The Biden administration is gearing up to introduce a new student loan forgiveness proposal that could potentially impact millions of Americans. Even though this plan is not as extensive as President Biden’s initial education debt relief plan that was blocked by the Supreme Court, it still has the potential to alleviate the debt burden for up to 10 million Americans, as estimated by higher education expert Mark Kantrowitz.

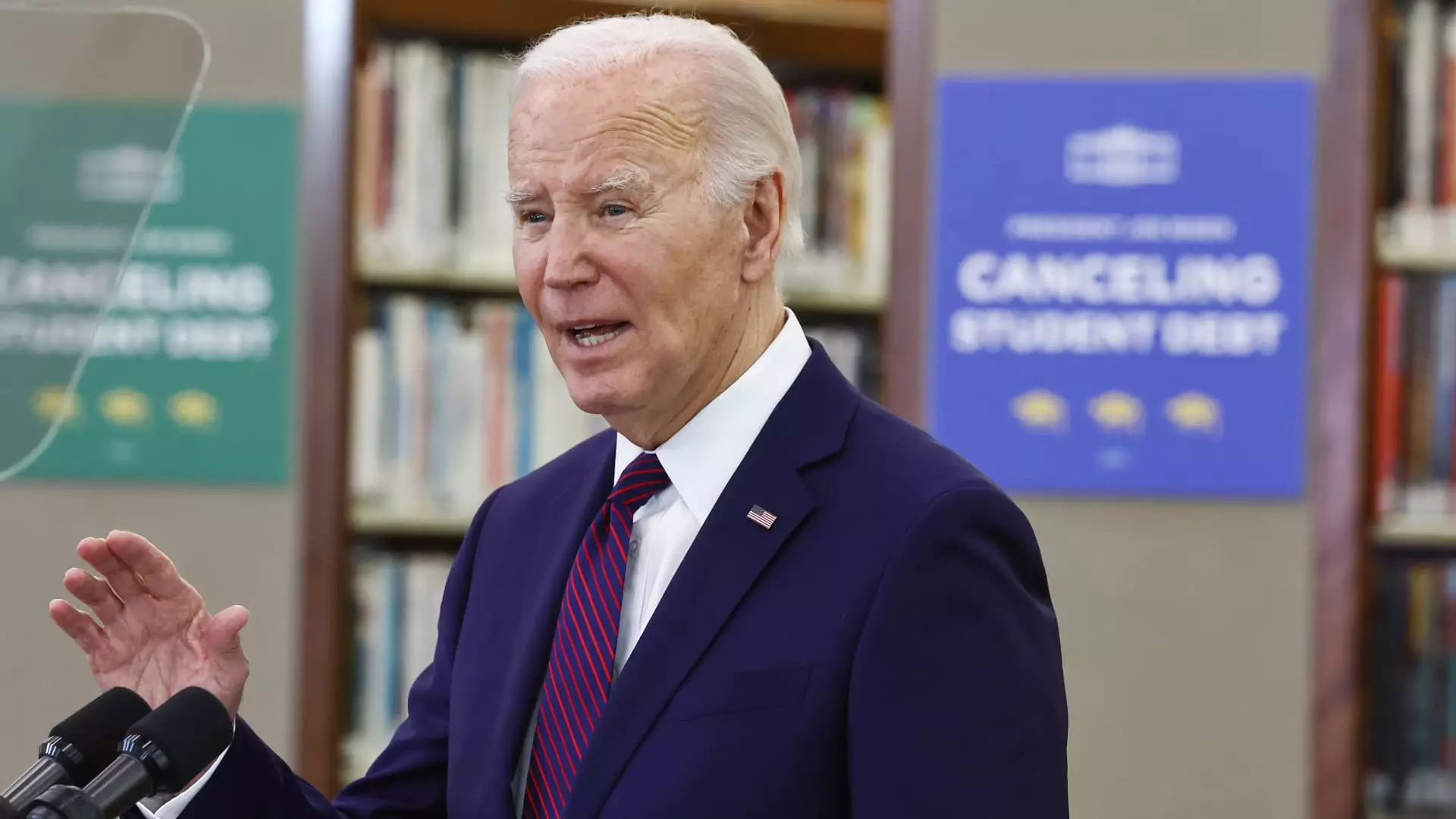

President Biden is expected to unveil the specifics of this new debt forgiveness plan during a speech in Madison, Wisconsin. The primary objective of this plan is to start forgiving debt for numerous student borrowers before the upcoming November election. Data from a recent survey reveals that nearly half of all voters consider canceling student loan debt to be a crucial issue in the 2024 presidential and congressional elections. This move could particularly resonate with young voters, a demographic that President Biden has struggled to connect with in the past.

The revised student loan forgiveness plan is anticipated to cater to various groups of borrowers, including individuals who have been repaying their loans for decades and those currently facing financial hardships. Following the Supreme Court’s rejection of President Biden’s $400 billion debt forgiveness proposal, his administration promptly began working on a revamped assistance package. The administration is confident in the legality of this updated plan, as it is more narrow in scope compared to its predecessor, thereby making it easier to justify in front of a skeptical court.

The Biden administration is utilizing the Higher Education Act as the legal basis for this new debt forgiveness plan, in contrast to the Heroes Act of 2003 used in the previous proposal. The Higher Education Act, signed into law by President Lyndon B. Johnson in 1965, empowers the education secretary to waive or release borrowers’ education debt under certain circumstances. This strategic shift in legal framework is expected to bolster the plan’s standing in potential legal challenges.

Unlike the previous attempt to cancel student debt through executive action, the Biden administration is now opting for the rulemaking process to implement its relief measures. A panel of negotiators has convened multiple times to define the parameters of this updated policy, with the final session wrapping up in February. Based on the regulatory timeline, the proposal is projected to be made public in the coming weeks. This approach is intended to ensure a more meticulous and transparent process for delivering student loan forgiveness.

The Biden administration’s forthcoming student loan forgiveness plan signifies a continued effort to address the mounting crisis of student debt in the United States. By refining the scope, legal justification, and implementation strategy of this proposal, the administration aims to provide much-needed relief to millions of Americans burdened by student loans. The success of this initiative will depend not only on its legal soundness but also on its ability to effectively alleviate the financial strain on student borrowers across the nation.