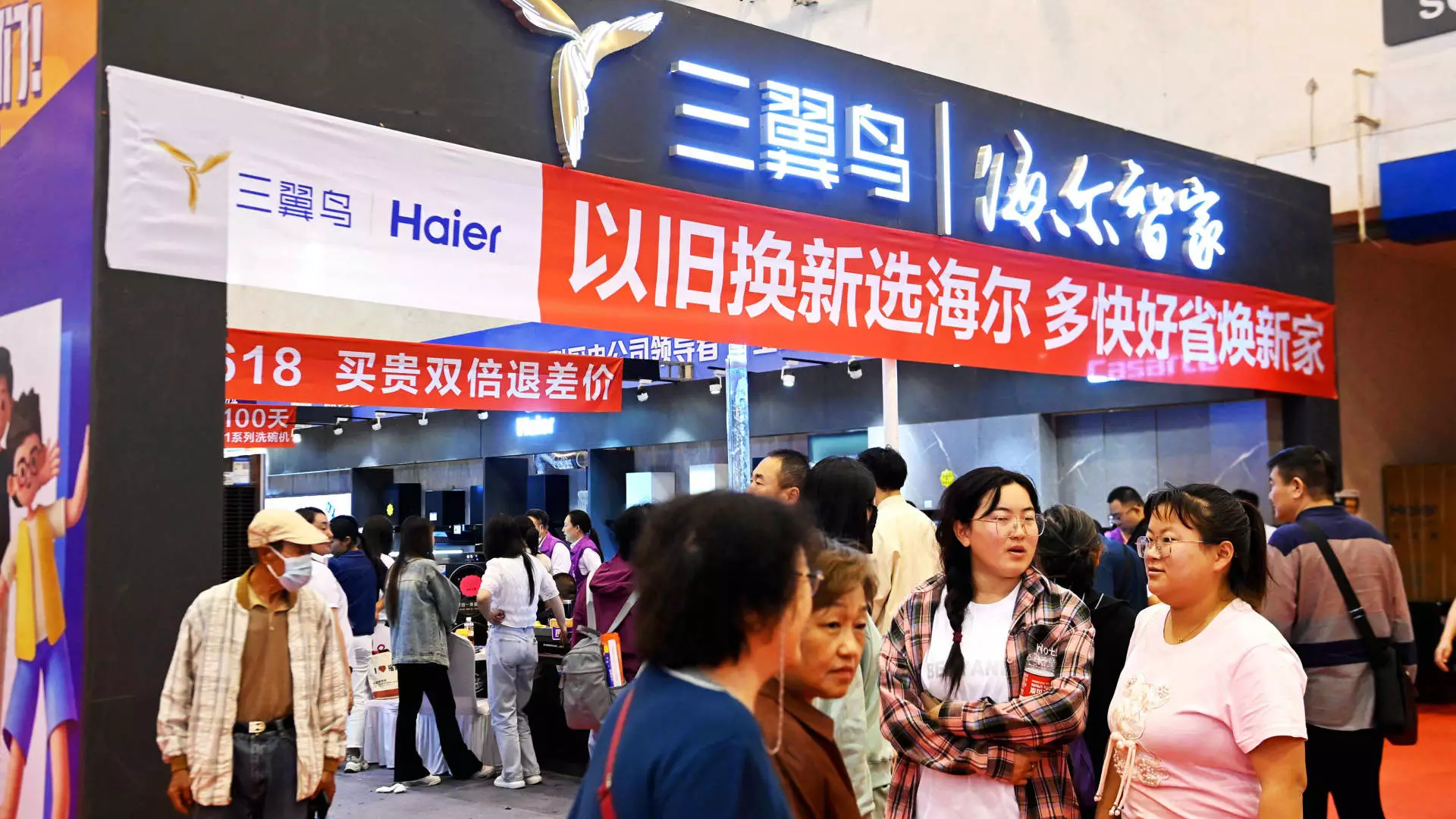

In July, China launched a bold initiative aiming to stimulate domestic consumption by encouraging trade-ins for household goods, such as cars and appliances, which aligns with its long-term economic goals. The government allocated a staggering 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds specifically designed for expanding policies around trade-ins and upgrades of consumer goods. This move reflects an acknowledgment of the critical role that domestic consumption plays in sustaining economic growth; however, evidence of its effectiveness is still lacking. Businesses within the country are expressing skepticism regarding the actual impact of these measures.

Despite positive intentions, reports suggest that the trade-in initiative has yet to translate into substantial changes on the ground. Companies are not witnessing a notable uptick in consumer behavior that reflects an observable surge in purchases thanks to the new measures. Jens Eskelund, the president of the EU Chamber of Commerce in China, highlighted this disconnection, urging a focus on practical implementation rather than merely the announcement of funds. This sentiment underscores a critical aspect: while financial resources are allocated, the efficacy of this initiative ultimately resides in how effectively those resources are deployed to benefit the average consumer.

China’s trade-in plan requires consumers to have a used product available for exchange and also to commit some upfront financial resources. This prerequisite might deter many potential participants, particularly amid ongoing uncertainties regarding job security and income stability. Consumers’ cautious spending habits, exacerbated by economic fluctuations and a shifting marketplace, further complicate the initiative’s objectives.

Consumer confidence is a pivotal factor in China’s consumption landscape. Reports indicate that retail sales growth has been slow, with June 2023 marking a mere 2% increase, the lowest growth figure reported since the Covid-19 pandemic commenced. Although there was slight improvement in July, with a 2.7% increase in retail sales, experts believe that the trade-in scheme’s anticipated support for retail transactions is limited. UBS Investment Bank’s Chief China Economist, Tao Wang, projected that this initiative might only bolster retail sales by approximately 0.3% in 2023.

Moreover, while the government incentivizes trade-ins particularly for new energy vehicles (NEVs), which saw a significant growth spurt of nearly 37% in July, overall vehicle sales experienced a decline. Consequently, even with a revitalization of NEVs catering to environmentally cautious consumers, the broader consumer goods sector remains under pressure. Trade-in offers for traditional vehicles and appliances may not be sufficiently appealing to stimulate considerable consumer spending, leading to a rather lukewarm outcome from the intended boost.

The recently launched trade-in program is designed to address broader consumer product trade-ins—critical to economic rejuvenation, but its immediate impact appears muted. Various segments, such as elevator manufacturers, have reported little to no increase in specific orders following the policy announcement. Companies like Otis and Kone are aware of the marketing potential but remain cautious about tangible results materializing quickly.

The property sector’s ongoing slump has affected several economic sectors connected to consumer goods. Kone, for example, noted a significant drop in Greater China revenue attributed to property issues, indicating that industries interconnected to the housing market are still struggling. The proposed policy may serve as a long-term catalyst for revitalization, but the lack of immediate demand signals complicates projections about growth.

On a more optimistic note, certain sectors such as e-commerce and the secondhand goods market appear to benefit from government support, particularly companies like ATRenew. The company reports a notable rise in trade-in transactions within specific categories, bolstered by its partnership with major platforms such as JD.com, which has seen a substantial uptick in order volume. While trade-in schemes might not bear immediate fruit for all sectors, specific areas, especially where consumer electronics are concerned, show a gradual upward trajectory.

While China’s initiatives around trade-ins reflect a proactive government strategy for stimulating consumption, the road ahead is fraught with challenges. A cautious consumer base coupled with slow implementation at the local government level raises multiple concerns, suggesting that while the potential for growth exists, its realization may take longer than expected. Transitioning to a stronger domestic economy might require not just fresh policies, but also a cultural shift in consumer psychology, fostering an environment ready to embrace change and spending.