The holiday season brings a peculiar tradition within the media industry: a set of predictions for the coming year articulated by anonymous executives who prefer to maintain their confidentiality. As we celebrate this season of cheer, executives from various segments of the entertainment landscape have stepped forward to offer an insightful glimpse into what they believe 2025 may hold. Contrasting past predictions, some of which faltered, this year shows an undertone of optimism mixed with caution, indicating that the industry is on the cusp of significant transformation.

Before diving into the future, it’s essential to reflect on the previous year. The predictions made for 2024 were a cocktail of ambitious aspirations and tempered expectations. While some forecasts aligned closely with reality—such as Disney and Warner Bros. Discovery collaborating on regional sports rights—others fell short of their mark. For instance, a major streaming bundle involving industry giants didn’t materialize as anticipated.

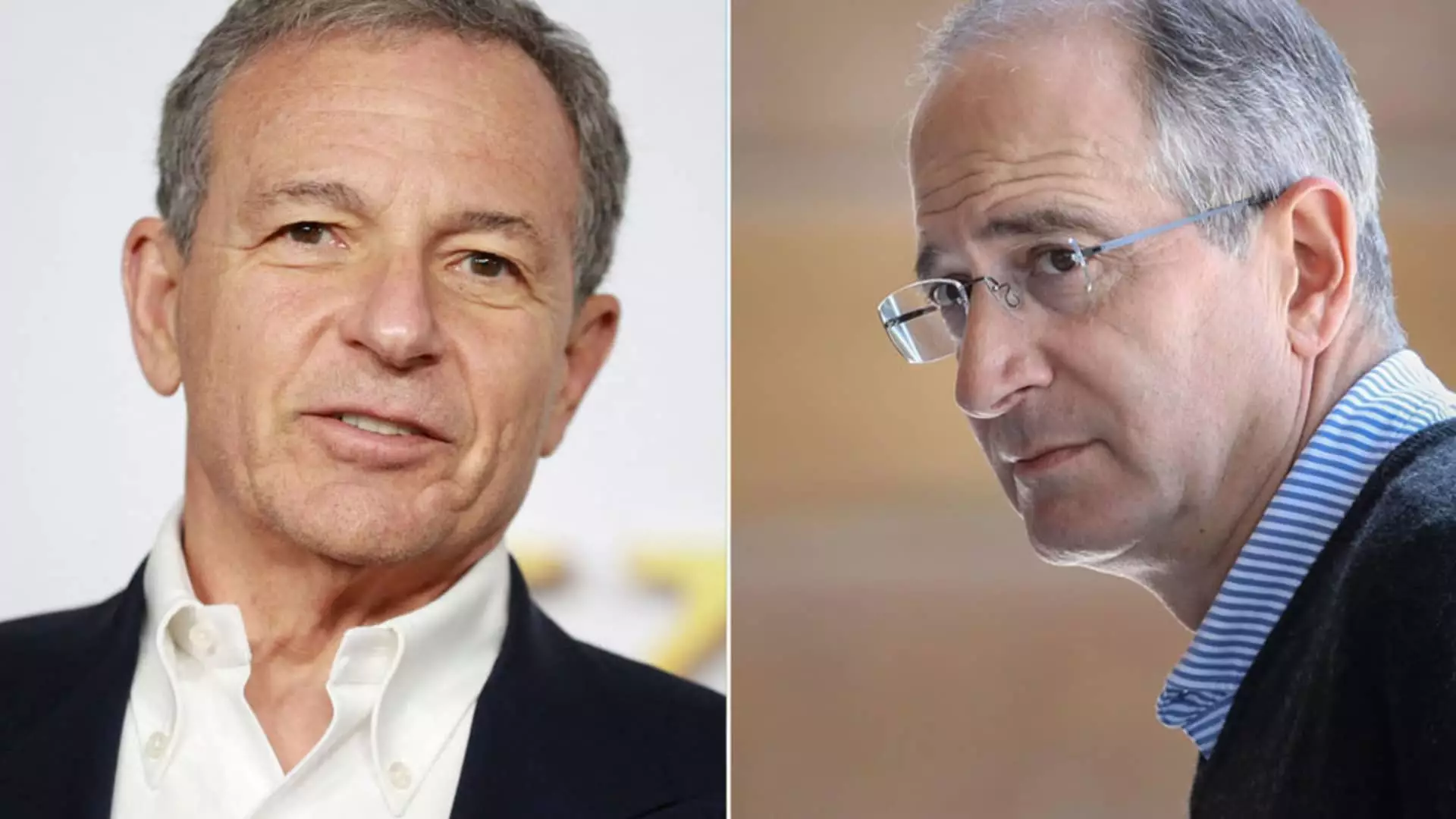

Moreover, the anticipated shakeup in Disney’s executive layer didn’t unfold as prophesied. With Bob Iger’s tenure continuing, speculation around the future leadership of Disney was pushed to 2026, indicating the organization’s desire to maintain stability amid shifting market dynamics. This analysis serves as a reminder that while predictions can provide a roadmap, the unpredictable nature of the media landscape makes certain outcomes elusive.

As we look forward to 2025, one of the most pressing themes stands out: consolidation. With Warner Bros. Discovery planning to separate its linear television assets, the industry is bracing for further shifts. Comcast’s potential maneuvering to unite the largest U.S. cable companies reflects a broader trend of creating efficiencies through mergers and acquisitions, driven by dwindling traditional cable valuations. The idea of a “SpinCo” could redefine how media companies organize themselves and tackle formidable competition from streaming services.

In an intriguing twist, some executives speculate on Fox’s resurgence as it eyes acquisitions of significant assets, including HBO and the Turner networks. This prediction suggests that, despite previous hurdles, Fox aims to fortify its position and regain a competitive edge in the entertainment ecosystem. Such moves can serve as pivotal turning points in shaping the media landscape, underscoring the continual flux within this industry.

However, increased consolidation is not without challenges. Regulatory scrutiny looms large, reminiscent of past obstacles faced by companies attempting to merge. The possibility of a new Trump administration permitting consolidation is met with skepticism. This commentary emphasizes that while many hope for a relaxation in antitrust regulations, the complexity of government oversight cannot be underestimated.

Companies such as EW Scripps and Tegna are grappling with declining share values, rooted in the ongoing trends of cord-cutting and shifting consumer preferences. This dynamic engenders a sense of urgency for smaller media entities, leading some to consider desperate exits as they strive to survive. The prospect of major networks acquiring troubled broadcasters hints at a potential reshaping of ownership structures, heralding a new era in the industry.

Another transformative prediction revolves around streaming services. The executives speculate about the possibility of combining offerings from Paramount Global, NBCUniversal, and Warner Bros. Discovery to form a prominent bundle. The competition in this arena is intense, with companies exploring new models to attract and retain subscribers. Collaboration may prove necessary as these entities work to create compelling value propositions amidst fierce competition.

Amid the streaming frenzy, ESPN’s new flagship service projected for a 2025 launch adds to the anticipation. The evolution of Venu, a much-touted joint venture faltering under legal challenges, paints a complex picture of how traditional media companies navigate the digital terrain. As these narratives unfold, the industry will be watching closely to see if innovative alliances can address the ongoing struggle for consumer attention.

As we venture into 2025, the media landscape remains unpredictable. While there are cautious optimism and a spirit of resilience echoed in the predictions offered by industry executives, the challenges of adapting to rapid changes persist. Will consolidation produce the efficiencies companies seek, or will it deliver unforeseen consequences that could reshape the industry for years to come?

Ultimately, as executives ponder their vision for the future, one can only hope that the upcoming year brings not only strategic successes but also creative breakthroughs that redefine the way audiences experience media. The heart of entertainment lies in its ability to innovate, adapt, and inspire—may 2025 deliver just that.