China’s economy appears to be at a crossroads, grappling with significant structural challenges as it seeks to stimulate growth amid declining domestic demand and apprehensions about deflation. Despite a series of policy maneuvers aimed at reinvigorating economic activity, these measures have yet to translate into a robust recovery that investors have desperately anticipated. A closer examination reveals the complexities underlying China’s economic situation and the prospective strategies that may pave the way for stabilization and growth.

Investors are still waiting for signs of recovery in China’s economy, which has been straining under various pressures. The policymakers have responded with a partial package of measures, including interest rate cuts and broad stimulus plans, yet these efforts appear insufficient in counterbalancing the underlying economic hurdles. The establishment of a timeline for when comprehensive fiscal support will be unveiled—expected to be discussed at the annual parliamentary meeting in March—has further exacerbated uncertainty.

As the situation stands, BlackRock Investment Institute expressed a cautious outlook regarding China’s economic recovery. Their report emphasized concerns over structural challenges that persist in the long term. The buzz surrounding the upcoming GDP figures for 2024, scheduled for release soon, heightens the anticipation but also the innate doubts about the actual health of the economy.

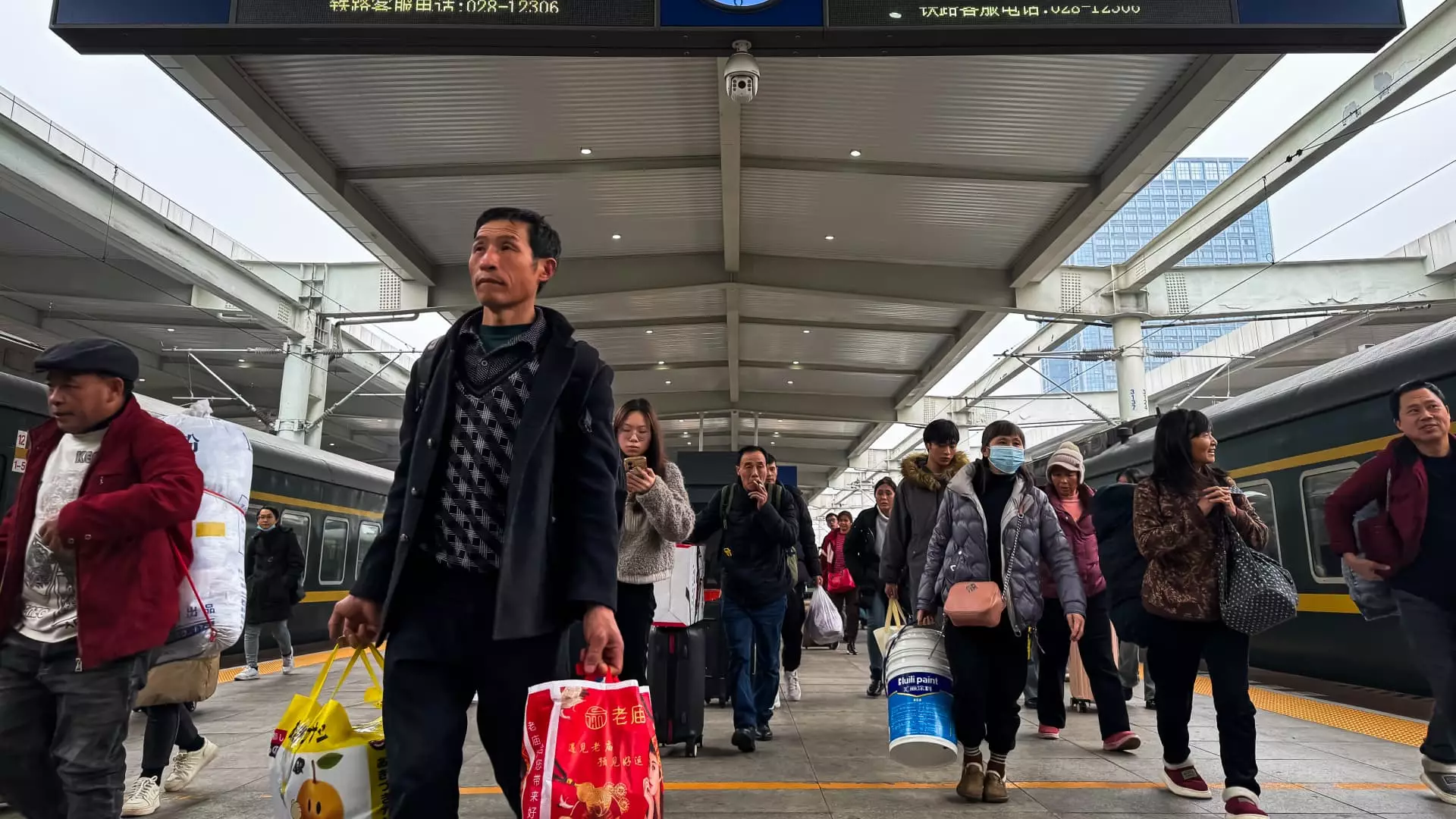

One of the stark concerns highlighted by officials is the stark decline in consumer demand, which reflects a hesitancy to spend among families and individuals. Consumer prices in China have seen minimal growth—only 0.5% increase excluding volatile sectors like food and energy. Such stagnation in consumer activity signifies a worrisome trend, especially as it marks the slowest price rise in a decade.

Beijing’s city mayor, Yin Yong, painted a grim picture in the annual report by reinforcing that weak consumer spending, coupled with declining foreign investments and pressures in specific industries, is pulling down the economic engine. The government’s target of achieving 2% inflation in consumer prices presents a goal that illustrates the struggle to stimulate internal economic demand in the midst of stagnant growth.

Real Estate Sector Woes

The commercial property market in China is continuing to feel the weight of economic stagnation as prices drop significantly. High-end offices in Beijing are reported to have suffered a steep fall in rents, with expectations hinting at a continued decline this year. The issue of occupied space in new shopping complexes reflects a more extensive challenge, as occupancy rates of 72% for new malls are below the previously accepted threshold for successful business launches.

Unlike their counterparts in the U.S. during the pandemic, Chinese authorities have not implemented direct cash payments to consumers, opting instead for a trade-in subsidy program to stimulate demand for consumer goods. This approach has yet to prove effective in generating the desired level of consumer engagement or restoring confidence in the market. Analysts point out that the anticipated benefits of this trade-in program may diminish by the second half of the year, as rising new home sales are not expected to reinvigorate demand significantly.

Government Strategy and Real Estate Recovery Measures

The trajectory of China’s real estate market remains a focal point of concern. Since the onset of tightened regulations on developers’ debt in 2020, the sector’s decline has had expansive implications for the economy itself. Recently, however, the government has modified its approach to bolster the real estate sector, seeking to stabilize it through newly introduced measures. These initiatives aim to address unfinished constructions and ease concerns surrounding the fallout from underperforming real estate companies.

Despite indications of a stock market rally, Goldman Sachs warns of high inventory levels in secondary cities, indicating that home prices may still have a way to fall before stabilizing. A considerable backlog of unsold properties highlights larger systemic issues intertwined with the real estate crisis and suggests a long road ahead for recovery in this crucial sector.

Geopolitical Factors and Future Directions

Moreover, China’s complicated relationship with the United States adds another layer of complexity to its economic challenges. Measures to enhance national security, particularly in technology sectors, have concurrently pressured foreign entities operating in China, prompting a shift toward localizing operations. These geopolitical tensions have further strained relations and stymied the potential for foreign investments crucial to sustaining economic growth.

In facing these multifaceted challenges, a recalibration of priorities has become necessary. Authorities are now emphasizing consumer-boosting initiatives over investment efficiency, implementing strategies intended not just to mitigate economic pressures, but to establish a more resilient framework for future developments.

China’s economic landscape stands at a critical juncture. Urgent reforms, monetary policies, and consumer incentives will all play pivotal roles in possibly turning the tide for an economy under duress. While there is a glimmer of hope through government strategies aimed at stimulating growth, the ultimate question remains—will these interventions be timely and robust enough to rejuvenate domestic demand and restore confidence in the marketplace? Only time will tell if China can navigate through its current complexities and emerge stronger, as the effectiveness of its strategies unfolds in the coming months.