Nvidia shares skyrocketed to over $1,000 for the first time in extended trading following the release of the chipmaker’s fiscal first-quarter results that exceeded analyst expectations. This remarkable jump in stock price highlights the confidence investors have in Nvidia’s performance and the AI industry as a whole.

Financial Performance Highlights

Nvidia reported impressive figures in its quarterly earnings report, surpassing market estimates and signaling the continued strength of the AI market. With a reported revenue of $26.04 billion compared to the expected $24.65 billion, Nvidia has demonstrated its ability to capitalize on the growing demand for AI chips.

One of Nvidia’s key business segments, data center sales, witnessed a staggering 427% increase from the previous year, reaching $22.6 billion in revenue. This surge in sales can be attributed to the high demand for Nvidia’s AI chips in building and deploying AI servers. The company’s finance chief, Colette Kress, pointed out that a significant portion of this revenue came from large cloud providers adopting Nvidia’s technology.

Introduction of Next-Generation AI Chip

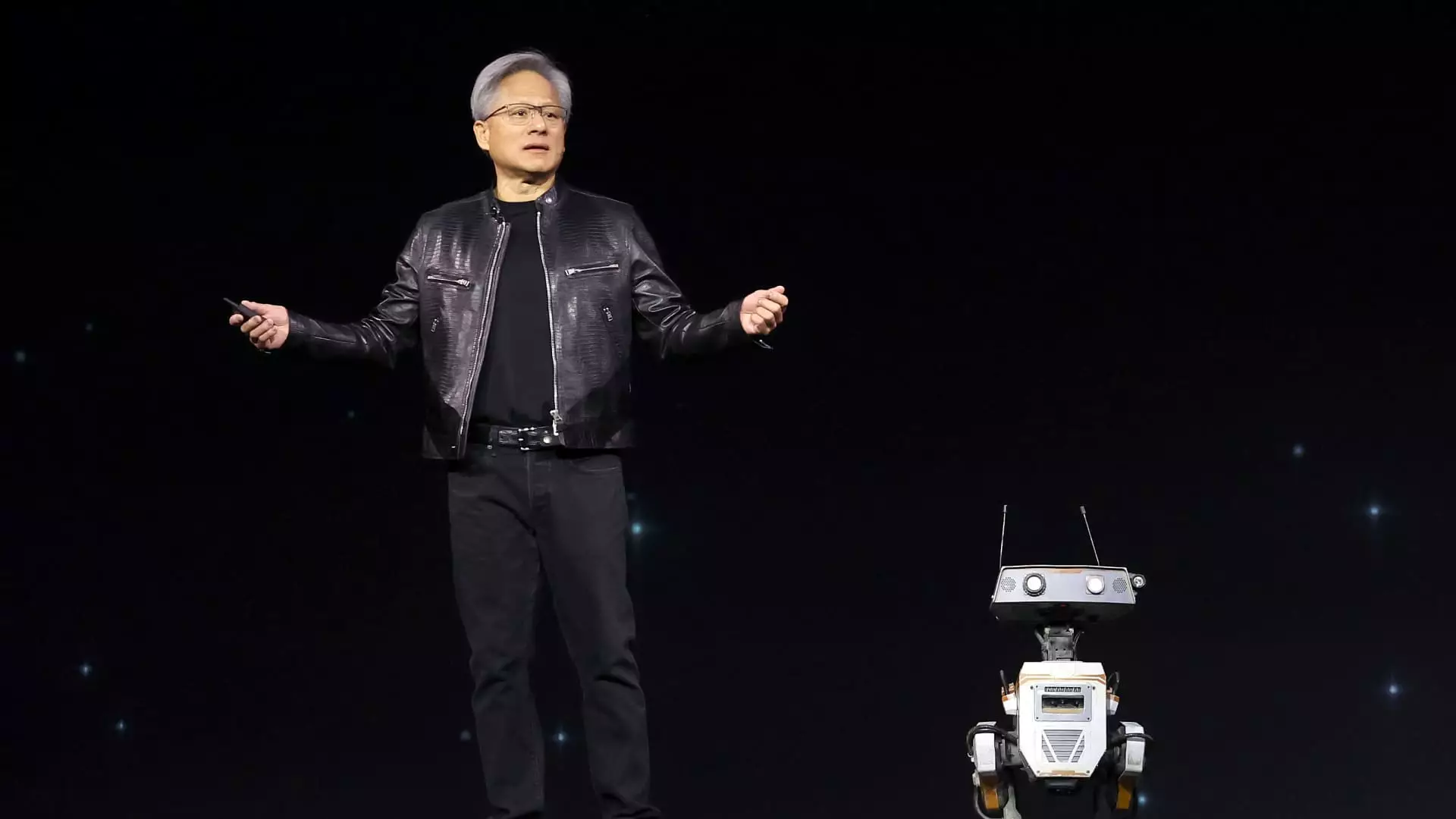

Nvidia’s CEO, Jensen Huang, announced the upcoming launch of the company’s next-generation AI chip, Blackwell. This new chip is expected to drive further revenue growth for Nvidia and is projected to be in data centers by the fourth quarter. The anticipation surrounding Blackwell indicates Nvidia’s commitment to innovation and staying ahead in the competitive AI landscape.

While Nvidia is best known for its data center sales, the company also reported growth in other areas such as gaming, networking, and automotive. Gaming revenue increased by 18% to $2.65 billion, largely due to strong consumer demand. Additionally, Nvidia’s networking revenue saw a substantial rise, showcasing the importance of interconnected systems in the AI ecosystem.

Nvidia’s strong financial performance is reflected not only in its revenue figures but also in its shareholder returns. The company bought back $7.7 billion worth of its shares and paid $98 million in dividends during the quarter. Moreover, Nvidia announced an increase in its quarterly cash dividend, further enhancing shareholder value.

Nvidia’s exceptional performance in the fiscal first quarter demonstrates its position as a market leader in the AI industry. With continued innovation, strategic partnerships, and a diversified product portfolio, Nvidia is well-positioned to capitalize on the growing demand for AI technology. Investors can look forward to sustained growth and value creation from this tech giant in the future.