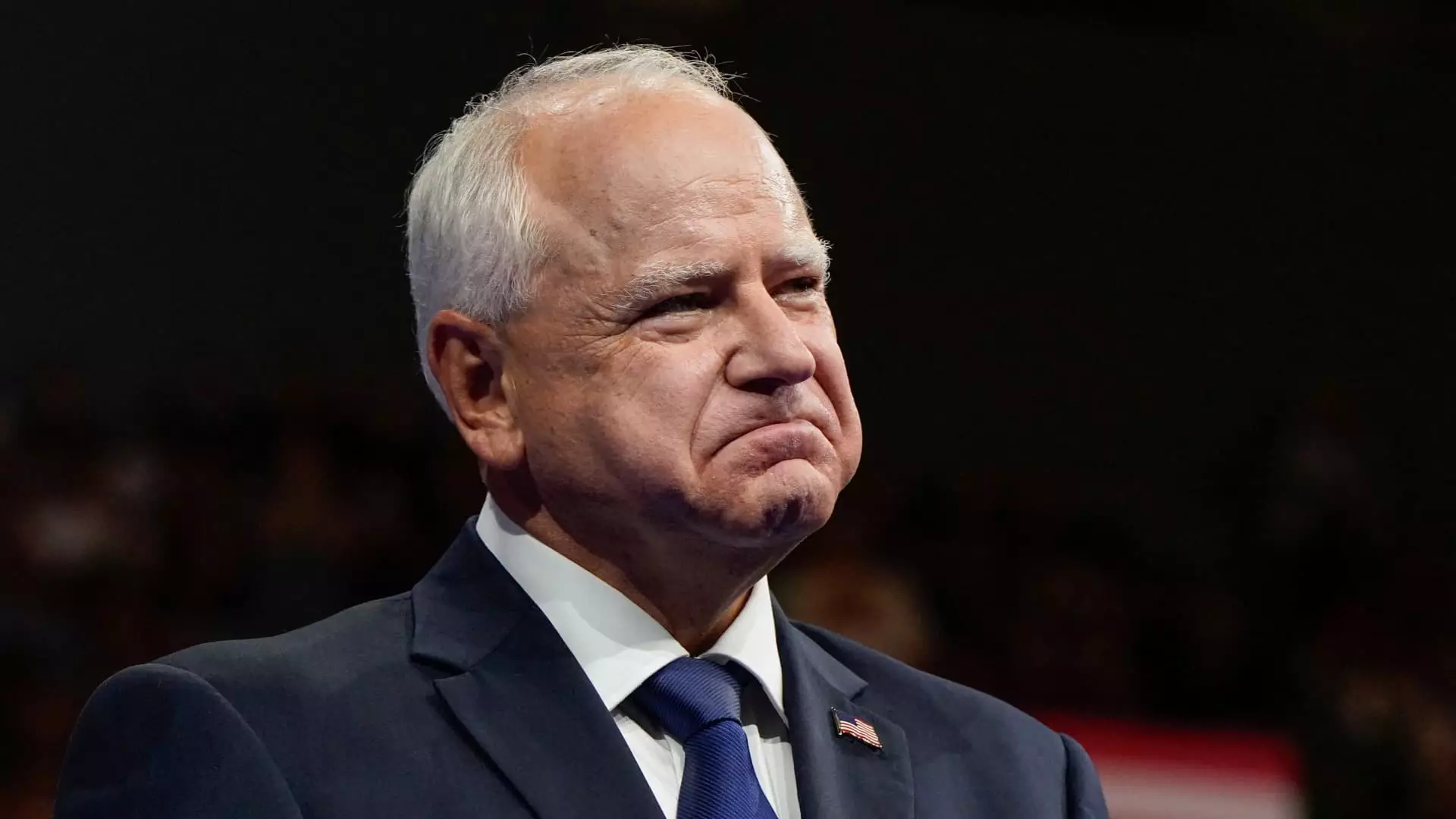

In recent news, there has been bipartisan support for exempting Social Security from income taxes as retirees struggle to afford the basics. Former President Donald Trump and Minnesota Governor Tim Walz have both put forth proposals in this regard, sparking discussions at both federal and state levels. While Trump aims to eliminate federal income tax on Social Security benefits, Governor Walz has already taken steps to expand exemptions in Minnesota.

It is important to note that there are significant differences between federal tax proposals and state legislation when it comes to exempting Social Security from income taxes. Federal income taxes on Social Security benefits are based on “combined income,” which includes various factors such as adjusted gross income and non-taxable interest. Depending on the level of combined income, a certain percentage of Social Security benefits may be subject to taxation. However, Trump’s proposal seeks to completely exempt seniors from paying federal taxes on their Social Security benefits, which could have a transformative impact.

According to estimates from the Tax Foundation, Trump’s proposal to exempt Social Security from federal income tax could increase the budget deficit by $1.6 trillion over a span of 10 years. This could also have implications for the solvency of the Social Security and Medicare trust funds, potentially accelerating insolvency by a significant margin. While Trump’s campaign has not yet commented on these estimates, it is clear that such a policy shift could have far-reaching consequences on government finances.

On the other hand, Governor Walz’s initiative in Minnesota to expand the state tax exemption for Social Security benefits shows a different approach. By eliminating the income tax on Social Security benefits for most seniors with adjusted gross incomes below a certain threshold, Minnesota aims to reduce the financial burden on retirees. This targeted policy change, as explained by Jared Walczak from the Tax Foundation, aligns Minnesota’s tax code with those of other states and has a relatively lower revenue cost compared to Trump’s federal proposal.

As discussions around exempting Social Security from income taxes continue, it is crucial to consider the broader implications of such policies. While providing relief to seniors is a noble goal, policymakers must also weigh the financial costs and potential impact on government programs like Social Security and Medicare. States have the flexibility to implement their own tax policies in this regard, but it is essential to strike a balance between providing assistance to retirees and maintaining fiscal responsibility.

The proposals and legislation surrounding the exemption of Social Security from income taxes highlight the complexities of balancing financial considerations with the needs of retirees. Whether at the federal or state level, these policy changes have the potential to reshape how we support our aging population. It is essential for policymakers to carefully evaluate the consequences of such decisions and ensure that any reforms are sustainable in the long run.