The stock market in the United States has seen a significant increase in concentration among just a few companies in recent years. According to a Morgan Stanley analysis, the top 10 stocks in the S&P 500 accounted for 27% of the index at the end of 2023, nearly double what it was a decade earlier. This rapid increase in concentration is the most significant since 1950, marking a concerning trend in the market dynamics.

The Influence of Top Companies on Investors

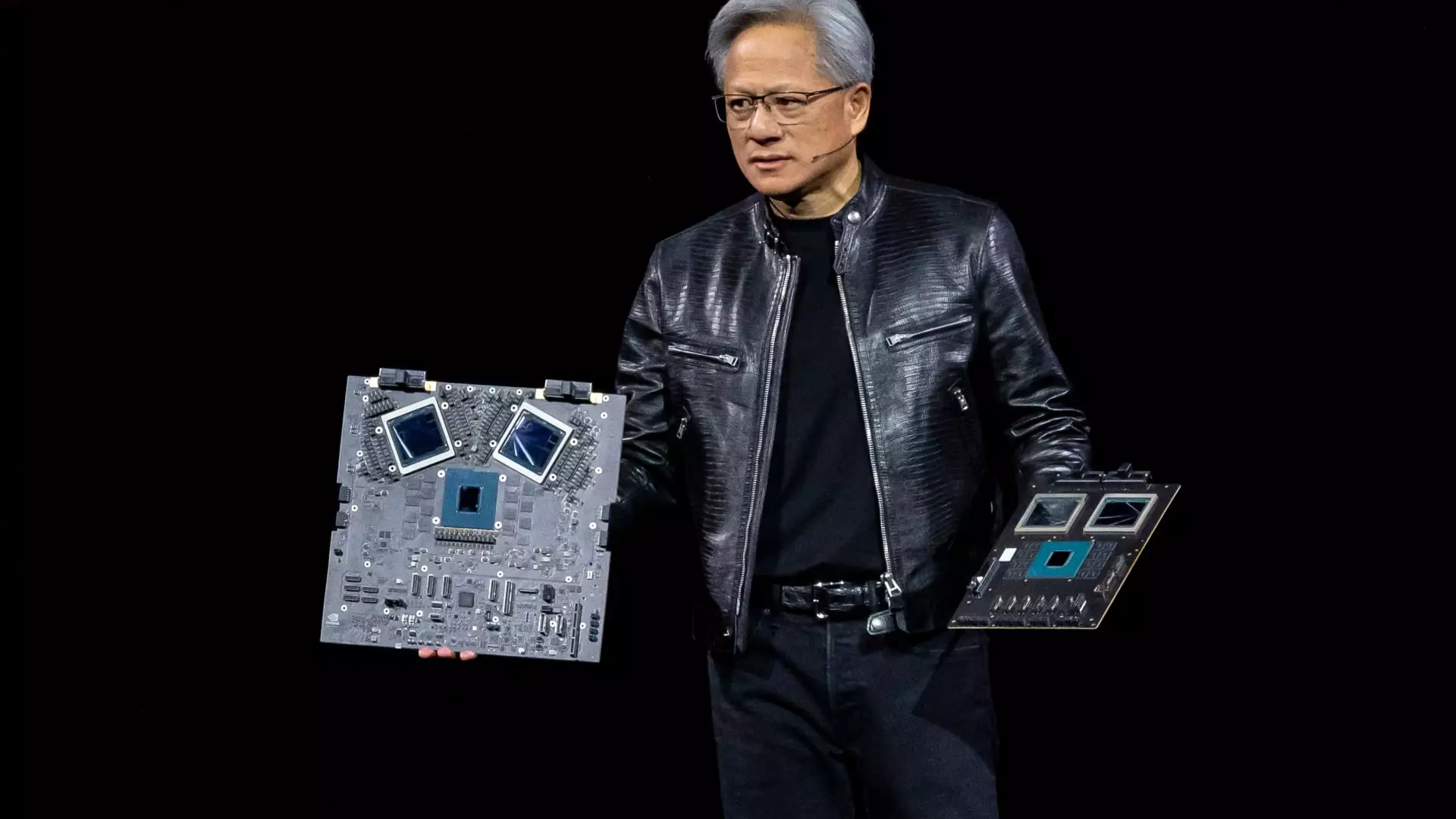

Experts express concerns about the outsized influence that this concentration may have on investors’ portfolios. The so-called “Magnificent Seven” companies, including Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla, make up about 31% of the index. These companies have accounted for more than half of the S&P 500’s gain in 2023, leading to fears that a downturn in any of these companies could put investor money at risk.

Certified financial planner Charlie Fitzgerald III from Orlando, Florida, highlighted the risk associated with this increased concentration. With nearly a third of the S&P 500 being invested in just seven stocks, diversification becomes crucial. Concentrating investments in a few companies exposes investors to a higher level of risk, especially if those companies experience significant market fluctuations.

Historical and Global Perspective

While some argue that the current concentration in the market is not unprecedented by historical or global standards, there are concerns about its potential impact. Research shows that in the 1930s and early 1960s, the top 10 stocks made up about 30% of the U.S. stock market, indicating a cyclical nature in market dynamics. However, the current scenario raises questions about the level of risk investors are exposed to in such a concentrated market.

Despite the rising concentration, many argue that investors are diversified beyond the U.S. stock market, reducing potential risks. Target-date funds offer a diversified investment approach that automatically allocates assets based on an individual’s age and investment goals. These funds provide exposure to a broad range of investments, including large U.S. companies, middle-sized and small U.S. companies, and foreign companies, enhancing diversification.

Expert Insights and Recommendations

Experts suggest that a well-diversified equity portfolio should include stocks from various sectors and market segments to mitigate risk. While concentration poses a potential challenge for investors, a balanced approach that incorporates a mix of assets can help navigate market uncertainties. Additionally, target-date funds remain a popular choice among investors seeking diversification and automatic asset allocation based on their risk tolerance and investment horizon.

The growing concentration in the U.S. stock market raises valid concerns about the potential risks for investors. While historical and global perspectives shed light on similar market dynamics in the past, the current scenario warrants caution and a strategic approach to diversification. By adopting a well-rounded investment strategy and utilizing diversified investment vehicles like target-date funds, investors can navigate the challenges posed by a concentrated market effectively.