Penn Entertainment, a major player in the media and gaming industry, has recently announced that it will be laying off approximately 100 employees in order to focus on the growth of ESPN Bet. This decision was communicated to staff members through an internal memo by CEO Jay Snowden, who emphasized that these changes are necessary to enhance operational efficiencies following the company’s acquisition of theScore in 2021.

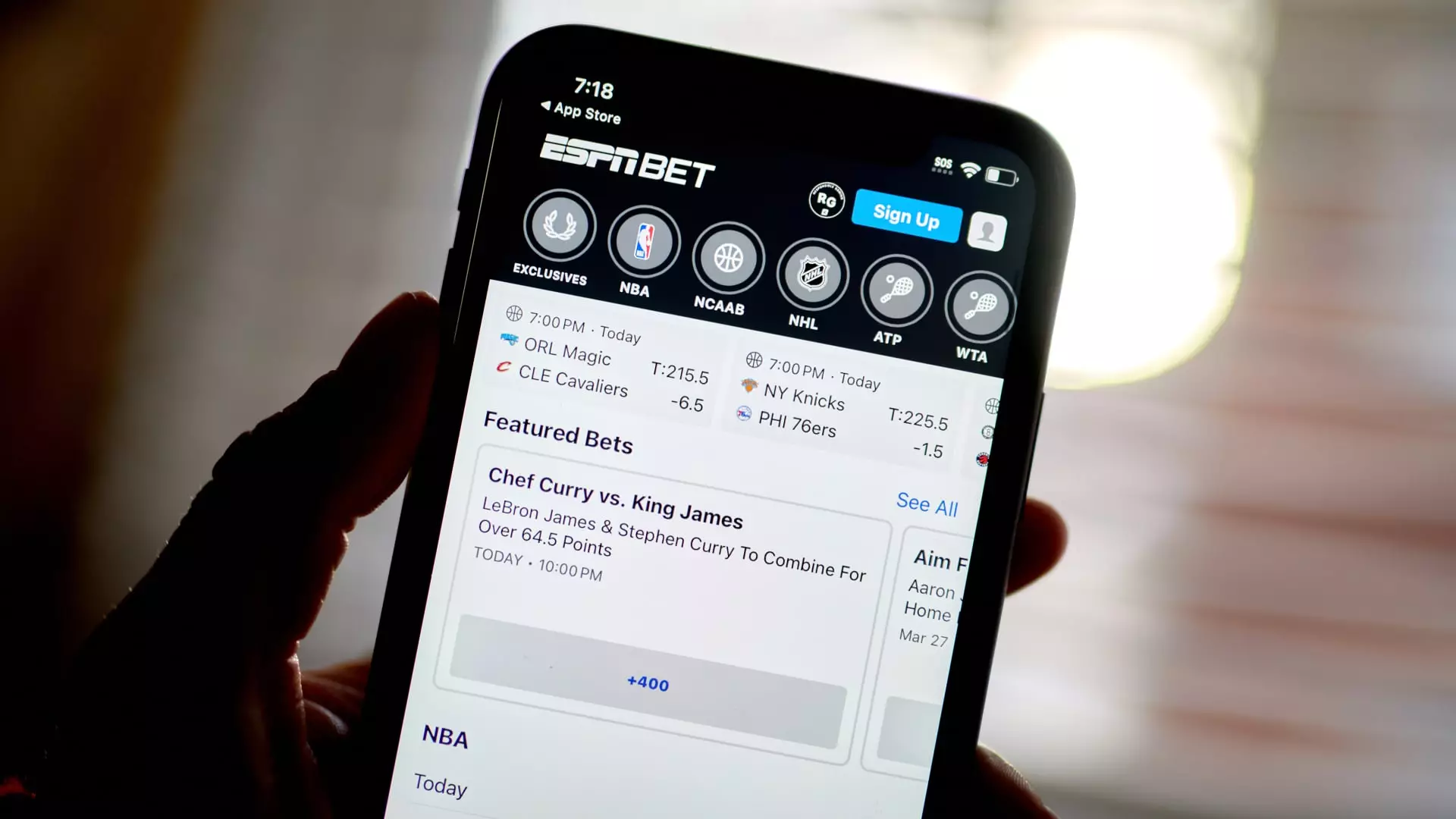

Snowden mentioned in the memo that the acquisition of theScore prompted the company to prioritize the build-out of its proprietary tech stack and the migration of its sportsbook to theScore’s platform. However, he acknowledged that organizational changes were put on hold temporarily. Now, Penn Entertainment is entering a new phase of growth in its interactive business, particularly with ESPN Bet, a branding partnership worth $2 billion with Disney’s ESPN.

Despite the company’s focus on growth, investors have been impatient for Penn Entertainment to demonstrate the potential of the rebranded sportsbook. Activist investor Donerail Group has even urged the board to consider selling the casino company. Speculations have emerged regarding potential interest from other gaming and casino companies, although analyst Barry Jonas believes that a sale in the near term is unlikely due to the complexities involved.

Focus on Product Development and Cost Efficiency

In response to investor concerns, Penn Entertainment is set to release new features for ESPN Bet this fall, particularly during the football season. Analyst Barry Jonas predicts that these enhancements will significantly improve the product and demonstrate the company’s commitment to delivering results from its investment. Additionally, there is a focus on cost management to ensure that the company’s resources are utilized effectively.

Despite the company’s efforts to drive growth and innovation, Penn Entertainment’s shares have experienced a significant decline of 25% year-to-date. The company has also fallen short of earnings expectations in the past two quarters and has lowered its guidance. Analysts remain cautious about the company’s outlook but believe that the success of ESPN Bet could be a potential turning point for Penn Entertainment. Truist has a buy rating on Penn Entertainment with a price target of $25.

Overall, Penn Entertainment is navigating through a period of change and transformation as it prioritizes growth and innovation in its interactive business. The layoff of employees, though unfortunate, signals a strategic shift in focus towards product development and operational efficiency in order to deliver value to investors and stakeholders.