Berkshire Hathaway, led by Warren Buffett, made headlines recently as it sold an additional 1.3 million shares of BYD, China’s largest electric vehicle maker. This move comes as the conglomerate continues to reduce its stake in the company, which was initially purchased in 2008. The decision to sell a portion of their holdings reflects Berkshire’s strategy to diversify its portfolio and capitalize on investment opportunities in the ever-evolving EV market.

When Berkshire Hathaway first invested in BYD in 2008 by purchasing around 225 million shares for $230 million, it was seen as a risky move. However, this bet turned out to be extremely lucrative as the EV market in China and globally experienced significant growth. By offloading half of its stake through sales in 2022 and 2023, Berkshire was able to capitalize on BYD’s soaring stock price, which skyrocketed nearly 600% to a record high in April 2022.

As Berkshire Hathaway’s stake in BYD now stands at 6.9%, down from 7%, many are speculating on the conglomerate’s future moves. Will Berkshire further reduce its holdings in BYD, or will it hold on to its remaining stake in anticipation of continued growth in the EV market? With BYD surpassing Tesla as the world’s top EV maker in the fourth quarter of 2023, the competition in the electric vehicle industry is heating up. Investors are closely watching Berkshire’s investment strategy to gain insights into the conglomerate’s outlook on the future of electric vehicles.

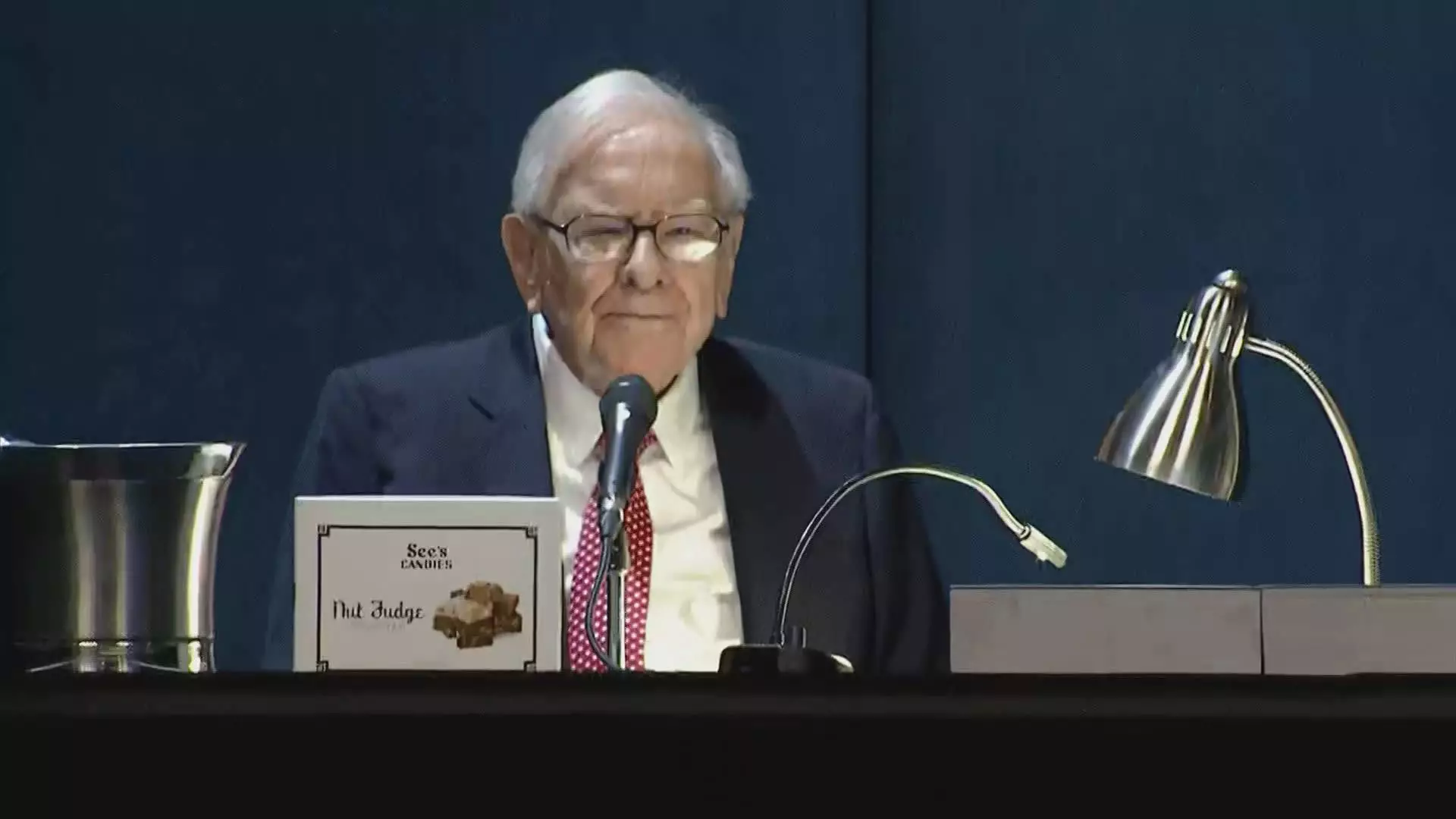

It is worth noting that the late Charlie Munger, Berkshire Hathaway’s vice chairman, played a significant role in the initial investment in BYD. Buffett himself credited Munger for deservedly receiving “100 percent of the credit for BYD.” Munger’s introduction to BYD through his friend Li Lu, founder of Himalaya Capital, highlights the importance of networking and relationships in the world of investing.

Berkshire Hathaway’s ongoing trimming of its stake in BYD reflects a strategic approach to managing its investment portfolio. As the EV market continues to evolve and grow, it will be interesting to see how Berkshire navigates its investments in this sector. The influence of key figures like Charlie Munger underscores the significance of individual insights and connections in shaping investment decisions.