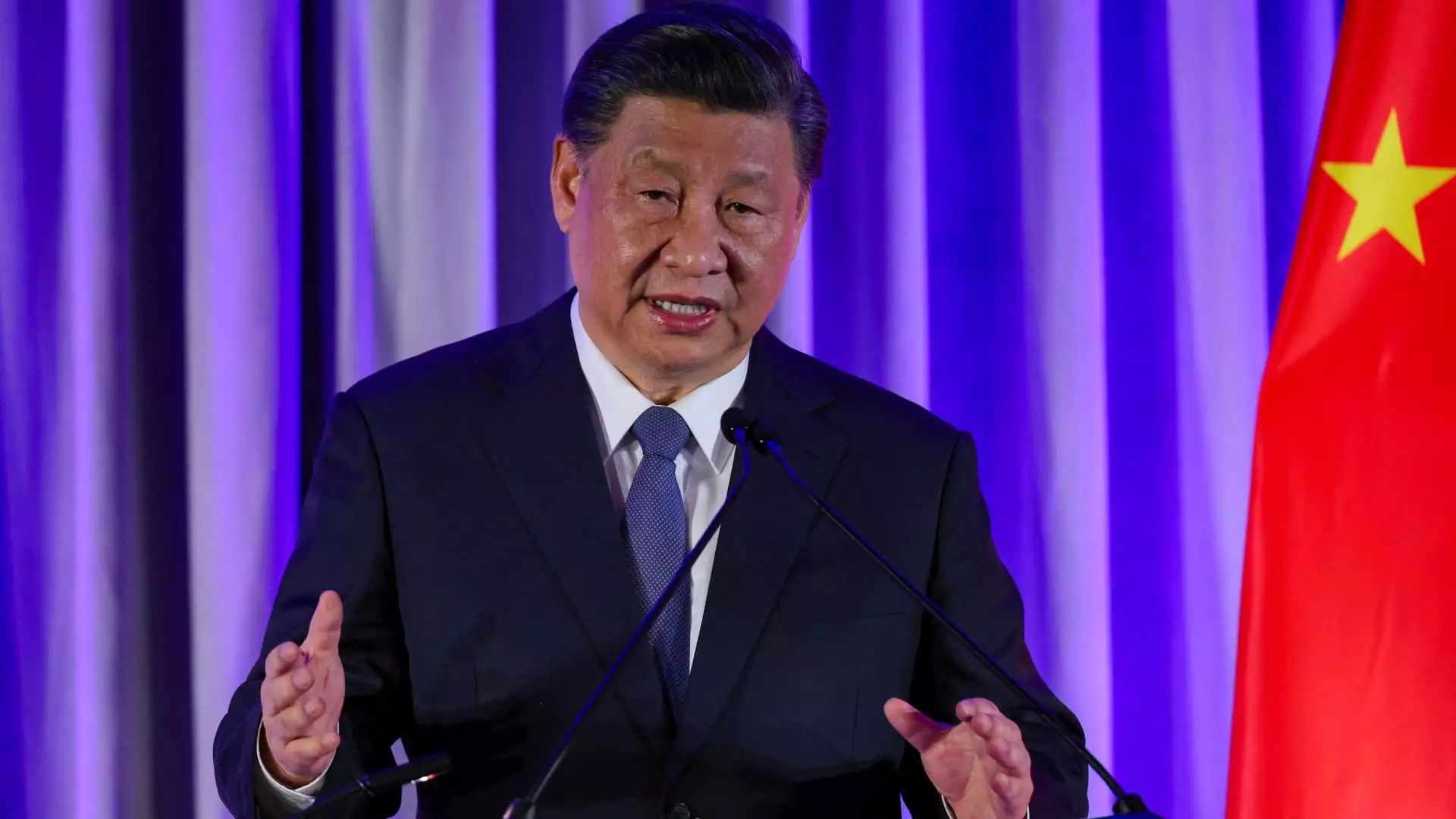

In a concerted effort to rejuvenate its slowing economy, China’s leadership has recently acknowledged the persistent downturn in its real estate sector. During a high-level meeting led by President Xi Jinping, key policymakers underscored the urgent need to halt the decline of the property market, a sector that has historically played a critical role in the country’s economic framework. The meeting, disseminated through state media channels, emphasized the necessity of fiscal and monetary support that directly addresses public concerns and stabilizes consumer confidence. This acknowledgment comes amid escalating worries about the economic ramifications of a beleaguered real estate sector, which historically accounted for over 25% of China’s GDP.

The state of the real estate market mirrors broader economic challenges faced by China. After a wave of regulatory crackdowns on developer debt in 2020, the property market has been beleaguered by severe declines in sales and prices. Between January and August, the value of newly sold homes plummeted by 23.6%, suggesting a serious lack of consumer confidence. Although there are indications of slight stabilization in real estate prices, with a modest decrease of 6.8% in August as opposed to a steeper 7.6% in July, the data still point to a protracted recovery process. Economists stress that the real challenge lies in shifting market sentiment from a “wait-and-see” approach to one that encourages consumer activity and investment in property.

The Politburo’s recent meeting outlines a series of adjustments aimed at stimulating growth within the sector. Discussions centered around limiting the growth of housing supply, prioritizing loans for strategically selected real estate projects, and alleviating the financial burden on homeowners through potential interest rate cuts. The People’s Bank of China estimates that forthcoming measures could reduce mortgage payments by approximately 150 billion yuan, illustrating a financial strategy intended to encourage home purchases. This approach signals a pivotal shift; instead of exclusively focusing on price inflation to generate a wealth effect, the government seems determined to stimulate demand by creating more favorable purchasing conditions.

The broader economic context is underlined by the need for immediate interventions to mitigate the effects of international competition and economic downturns. There are speculations that China may settle for economic growth below the previously targeted 5%, leading to potential adjustments in expectations from both local and international economic analysts. The shift in government tone reflects a balancing act between short-term urgency for growth and the long-term goal of restructuring the economic landscape.

The reactions from financial analysts and institutions to the recent meeting have varied significantly. Some, like HSBC, convey optimism, suggesting that the recent announcements may signal a turning tide in fiscal policy – potentially leading to more vigorous stimulative efforts moving forward. Conversely, institutions such as Capital Economics remain cautious, critiquing the vagueness surrounding potential large-scale fiscal support. This divide in economic outlook underscores the uncertainties within China’s economic governance and the extent to which it will be prepared to intervene in struggling sectors.

While the meeting’s insights represent a proactive step in addressing immediate economic needs, much depends on the execution and clarity of the proposed policies. The emphasis on stability and gradual growth evokes the complexity of repositioning China within a dynamic global economic environment. Underneath the surface, this transition will inevitably involve some degree of contention—balancing the short-term need to stimulate growth with the essential long-term reforms necessary to ensure sustainable economic health.

As analysts speculate about the future, the consensus remains cautious. The upcoming months will be crucial for assessing whether the politically pronounced support for property and broader economic stabilization will translate into tangible changes on the ground. Economic forecasts have already been altered, with Goldman Sachs projecting growth of around 4.7% for 2024—a slight upward revision but indicative of a more tempered economic environment.

China stands at a critical juncture. If the country can successfully navigate its economic challenges, the strategic interventions outlined in the recent Politburo meeting may catalyze much-needed revitalization of its real estate sector. Conversely, if these measures fall short, both the public’s trust in governmental economic stewardship and the health of the overarching economy could be at risk. The decision-makers in Beijing must tread carefully as they seek to unlock the potential of a sector that has long been a cornerstone of China’s economic success.