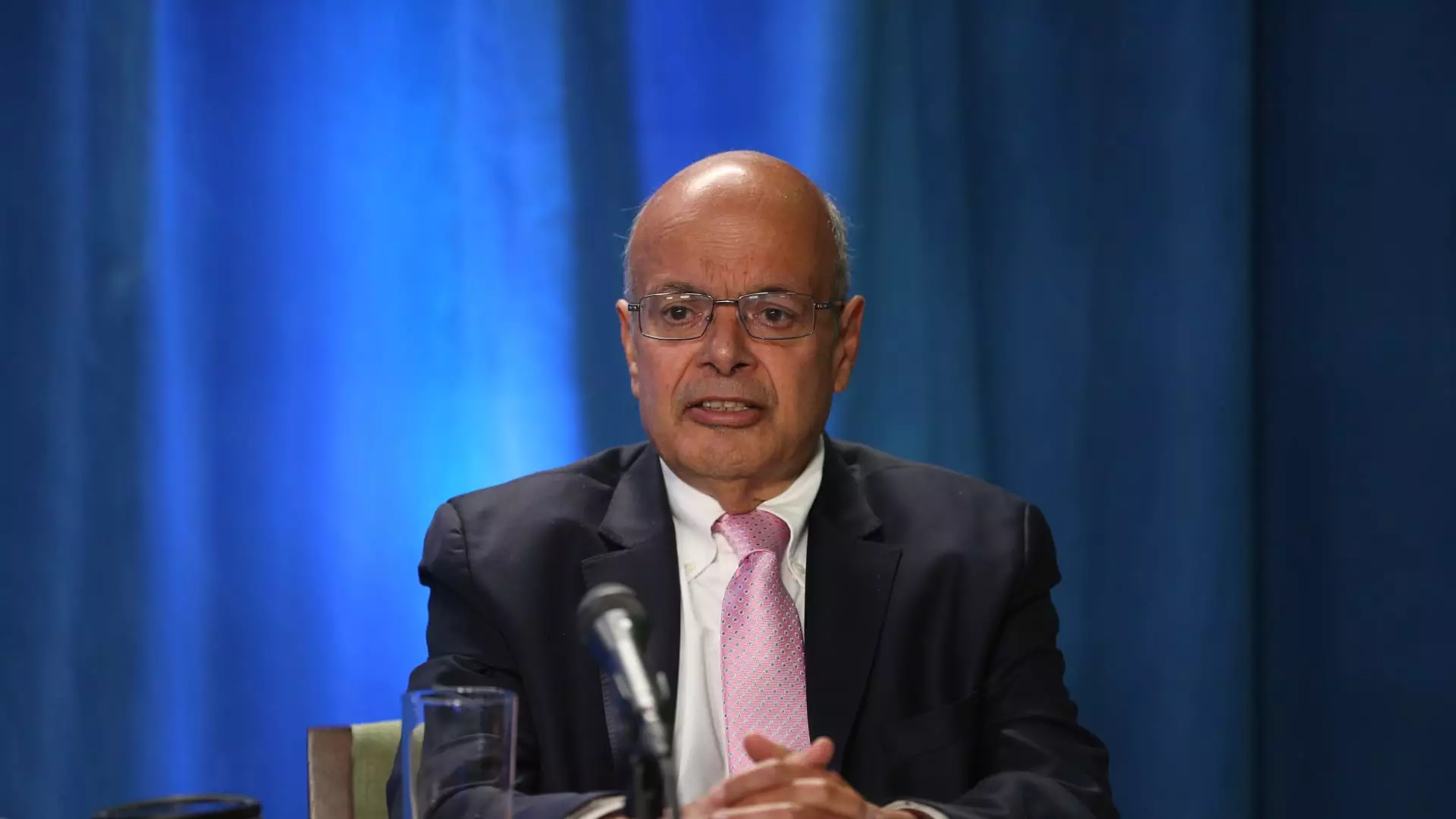

Ajit Jain, often recognized as one of the pivotal forces behind Berkshire Hathaway’s insurance operations, recently made headlines by divesting over half of his stake in the conglomerate. This decision has stirred speculation among investors and analysts alike, considering Jain’s longstanding affiliation with Berkshire, which began in 1986. According to a regulatory filing, Jain offloaded 200 shares of Berkshire Class A, amassing approximately $139 million. Having retained only 61 shares for himself, along with his family trusts and his nonprofit Jain Foundation, Jain’s sale underscores a significant pivot in his portfolio strategy.

The intricacies behind Jain’s decision come into sharper focus when one examines the current landscape of Berkshire Hathaway’s stock valuation. With the shares having recently surpassed the $700,000 mark and a notable market capitalization exceeding $1 trillion at the end of August, it’s apparent that Jain took advantage of a peak valuation for his sale. Analysts are interpreting this move not merely as a personal financial maneuver but as a potential indicator of how Jain perceives Berkshire’s future growth prospects. David Kass, a finance professor, has indicated that this transaction might signal Jain’s belief that the stock is nearing its peak value.

This is notable given the broader context in which Berkshire Hathaway has scaled back its stock buyback activities. In stark contrast to previous quarters, where repurchases totaled approximately $2 billion, the company’s recent figures showed a mere $345 million in buybacks. This decline in stock repurchase activity could be interpreted as a sign of caution, suggesting that even leadership within Berkshire may view the stock as overvalued.

Jain’s influence in steering Berkshire Hathaway’s insurance apparatus has been substantial. He has been instrumental in pushing the company into the reinsurance market and revitalizing Geico, its flagship auto insurance subsidiary. Since assuming the role of vice chairman of insurance operations in 2018, he has been credited with generating immense value for shareholders. Warren Buffett himself has lauded Jain’s contributions, noting in past letters that Jain has created “tens of billions of value for Berkshire shareholders.” Such accolades have primed Jain as a potential successor to Buffett, a speculation that recent events may inadvertently quash.

Despite being regarded as a frontrunner for leadership, Buffett recently clarified that Jain has no desire to ascend to the top position within Berkshire Hathaway. This clarification speaks volumes about the company’s internal culture, which values the operational efficiency and success Jain offers, while allowing the iconic Buffett to remain at the helm, at least for the foreseeable future.

The ramifications of Jain’s share sale extend beyond the immediate financial implications. Investor sentiment can be influenced by such high-profile transactions. When a high-ranking executive like Jain reduces his stake significantly, it prompts inquiries regarding the long-term viability of the company’s stock and its future growth trajectory. Analysts like Bill Stone express reservations about further stock repurchases, especially given the current valuation metrics. With Berkshire trading at over 1.6 times book value, it raises questions about whether now is a prudent time for company buybacks or for individual shareholders to consider exiting positions.

Moreover, as the landscape of Berkshire’s leadership evolves, so too does the narrative surrounding its strategic direction. While Jain remains a highly respected figure, his decision to sell shares invites scrutiny over the conglomerate’s priorities moving forward. Will Berkshire continue to diversify and innovate under its existing leadership structure, or will the absence of Jain’s personal investment signal a shift toward more conservative strategies?

Ajit Jain’s recent decision to sell a significant portion of his Berkshire Hathaway shares raises multifaceted questions about both his financial strategy and the company’s future. While the divestment represents a personal financial maneuver amid peaks in valuation, it also may reflect a broader sentiment about the company’s stock price and market conditions. As Berkshire navigates these turbulent waters, investors will remain keenly focused on leadership dynamics and perceived valuations in the quest for sustained growth and profitability. The future of Berkshire Hathaway remains in the balance, influenced by yesterday’s decisions and tomorrow’s aspirations.