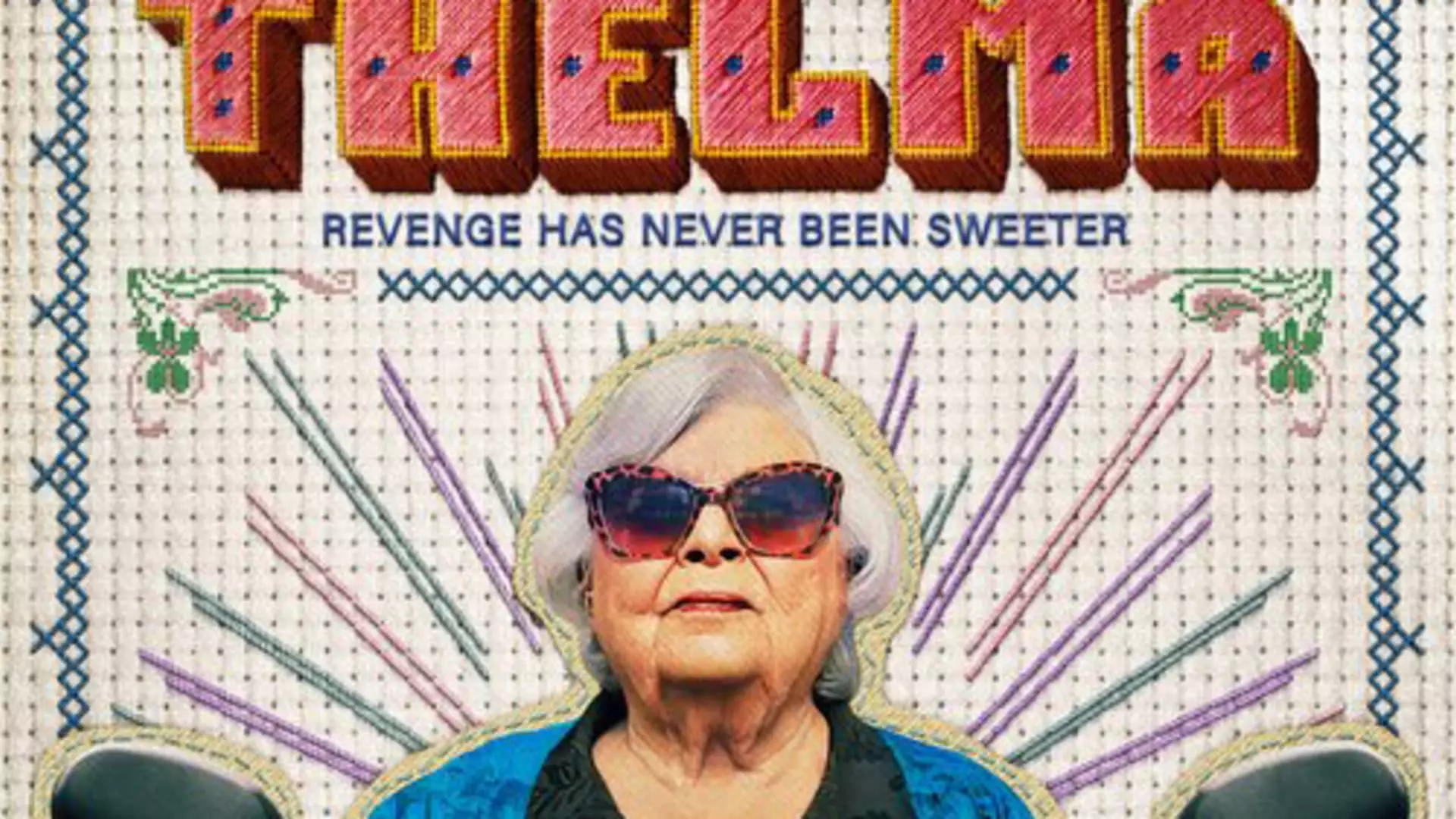

In the movie “Thelma,” a 93-year-old woman falls victim to a scam call where she is tricked into sending $10,000 to a P.O. Box address after believing it was her grandson in need. This type of scam, also known as grandparents’ scams or family emergency scams, is unfortunately all too real in today’s world. According to the U.S. Federal Trade Commission, imposter fraud led to losses of nearly $2.7 billion last year. The threat posed by these scams is only increasing in the age of artificial intelligence, making it easier for scammers to manipulate and deceive their targets.

The story depicted in the movie is not far from reality. The real Thelma, a 103-year-old grandmother, had a similar experience where she was almost swindled out of money by scammers. While in the movie, Thelma embarks on an adventurous quest to retrieve her funds, in reality, her family intervened before she could send any money. The emotional response to these scams is genuine and can lead individuals to act irrationally out of fear and panic, as illustrated in both the movie and the real-life event.

Imposter fraud, especially through AI voice scams, is becoming increasingly common. Reports to the FTC indicate that it was the most prevalent type of fraud in 2023, with a rise in reports of business and government impersonators. Scammers are leveraging social media and generative AI to create deep fake voices that can sound like familiar individuals in distress. This manipulation preys on the emotions of victims, leading them to make hasty decisions to help their loved ones.

Older adults, like Thelma in the movie, are often targeted by scammers due to cognitive vulnerabilities that come with age. As individuals grow older, their decision-making abilities can decline, making them more susceptible to manipulation. However, younger generations are not immune to these scams, especially as they spend more time online and are exposed to a higher volume of digital content. Education and awareness are critical in protecting all age groups from falling victim to AI voice scams.

Having conversations with loved ones about the risks of scams can be challenging but essential. Establishing an aging plan early on, involving family members in financial decisions, and setting up basic security measures like credit freezes and multifactor authentication can serve as critical defenses against scammers. By taking a proactive approach to safeguarding personal information and staying informed about emerging scams, individuals can reduce their risk of becoming victims of AI voice fraud.

As technology advances, so do the tactics employed by scammers to exploit vulnerable individuals. AI voice scams represent a significant threat to personal and financial security, requiring proactive measures to mitigate the risk. By understanding the nature of these scams, educating oneself and loved ones, and implementing robust security practices, individuals can defend against the pervasive threat of AI voice fraud. Stay vigilant, stay informed, and stay one step ahead of those seeking to deceive and exploit.