As Nvidia prepares to reveal its fiscal third-quarter earnings, the financial community is on edge, eager to gauge how the semiconductor giant adapts to the fast-paced transformations within the artificial intelligence (AI) landscape. The anticipated earnings report, which will be released after market hours on Wednesday, is expected to provide crucial insights. Investors are particularly focused on whether Nvidia can maintain its explosive growth trajectory as AI technologies become increasingly mainstream.

According to consensus estimates from LSEG, Nvidia is projected to generate around $33.16 billion in revenue, with an earnings per share (EPS) of approximately 75 cents on an adjusted basis. However, the more critical aspect lies in Nvidia’s forecast for the upcoming quarter. Wall Street analysts anticipate an upward projection of 82 cents per share and total sales of about $37.08 billion. These figures reflect a keen interest in Nvidia’s ability to sustain momentum within a rapidly evolving market.

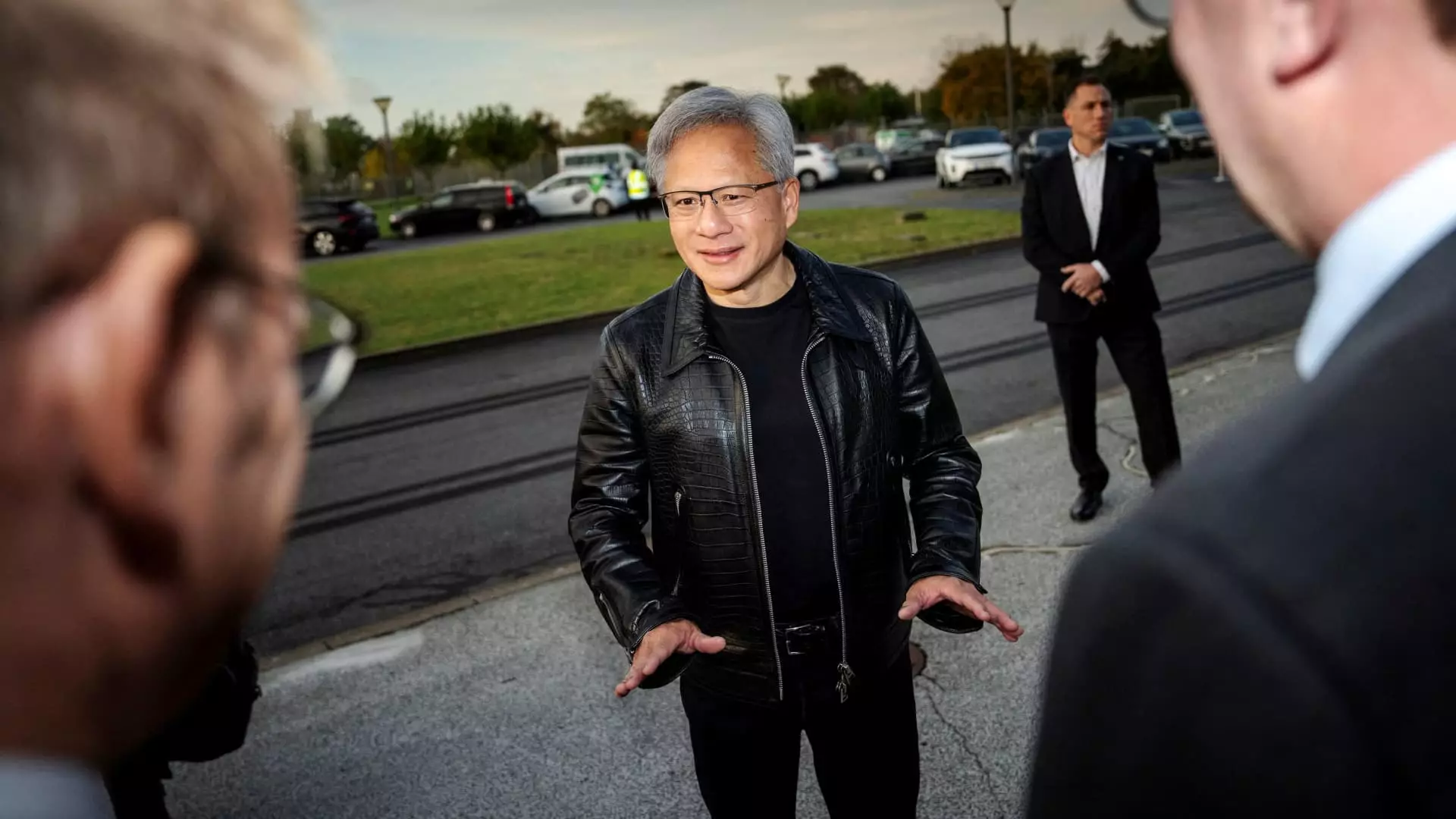

Central to Nvidia’s growth narrative is its forthcoming Blackwell AI chip, designed specifically for data center applications. This next-generation microchip is already entering the hands of key customers, including tech giants like Microsoft, Google, and Oracle. Analysts will scrutinize comments from CEO Jensen Huang during the earnings call, particularly regarding the demand for Blackwell. Given the ongoing AI boom, investor attention will likely center on whether this new technology can successfully capture and bolster long-term growth.

While expectations for Blackwell are high, Nvidia may face challenges related to reports of overheating issues concerning some systems utilizing these chips. Investors are likely to seek clarity on this matter during the earnings call, as it could have ramifications not just for Blackwell’s sales, but also for the company’s reputation in the competitive semiconductor space. Earlier this August, Nvidia indicated its confidence in generating “several billion” dollars in Blackwell sales during the forthcoming quarter, a statement that lends urgency to addressing any potential operational hurdles.

Nvidia’s stock has experienced a staggering surge, nearly tripling in value since the dawn of 2024. This remarkable ascent reflects the heightened demand for AI-related technologies, with the company reporting an impressive 122% increase in sales in the most recent quarter. However, this figure signals a noticeable slowdown compared to the previous quarters, where year-over-year growth reached 262% in April and 265% in January. Such a marked dip raises questions for investors about the sustainability of Nvidia’s growth amidst a rapidly saturating market.

As Nvidia stands at this pivotal moment, stakeholders and analysts await insights that divulge the company’s strategy moving forward. Maintaining growth in the face of potential headwinds will require not only innovative technology but also adept management in addressing emerging challenges. With focus on the Blackwell chip and broader market dynamics, Nvidia’s third-quarter results promise to offer essential guidance for its future trajectory in an ever-evolving tech landscape.