The sell-off in GameStop shares on Wednesday intensified during afternoon trading, leading to a significant drop in the stock price. This sell-off coincided with a spike in trading volume in the call options owned by meme stock leader “Roaring Kitty”, whose real name is Keith Gill. Despite disclosing his portfolio on Monday night with 120,000 call options contracts with a strike price of $20 and an expiration date of June 21, the price of these contracts dropped more than 40% during the session. Interestingly, GameStop calls with the exact strike price and expiration saw a huge increase in trading volume, reaching 93,266 contracts on Wednesday, more than nine times the 30-day average volume.

While it is unclear whether Roaring Kitty was behind the large volume of trading in GameStop calls, options traders have speculated his involvement given his significant holdings of those contracts. There have been discussions regarding Gill’s potential actions with his call options, as some traders believe he may need to sell them prior to expiration or roll the position into another call option. This speculation arises from the possibility that Gill would need a substantial amount of cash to exercise the calls on June 21, which could potentially impact the price of the stock.

Wall Street has been closely monitoring any indications of Gill unloading his position, as exercising the calls would require him to have $240 million to take custody of the stock, which is more than what has been publicly disclosed in his E-Trade account. The situation has sparked discussions about the potential implications on the stock price if Gill were to execute his call options. The uncertainty surrounding Roaring Kitty’s actions and the significant volume of trading in GameStop calls have added to the intrigue and speculation in the market.

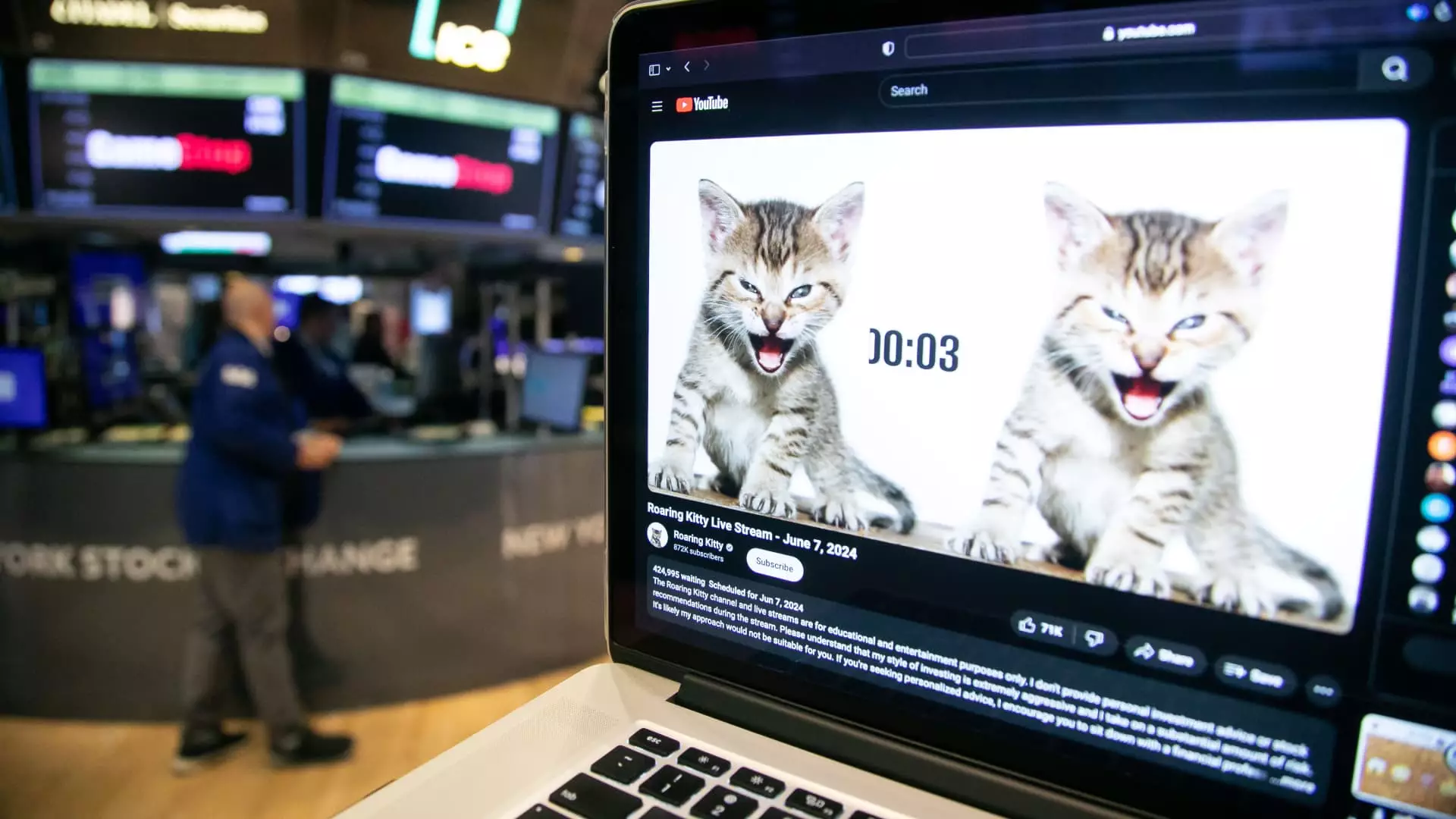

The sell-off in GameStop shares and the surge in trading volume in the call options owned by Roaring Kitty have brought attention to the potential impact on the stock price and the actions that Gill may need to take in the coming weeks. The mystery behind the trading activity and the speculation surrounding Gill’s position have created a sense of uncertainty and intrigue in the market. As investors and traders continue to watch for any developments, the situation remains fluid and subject to further speculation and analysis.