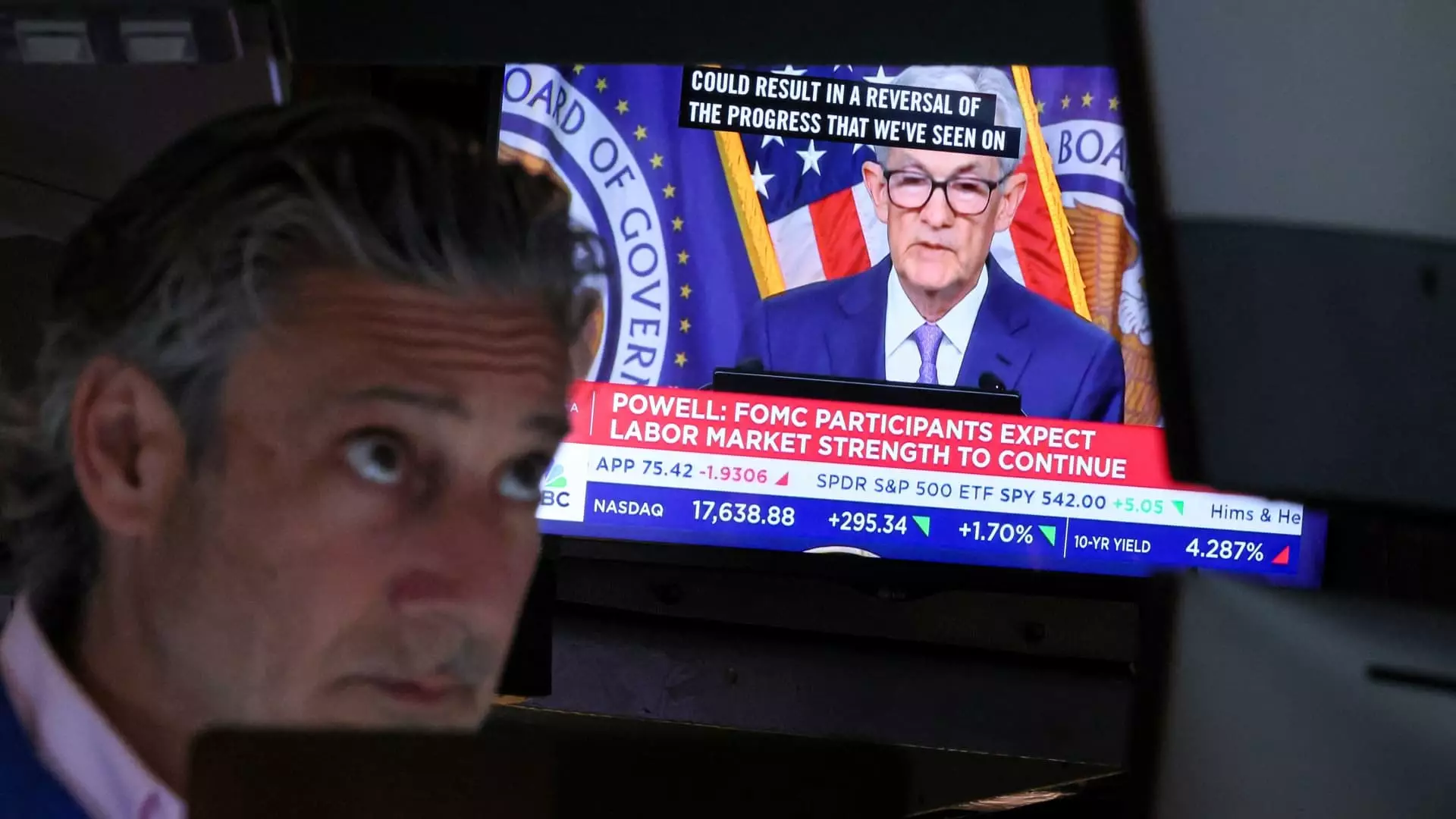

The stock market has seen significant gains since the last monthly meeting in June due to the anticipated Federal Reserve interest rate cut. Recent upbeat inflation data has propelled stocks to new highs, with the Dow Jones Industrial Average and the S&P 500 reaching all-time intraday highs. The Nasdaq Composite also hit a new high, signaling a positive trend in the market. However, the market is not without its challenges, as evidenced by the recent tech pullback.

The CNBC Investing Club, led by Jim Cramer, has been proactive in its approach to the market, executing a series of trades to take advantage of the current market conditions. The Club has offloaded shares of TJX Companies to raise additional cash and made profitable sales of Meta Platforms and Palo Alto Networks. Additionally, the Club has capitalized on opportunities during the tech pullback by initiating a small position in Advanced Micro Devices.

One key theme that has emerged in the stock market is the shift in investor sentiment towards sectors outside of Big Tech. The Russell 2000, which measures the performance of small-cap U.S. stocks, has surged, while the tech-heavy Nasdaq has seen a slight decline. This rotation has impacted the performance of various stocks in the portfolio, with some mega-cap stocks experiencing losses since the last meeting.

The top five performing stocks in the portfolio have showcased the diverse opportunities present in the market. Companies like Ford Motor, Morgan Stanley, Stanley Black & Decker, Apple, and Dover have all seen significant gains, driven by various factors ranging from improving sales to monetary policy easing. These companies have outperformed mega-cap tech stocks, highlighting the opportunities in sectors beyond Big Tech.

The Club’s strategy of diversifying its portfolio and capitalizing on market trends has proven successful in navigating the current market environment. By identifying opportunities in sectors experiencing growth and potential catalysts, the Club has been able to generate positive returns and position itself for future gains. The focus on long-term growth and strategic investments has enabled the Club to thrive in a dynamic market landscape.

As a subscriber to the CNBC Investing Club with Jim Cramer, members receive trade alerts before any transactions are made. Jim Cramer follows a specific protocol before executing trades in the charitable trust’s portfolio, ensuring transparency and accountability in the investment process. Members have access to valuable insights and recommendations from Jim Cramer, a seasoned market expert, to make informed investment decisions.

The stock market has experienced notable trends and opportunities in recent months, driven by factors such as the Federal Reserve interest rate cut and market rotation. The CNBC Investing Club with Jim Cramer has effectively navigated these trends, capitalizing on opportunities and maximizing returns for its members. By staying proactive, diversifying the portfolio, and identifying growth sectors, the Club has positioned itself for continued success in the ever-changing market landscape.