Berkshire Hathaway’s cash reserve grew to a staggering $276.9 billion in the last quarter, breaking its previous record of $189 billion. This increase was partly due to Warren Buffett’s decision to sell off a significant portion of his stock holdings, including shares in Apple. This move seems to suggest caution on the part of Berkshire Hathaway, possibly indicating a lack of attractive investment opportunities.

It’s worth noting that Berkshire Hathaway has been selling off stocks for the past seven quarters, but the pace accelerated in the last period, with over $75 billion in equities sold in the second quarter alone. This selling spree extended into the third quarter, with holdings in Bank of America being trimmed for 12 consecutive days. Buffett’s reluctance to deploy capital in the current market conditions seems justified, given the high valuations and economic uncertainties.

Despite the selling of stocks, Berkshire Hathaway’s operating earnings saw a healthy increase in the second quarter, primarily driven by the strong performance of its fully-owned businesses such as Geico. Operating earnings surged to $11.6 billion, marking a 15% jump from the previous year. Geico’s underwriting earnings before taxes more than tripled in the second quarter, showcasing the profitability of Berkshire’s insurance businesses.

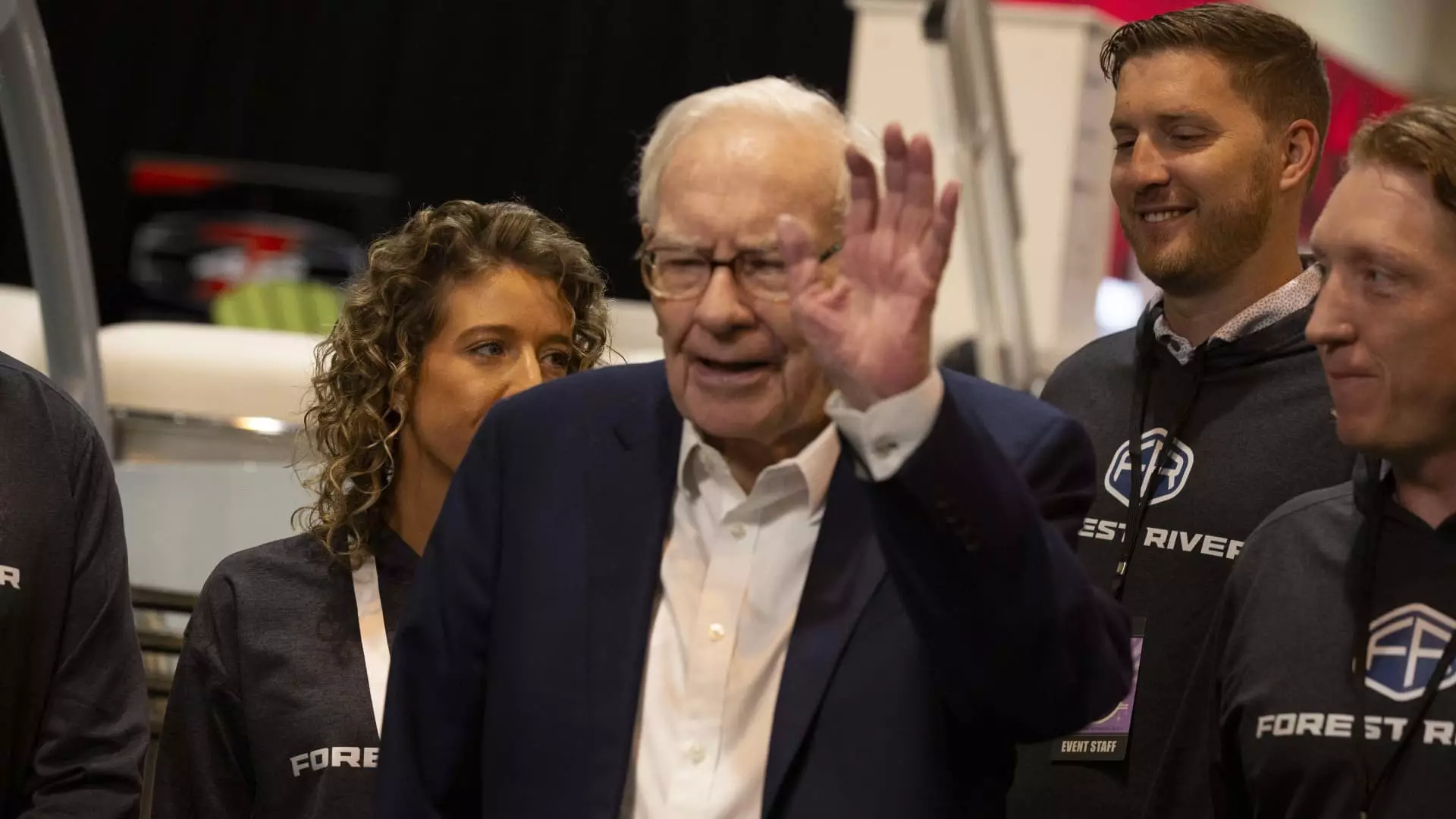

Warren Buffett’s cautious stance on deploying capital reflects his disciplined approach to investing. While he expressed willingness to make acquisitions, high market prices have deterred him from making any significant moves. The buyback of Berkshire’s own stock in the second quarter was notably lower than in the previous quarters, signaling a lack of compelling investment opportunities in the market.

The recent volatility in the stock market, highlighted by the 600-point drop in the Dow Jones Industrial average, indicates growing concerns about the economy. Weak economic data, including disappointing job reports, have raised doubts about the sustainability of the current bull market. Investors are also wary of high valuations in the technology sector, which has been a key driver of market growth.

Berkshire Hathaway’s record cash pile and Warren Buffett’s selling trends reflect a cautious approach to investing in the current market environment. The strong performance of its core businesses provides a solid foundation for future growth, but the lack of attractive investment opportunities remains a challenge. As economic uncertainties persist and market valuations remain elevated, Berkshire Hathaway’s strategic decisions will continue to be closely watched by investors.