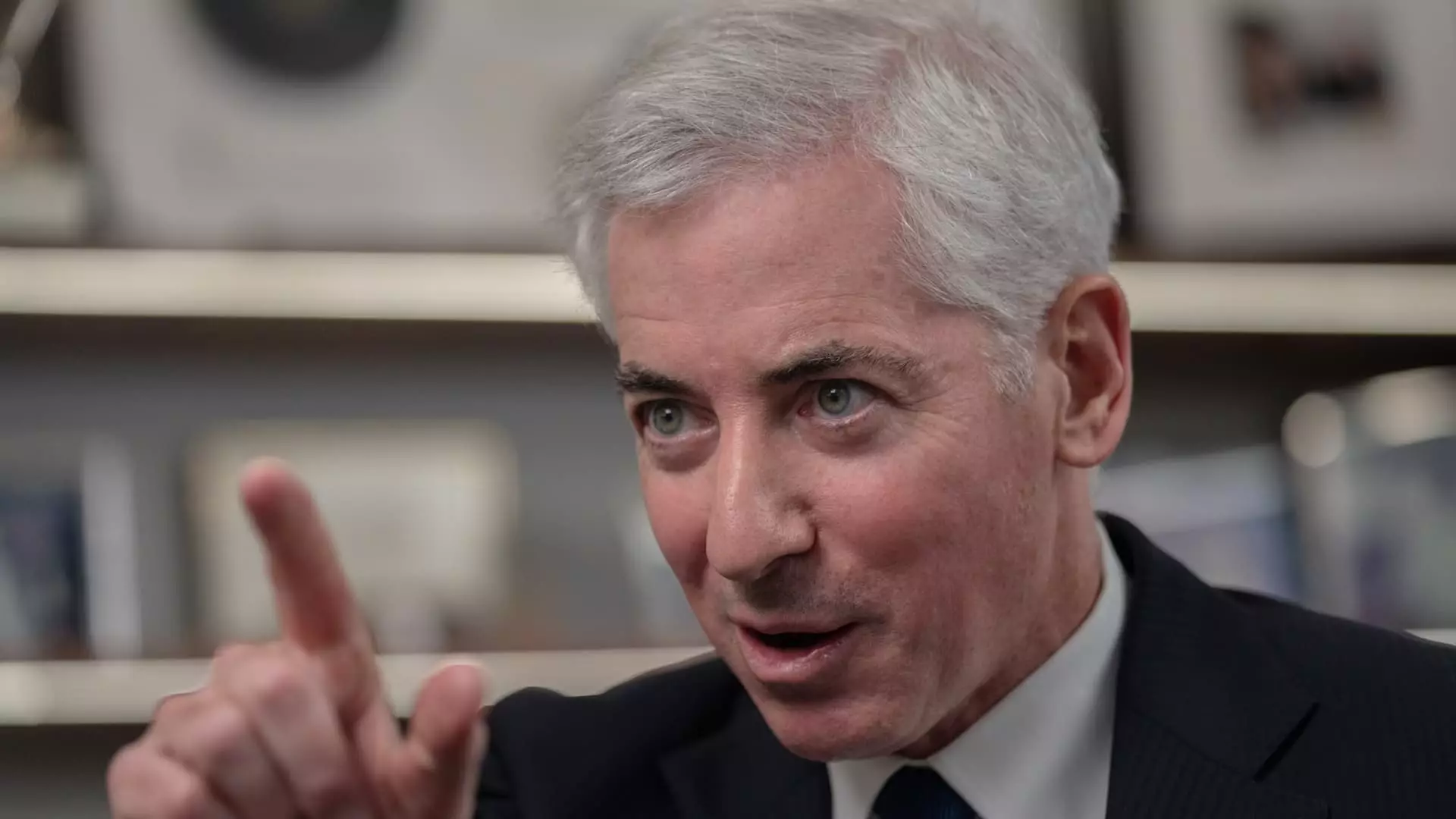

After much anticipation, Bill Ackman’s Pershing Square USA has decided to withdraw its plans for an initial public offering. The decision came as a surprise to many, especially after investor demand appeared to wane from the original expectations. This move showcases the unpredictable nature of the financial markets and the challenges that even prominent figures like Ackman face when it comes to raising capital.

Despite the setback, Ackman remains determined to pursue an IPO for his fund in the future. He has expressed his intention to come back with a revised plan for the offering, aiming to model it after Berkshire Hathaway. This demonstrates his resilience and commitment to exploring different avenues to achieve his financial goals.

The decision to withdraw the IPO plans has sparked speculation and raised questions about the future of Pershing Square. With $18.7 billion in assets under management as of June, the fund holds significant value in the financial market. However, the recent developments, including the lower-than-expected fundraising target of $2 billion, have cast doubt on the fund’s ability to attract investors.

Ackman’s move to publicly list Pershing Square was seen as a strategic decision to capitalize on his growing popularity among retail investors. With over one million followers on social media platform X, Ackman has used his platform to share his views on various topics, including the U.S. presidential election and antisemitism. The decision to delay the IPO could potentially impact the trust and confidence of retail investors in Ackman’s investment strategies.

The withdrawal of the IPO plans serves as a valuable lesson for Ackman and other hedge fund managers in the industry. It highlights the importance of thorough market research, investor sentiment analysis, and strategic planning when embarking on significant financial ventures. Ackman’s willingness to adapt and revise his plans demonstrates his ability to navigate challenges in the dynamic financial landscape.

While the withdrawal of Pershing Square’s IPO plans may have been a setback, it also presents an opportunity for reflection, learning, and growth. Ackman’s resilience and determination will undoubtedly pave the way for future success in his financial endeavors.