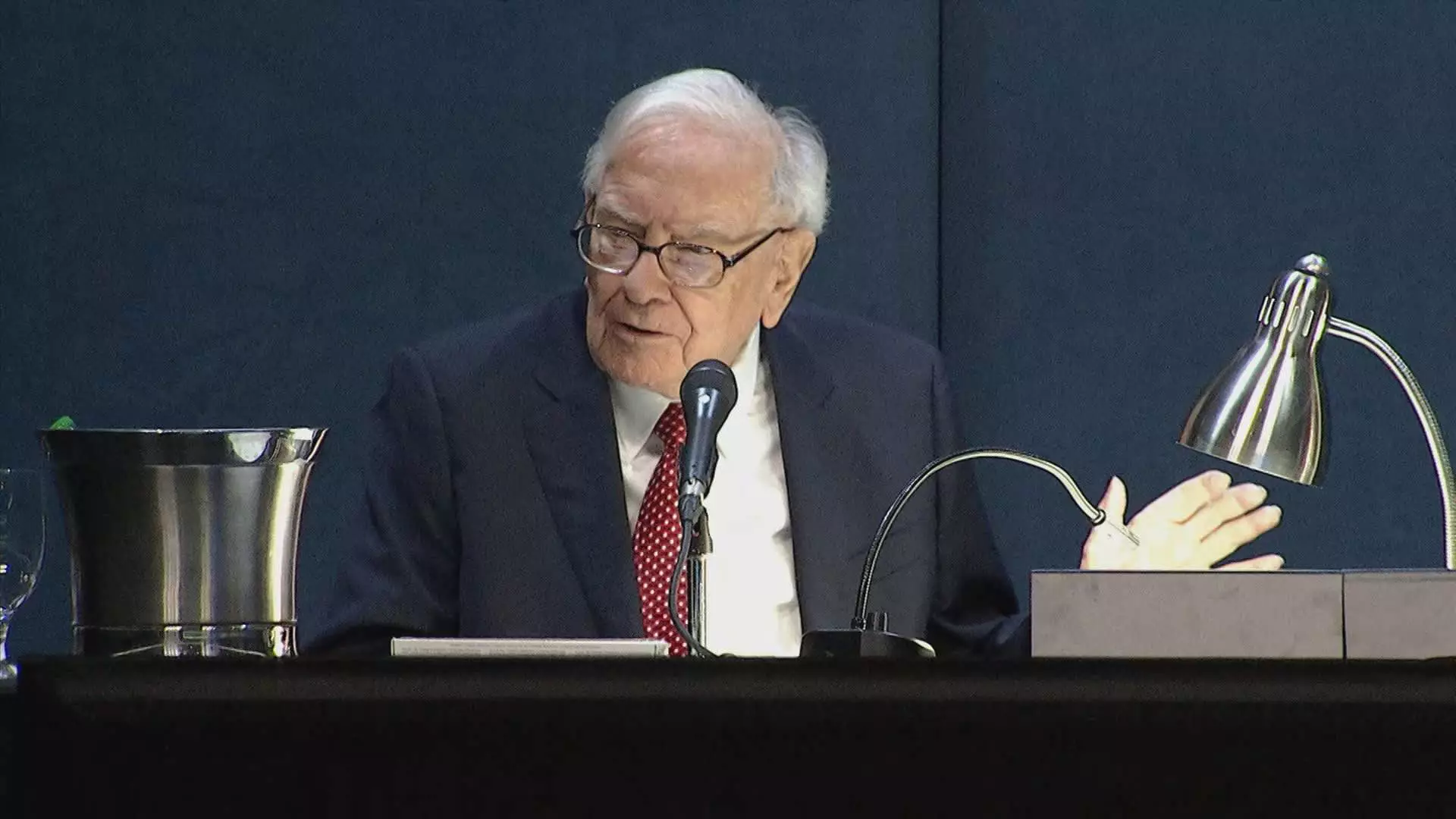

Warren Buffett, often referred to as the “Oracle of Omaha,” has long been known for his successful investments and his strategic approach to the stock market. Recently, it was revealed that he now owns the exact same number of shares of Apple as he does Coca-Cola, sparking curiosity among his followers. This observation was made after a regulatory filing disclosed Berkshire Hathaway’s equity holdings at the end of the second quarter. The interesting part is the identical 400 million share count in both Apple and Coca-Cola, with the latter being Buffett’s oldest and longest stock position.

Buffett’s love for Coca-Cola dates back to 1988 when he first bought 14,172,500 shares of the iconic beverage company. Over the years, he increased his stake to 100 million shares by 1994 and has since kept it steady at a round-number share count for the past 30 years. Through stock splits in 2006 and 2012, Berkshire’s holding in Coca-Cola reached 400 million shares. Buffett’s fascination with Coca-Cola started at a young age when he sold the soft drink around his neighborhood after buying them for a cheap price from his family’s grocery store. This history with Coca-Cola may shed light on his unique investment approach to the company.

Despite being a proponent of value investing, Buffett’s foray into tech stocks like Apple has raised eyebrows among traditional investors. However, Buffett views Apple more as a consumer products company similar to Coca-Cola, rather than a pure technology investment. He has praised the loyal customer base of the iPhone and highlighted its significance in people’s lives. Nevertheless, Berkshire’s significant reduction in its Apple stake in the second quarter surprised many, with some speculating it was part of a broader portfolio adjustment strategy rather than a reflection of Apple’s prospects.

The alignment of the share count of Apple and Coca-Cola at 400 million has led to theories about Buffett’s intentions. Some believe that Buffett’s preference for round numbers might suggest that he has no immediate plans to further sell Apple shares. This parallel between Coca-Cola and Apple could indicate that Apple has become a “permanent” holding for Buffett, akin to his long-standing relationship with Coca-Cola. However, there are differing opinions on whether this alignment was a deliberate strategy or just a coincidence.

Warren Buffett’s stock holdings reflect his unique investment philosophy that blends traditional value investing with strategic bets on consumer-centric companies like Coca-Cola and Apple. The equal share count in Apple and Coca-Cola symbolizes Buffett’s long-term commitment to these companies and may hint at his future investment decisions. Whether this alignment was a planned move by Buffett or a serendipitous event remains a topic of debate among analysts and investors. Buffett’s ability to maintain successful investments in both traditional and tech companies showcases his versatility as an investor and cements his reputation as one of the greatest investors of all time.