The recent livestream of the CNBC Investing Club with Jim Cramer highlighted the positive movement in the U.S. stock market, with the S & P 500 climbing 1.5%, the Dow Jones Industrial Average jumping 1%, and the Nasdaq Composite rising by 1.9%. The livestream emphasized the rebound from the market’s three-day losing streak, with Jim Cramer pointing out that the previous day’s decline may have been just a temporary setback. However, the analysis was somewhat superficial, failing to delve deeper into the underlying causes of the market volatility beyond mentioning the “yen carry trade” and U.S. recession concerns.

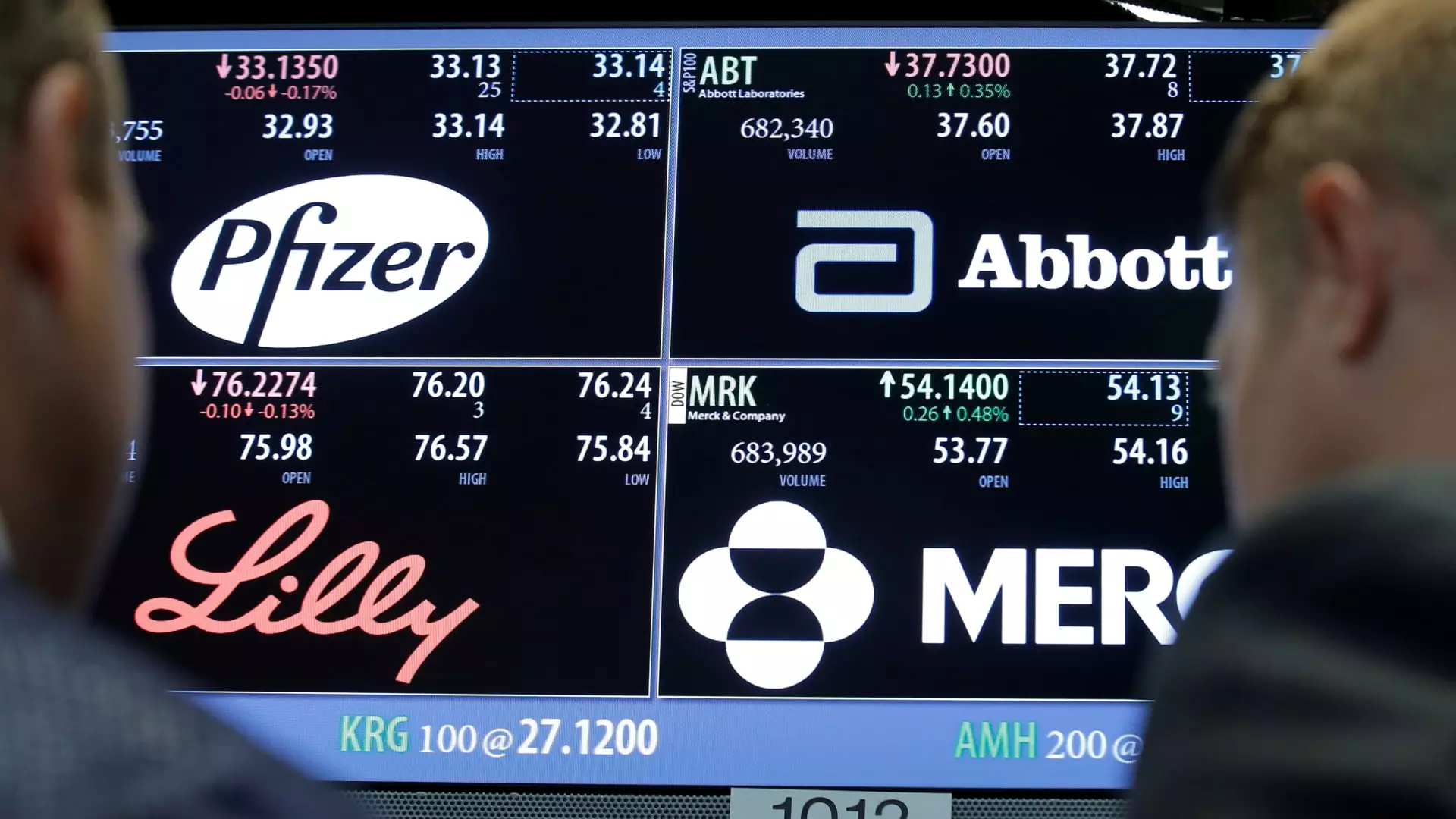

The livestream also discussed the performance of individual stocks, such as Eli Lilly, which declined 1.7% following disappointing earnings results from peer company Novo Nordisk. While the discussion touched on the potential impact on Eli Lilly’s GLP-1 drugs Zepbound and Mounjaro, it failed to provide a comprehensive analysis of the future prospects of the company. Furthermore, the focus on short-term stock price movements and quarterly results overlooked the long-term fundamentals that drive stock performance.

Another highlight of the livestream was the positive news for Amazon’s e-commerce business following CVS Health’s announcement of retail store closures. The discussion highlighted the potential benefits for Amazon’s platform as consumers increasingly rely on online shopping for everyday essentials. However, the analysis failed to address the broader implications of this trend for the e-commerce sector as a whole, focusing solely on the immediate impact on Amazon’s stock price.

Investing Club Guidance

The livestream also provided insights into the trading practices of the CNBC Investing Club, including the timing of trade alerts and the principles guiding Jim Cramer’s investment decisions. While this information may be valuable for club members looking to mirror Cramer’s trades, it lacked a critical assessment of the risks and uncertainties inherent in stock trading. The emphasis on following Cramer’s lead without considering individual risk profiles and investment goals could lead to suboptimal investment outcomes for club members.

Overall, the CNBC Investing Club livestream with Jim Cramer provided a superficial analysis of market movements, stock performance, and trading practices. The lack of in-depth analysis and critical evaluation of investment decisions may limit the effectiveness of the guidance provided to club members. Moving forward, a more comprehensive and critical approach to analyzing market trends, stock fundamentals, and investment strategies could enhance the value of the CNBC Investing Club for individual investors.