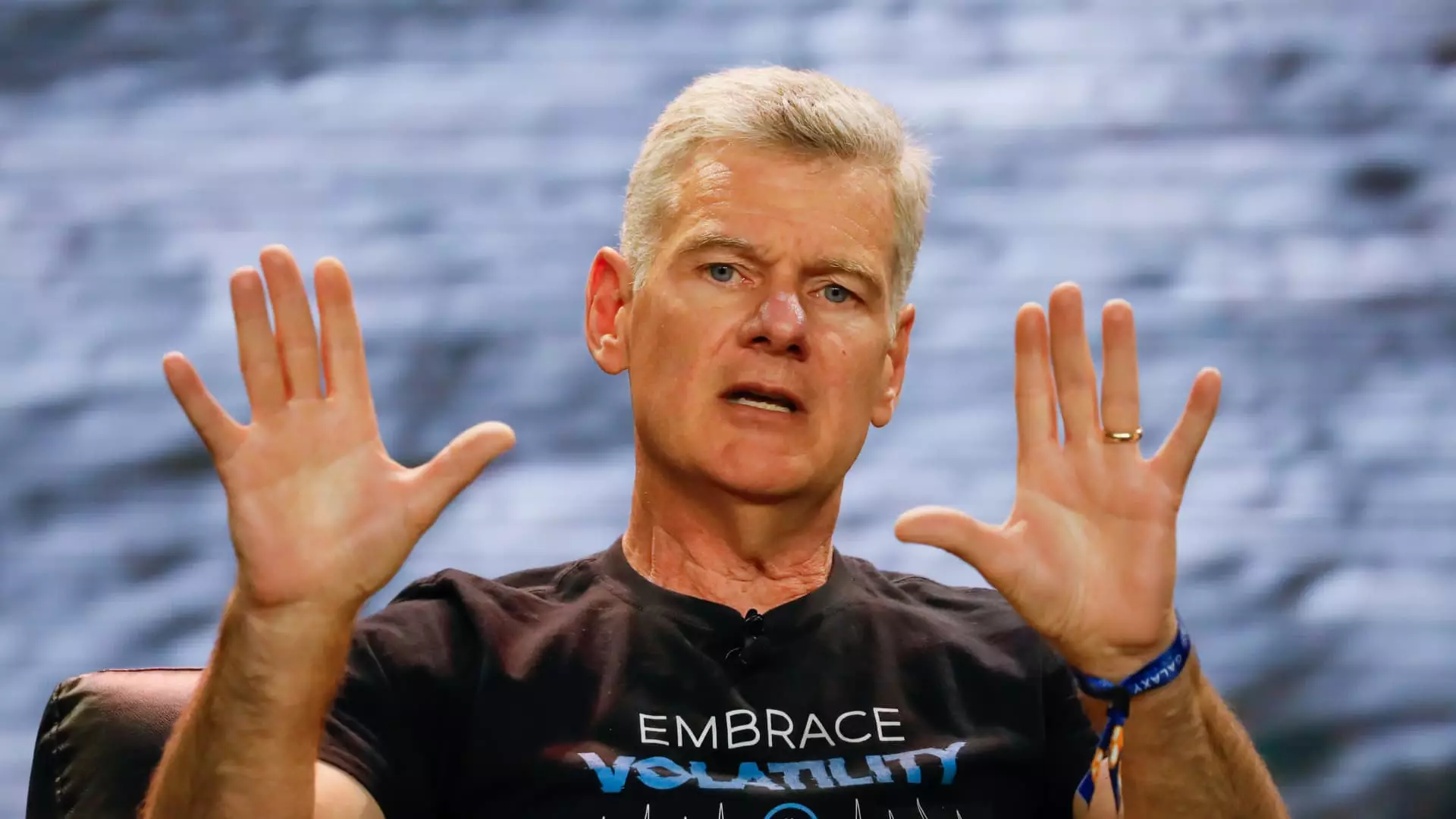

Cryptocurrency has been a hot topic in the financial world, with hedge fund manager Mark Yusko making bold predictions about the future of bitcoin. Yusko believes that bitcoin will more than double in value this year, reaching an impressive $150,000. This forecast is based on his belief that bitcoin is the “king” of cryptocurrencies and a superior form of gold. Yusko suggests that investors allocate at least 1% to 3% of their portfolios to bitcoin in order to capitalize on its potential growth.

Yusko points to the recent launch of bitcoin exchange-traded funds (ETFs) as a major driver of bullish sentiment for the cryptocurrency. These ETFs provide a more accessible way for investors to gain exposure to bitcoin, potentially leading to increased demand and price appreciation. Additionally, Yusko highlights the upcoming bitcoin halving event, which will reduce the mining reward by half and create a supply shock in the market. He expects this event to generate significant tailwinds for bitcoin and drive its price higher.

Yusko suggests that bitcoin’s price could potentially increase tenfold over the next decade, emphasizing the historical patterns of price surges following halving events. He predicts that bitcoin’s price will become more parabolic towards the end of the year, with the peak likely occurring around Thanksgiving or Christmas. Yusko’s firm is also optimistic about the prospects of cryptocurrency trading platform Coinbase, which has experienced significant growth in its share price over the past year.

While Yusko’s predictions for bitcoin may seem ambitious, they are based on his understanding of market trends and historical patterns. Whether bitcoin will reach $150,000 remains to be seen, but the increasing adoption and acceptance of cryptocurrencies suggest that their value could continue to rise in the future. Investors may want to consider allocating a portion of their portfolios to bitcoin and other digital assets as part of a diversified investment strategy.