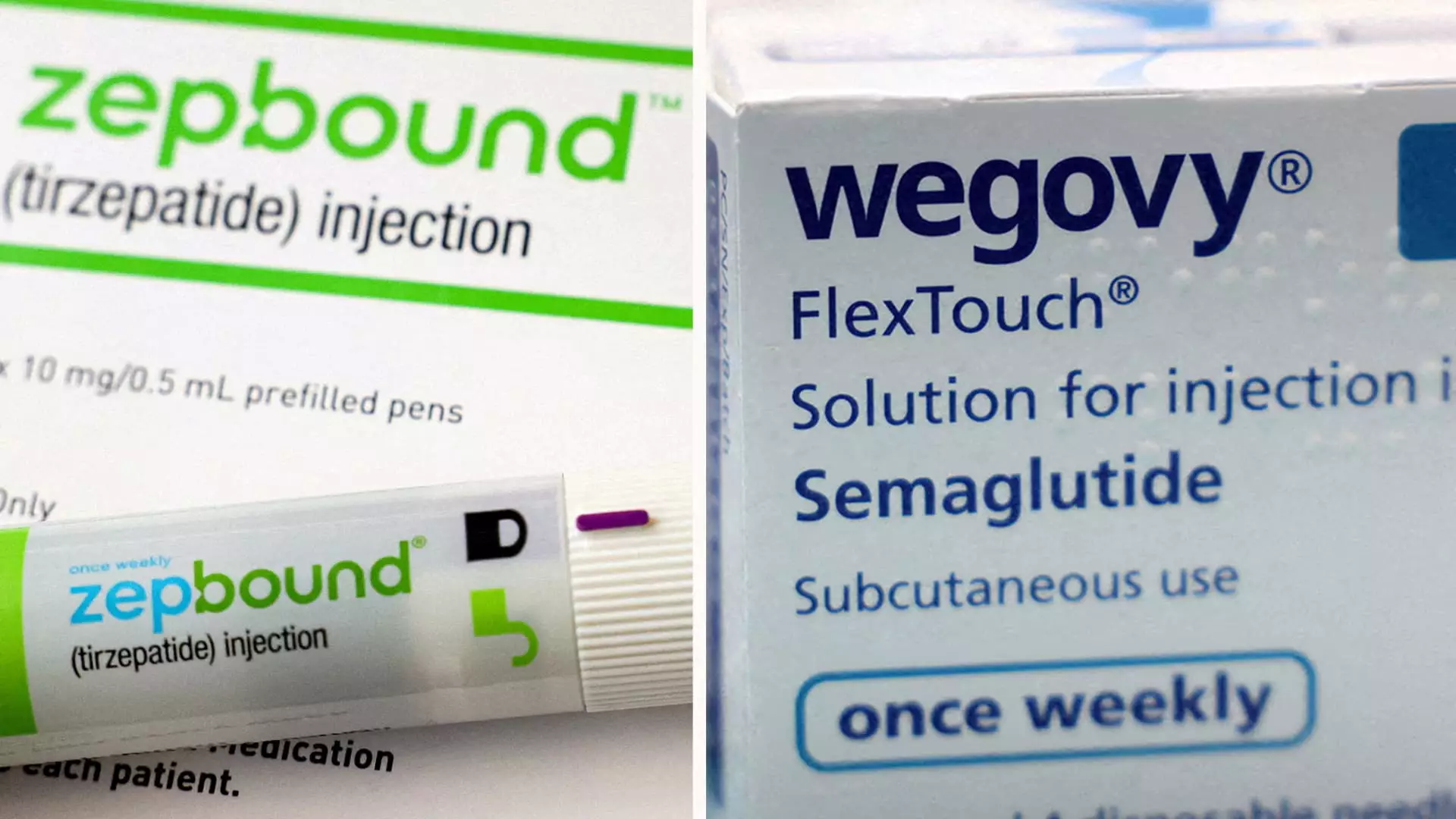

The recent announcement from Eli Lilly regarding its obesity treatment, Zepbound, has garnered significant attention, especially given its promising results compared to Novo Nordisk’s established drug, Wegovy. The findings stem from a rigorous head-to-head clinical trial, which indicates that Zepbound may potentially revolutionize treatment options for individuals struggling with obesity. In a society increasingly burdened by obesity-related health issues, the implications of these results extend beyond the pharmaceutical sector; they could reshape healthcare approaches to weight management and overall public health strategies.

According to the trial, patients receiving Zepbound experienced an unprecedented average weight loss of 20.2%, roughly translating to 50 pounds, after 72 weeks. In stark contrast, those treated with Wegovy achieved a weight loss of about 13.7%, or approximately 33 pounds, during the same timeframe. This notable disparity has led Eli Lilly to assert that Zepbound provides a 47% higher relative weight reduction than Wegovy, a claim that is grounded in solid clinical evidence from their phase three trial involving 751 participants.

Significant Clinical Findings

The results of the study shed light on Zepbound’s effectiveness, revealing that over 31% of participants lost at least a quarter of their body weight, compared to only 16% among Wegovy users achieving similar results. This distinction is critical; losing a significant percentage of body weight can substantially improve overall health and reduce the risk of obesity-related complications. Further supporting Eli Lilly’s claims, earlier studies have also indicated Zepbound’s potential superiority in weight management, outpacing Wegovy in weight loss metrics across varied study designs.

The design of the trial, where participants suffering from obesity or overweight conditions but not diabetes were meticulously randomized, provides robust evidence of Zepbound’s advantages over its competitor. The implications of such data are profound, as they suggest that healthcare providers and patients may have a more effective option available in Zepbound, potentially transforming patient outcomes and quality of life.

The competitive landscape between Eli Lilly and Novo Nordisk demonstrates a growing market for obesity medications—an industry that some analysts predict might be worth as much as $150 billion annually by 2030. While Wegovy has been on the market longer, Zepbound’s recent approval presents it as a formidable challenger. GlobalData forecasts attributed to Zepbound estimate an annual revenue of $27.2 billion by 2030, surpassing Wegovy’s projected $18.7 billion. Such projections hint at the fierce competition and rapid evolution within the weight loss drug market.

Eli Lilly’s strategy appears to rest on leveraging Zepbound’s superior efficacy in order to gain market share in a lucrative category. As both companies endeavor to expand their manufacturing capabilities amidst surging demand, the market dynamics and consumer access to these treatments remain critical areas of focus. Notably, Zepbound and Wegovy are priced at approximately $1,000 per month, a considerable financial burden that may limit accessibility without adequate insurance coverage, sparking a critical dialogue about insurance policies related to weight loss treatments in the U.S.

An understanding of how these treatments operate reveals crucial differences. Zepbound functions by activating two gut hormones, GIP and GLP-1, to modulate appetite and blood sugar levels. In contrast, Wegovy solely targets GLP-1, raising questions among researchers about its overall efficacy in fat and sugar metabolism. Such differences might explain the varying outcomes in weight loss between the two medications, highlighting the potential for Zepbound to effect more comprehensive metabolic changes.

Eli Lilly’s announcement regarding Zepbound signals not only a potential shift in the obesity treatment paradigm but also underscores the growing urgency to address obesity as a critical public health issue. As clinical evidence mounts, stakeholders in healthcare must navigate the complexities of treatment options, pricing, and accessibility to ensure that patients receive the most effective care possible.