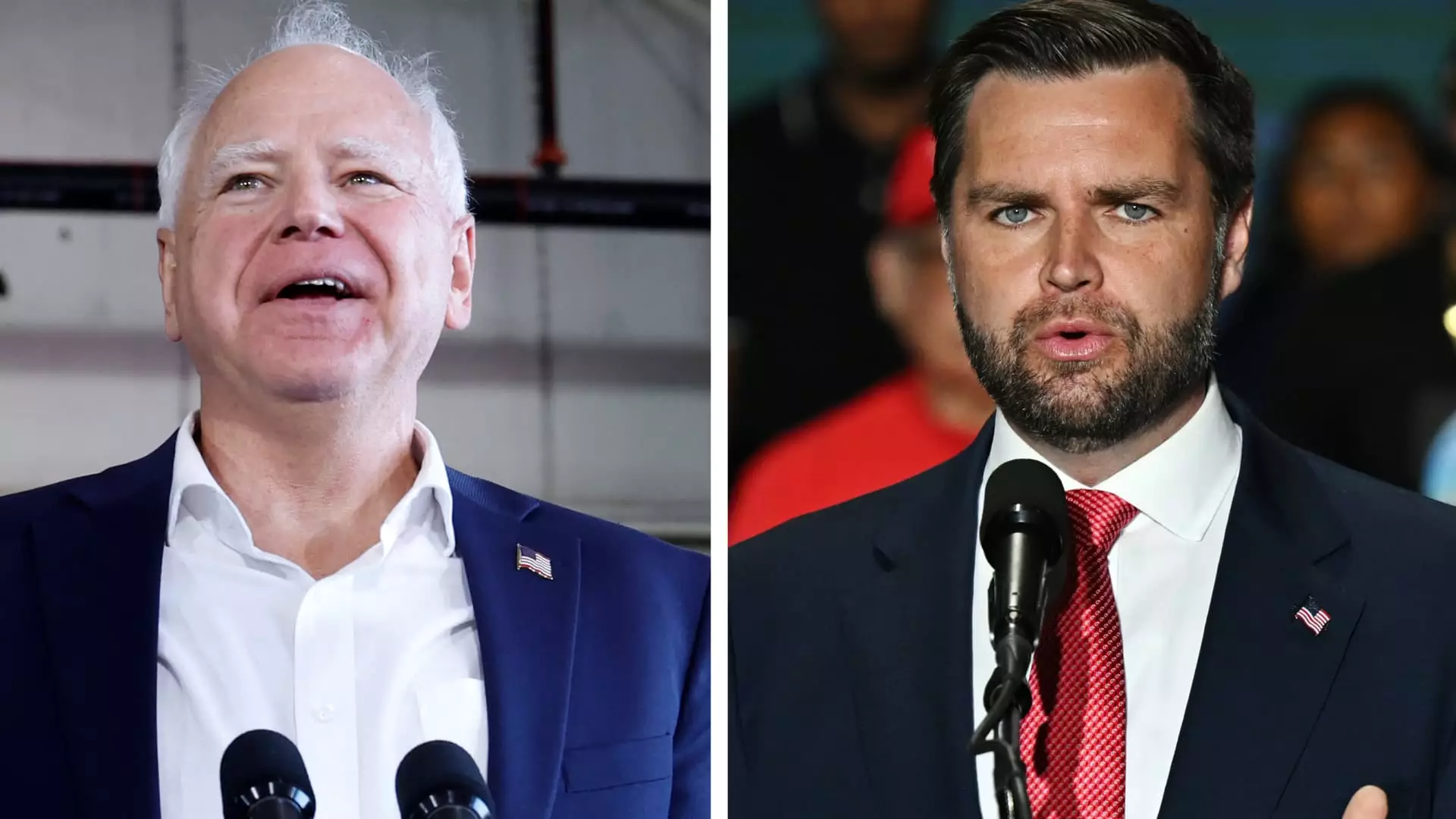

With the finalization of major party tickets, the focus of many voters has shifted to the candidates’ personal finance policies that could potentially impact their wallets. Vice President Kamala Harris and Minnesota Governor Tim Walz, along with former President Donald Trump and Senator JD Vance of Ohio, are drawing battle lines over class warfare, attempting to showcase their connection or disconnect with middle-class Americans. With less than 90 days until the election, it is crucial to understand where each candidate stands on key financial issues that could shape the future economic policy under a Harris or Trump presidency.

Affordable housing is a critical issue for many Americans, and both Tim Walz and JD Vance have addressed this concern. Governor Walz took a significant step by signing housing legislation in May 2023 that included substantial funding for down payment assistance, housing infrastructure, and workforce housing. Analysts anticipate that Walz will advocate for demand-side approaches to housing, focusing on enhancing housing quality and decreasing monthly housing costs. In contrast, Vance has also emphasized affordable housing during his campaign, highlighting it in his Republican National Convention acceptance speech. Vance has criticized institutional ownership of rental homes and Chinese buyers for U.S. real estate, positioning himself as a proponent of affordable housing.

One of the critical financial policies at stake is the child tax credit, particularly amidst the impending expiration of tax breaks enacted by President Trump after 2025. The temporary expansion of the child tax credit in 2021 significantly reduced the child poverty rate, prompting Minnesota to implement a state-level refundable child tax credit. While Governor Walz views this as a major achievement, the permanence of this federal expansion remains uncertain. Senate Republicans recently blocked a federal child tax credit expansion, with Senator Mike Crapo calling it a political move. JD Vance, who has emphasized family values in his campaign, showed support for the child tax credit but has been vocal against forgiving student loans.

VD Vance has staunchly opposed student loan forgiveness policies, arguing that they primarily benefit the wealthy and corrupt university administrators. He has been vocal against forgiving student debt, advocating for a more stringent approach. In contrast, Governor Walz, with his background in education, has supported programs to alleviate the burden of student loans on individuals. He signed legislation for a student loan forgiveness program for nurses in Minnesota and backed a free tuition initiative for low-income students. Walz’s commitment to addressing student debt issues stems from his personal perspective as a former school teacher and a parent.

The personal finance policies of Vice President Kamala Harris and Senator JD Vance offer a stark contrast in approaches to key financial issues. While Walz focuses on housing affordability and student debt relief, Vance leans towards a more conservative stance on fiscal matters. The upcoming election will serve as a decisive moment for American voters to weigh in on these critical financial policies and determine the economic direction of the country based on their financial well-being.