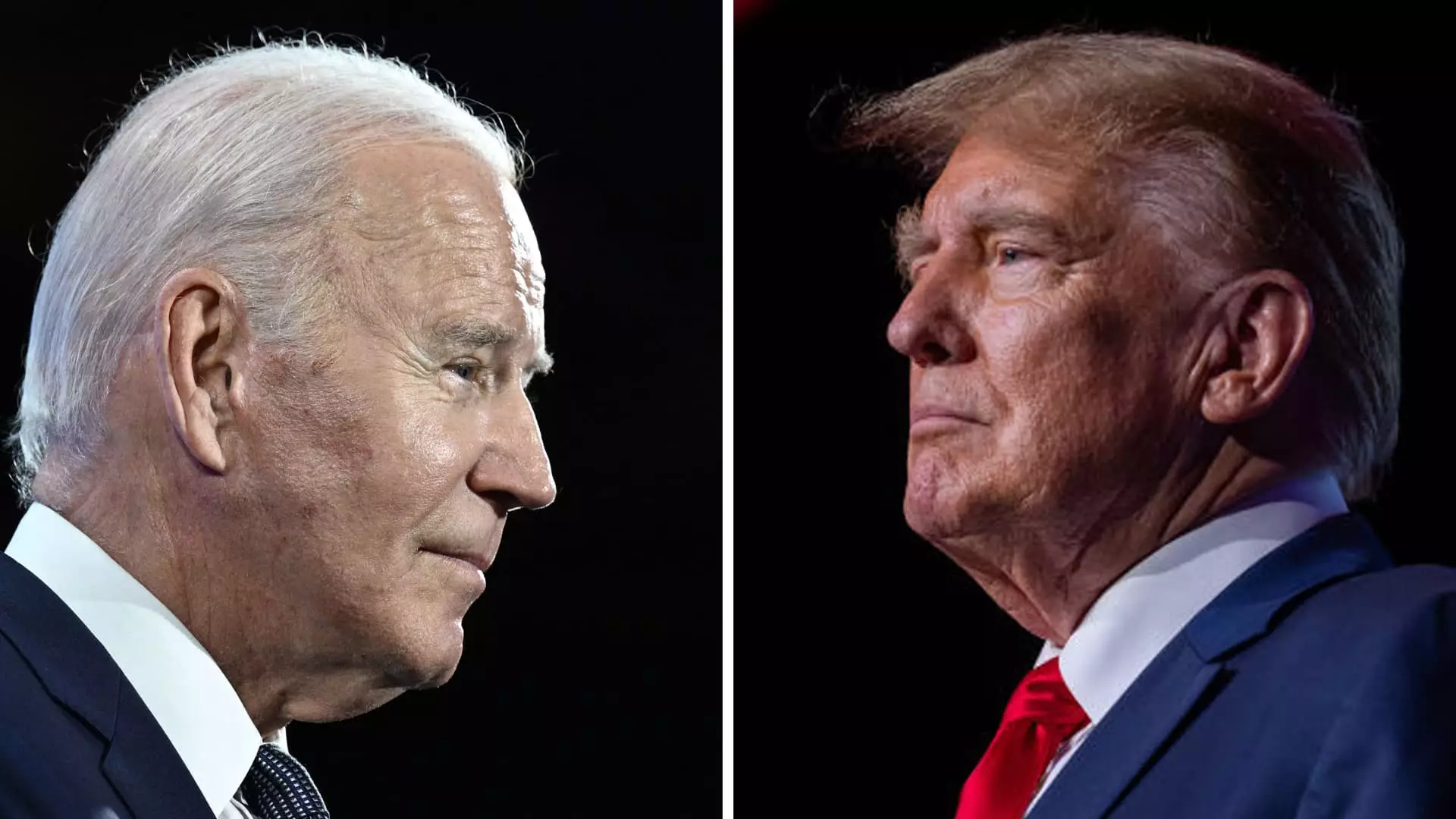

The looming expiration of trillions in tax breaks enacted by former President Donald Trump through the Tax Cuts and Jobs Act of 2017 has sparked a debate among presumptive nominees President Joe Biden and Donald Trump. Both candidates have pledged to extend these tax breaks for most Americans, but the question remains on how to pay for it.

Trillions in tax breaks are set to expire after 2025, which could result in increased taxes for more than 60% of filers, according to the Tax Foundation. Some of the expiring provisions include lower federal income brackets, higher standard deductions, a more generous child tax credit, and more. The federal budget deficit is expected to be a significant obstacle as the 2025 tax cliff approaches.

Fully extending the Tax Cuts and Jobs Act provisions could potentially add an estimated $4.6 trillion to the deficit over the next decade, according to the Congressional Budget Office. The cost of extending major parts of the TCJA has increased by about 50% since initial estimates in 2018, creating additional financial strain.

Initial projections in 2018 suggested that economic growth from the TCJA would cover about 20% of the cost of tax cuts. However, studies have shown that the effects were smaller than anticipated. There is skepticism among economists about the ability of the TCJA to pay for itself, let alone extending or making it permanent.

Policy Proposals

President Trump is advocating for extending all TCJA provisions, while Biden plans to focus on extending tax breaks for taxpayers making less than $400,000. Biden’s economic advisor, Lael Brainard, has proposed higher taxes on the ultra-wealthy and corporations to fund TCJA extensions for middle-class Americans. On the other hand, Trump has renewed his support for tariffs as a means of generating revenue.

The outcome of these policy proposals remains uncertain, especially given the upcoming elections and the uncertainty surrounding which party will control the White House and Congress. The debate over extending tax breaks reflects the broader economic and financial challenges facing the country in the years ahead.

The debate over extending tax breaks is a crucial issue that will have far-reaching implications for American taxpayers. Both President Joe Biden and former President Donald Trump have presented their approaches to addressing this issue, but the question of how to pay for these extensions remains a significant challenge. As the 2025 tax cliff approaches, it is essential for policymakers to carefully consider the economic, financial, and social impact of their decisions.