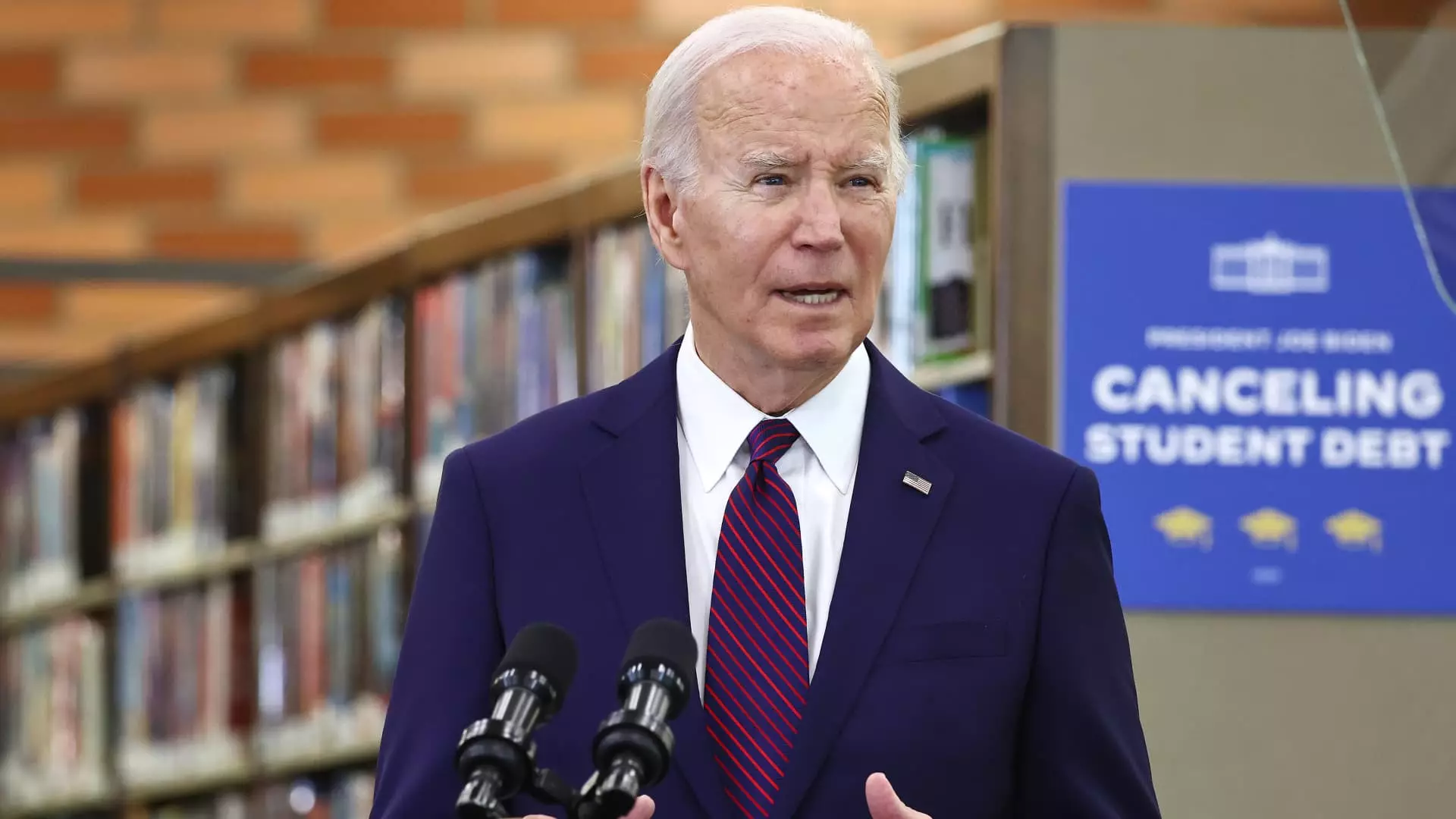

President Joe Biden recently unveiled his new student loan forgiveness plan after facing setbacks with his initial attempt. The Supreme Court rejected his first plan, which aimed to provide broad education debt relief to millions of borrowers. Biden acknowledged the growing burden of student loans on working- and middle-class individuals, highlighting the challenges they face in repaying their debts even years after completing their education.

In his revised plan, Biden has tailored the eligibility criteria to target specific groups of borrowers rather than offering blanket forgiveness to all federal student loan holders. This strategic approach aims to address legal concerns and increase the chances of the new plan surviving potential legal challenges. By focusing on borrowers who meet certain criteria, the Biden administration hopes to provide relief to those who need it most while navigating legal complexities.

The new plan aims to forgive the debts of borrowers who fall into the following categories:

– Individuals eligible for debt cancellation under existing government programs but have not yet applied

– Borrowers who have been in repayment for 20 years or more on their undergraduate loans or 25 years or more on their graduate loans

– Attendees of schools with questionable value

– Borrowers experiencing financial hardship

While the definition of financial hardship is still being clarified, it may encompass individuals burdened by medical debt or high child-care expenses. Additionally, the new plan proposes forgiving up to $20,000 in unpaid interest on federal student loans for all borrowers, regardless of their income levels.

Critics of broad student loan forgiveness, including Republican officials like Missouri Attorney General Andrew Bailey, have raised concerns about Biden’s revised plan mirroring his original proposal. Bailey and other Republican leaders have threatened legal action against the administration, arguing that sweeping debt cancellation would violate constitutional boundaries and harm lenders’ financial interests.

Despite the legal challenges ahead, the Biden administration remains committed to implementing its revised student loan forgiveness plan. The tensions between federal authority, legal constraints, and political opposition underscore the complexities of addressing the student debt crisis in the United States.

As the administration finalizes the details of the new forgiveness program, higher education experts anticipate additional legal battles and controversies to arise. While the revised plan aims to target specific borrower groups and navigate legal scrutiny, its effectiveness in providing meaningful relief remains uncertain.

President Biden’s efforts to address the student loan crisis through revised forgiveness initiatives reflect the complex interplay of legal, political, and economic factors at play. The ongoing debate over the scope and impact of student loan forgiveness underscores the challenges of implementing comprehensive solutions in a deeply divided political landscape.