China’s recent economic data has revealed a mixed picture of growth in April. Retail sales rose only 2.3% from a year ago, which was significantly lower than the 3.8% increase forecasted by a Reuters poll. This slow growth indicates a potential downturn in consumer spending, reflecting uncertainty about future income and cautiousness among consumers.

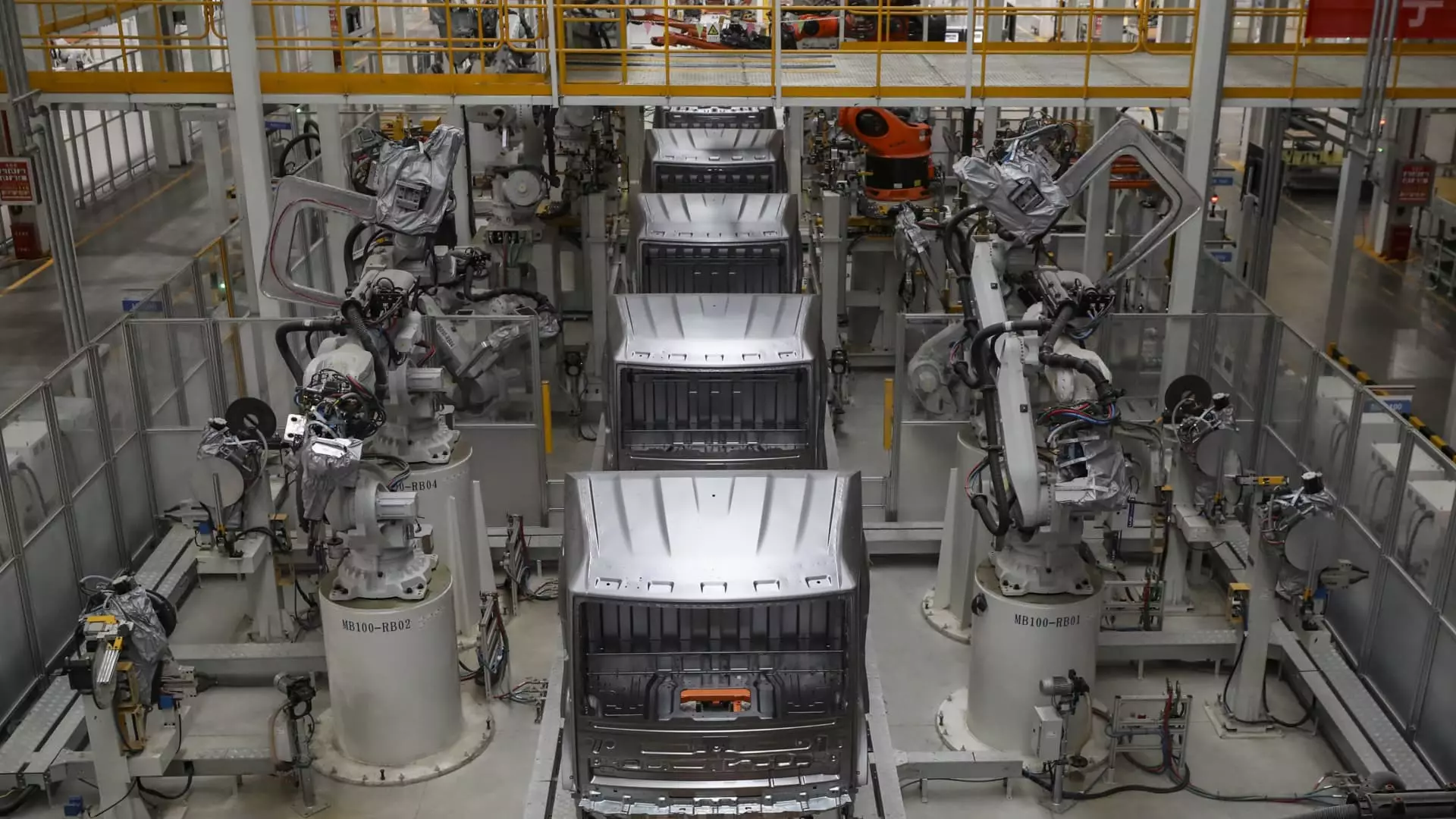

On the other hand, industrial production in China remained robust, with a 6.7% increase in April from a year ago, beating expectations for a 5.5% growth. This marked pickup from the previous month’s 4.5% growth suggests that the industrial sector continues to drive economic growth in the country.

However, fixed asset investment only rose by 4.2% for the first four months of the year, lower than the expected 4.6% increase. Real estate investment saw a steep decline of 9.8% year-on-year for the first four months of 2024, indicating a significant slowdown in this sector. This decline in real estate investment could have far-reaching effects on the overall economy.

The April figures were affected by the May 1 Labor Day holiday and the high base from last year. The multi-day May 1 Labor Day holiday last year included two days in April, while this year, the holiday didn’t begin until May 1. This shift in the timing of the holiday may have skewed the data, making it essential to interpret the numbers with caution.

China also initiated a program on Friday to issue decades-long bonds to fund strategic projects. This move is expected to have a significant economic impact, with the effects likely to be felt in the first half of next year. Issuing ultra-long bonds could also help boost market confidence and provide the necessary funding for critical infrastructure projects.

Despite the challenges in the real estate sector, other indicators point to stabilizing domestic demand. Consumer prices increased slightly last month, while a measure of factory-level prices continued to decline. While new loan data for April showed a significant slump, it may have been influenced by changes in data measurement and sluggish demand from businesses and households.

Dan Wang, chief economist at Hang Seng Bank (China), expects the Chinese property market to stabilize by the end of next year. She noted that while the policy measures to curb speculation in the real estate sector may have been successful, they have had a rapid and severe impact. Despite the challenges in the housing market, the Chinese economy has shown resilience, particularly in industrial investment and manufacturing.

China’s official GDP grew by 5.3% in the first quarter of the year, surpassing expectations for a 4.6% increase. With a target of around 5% GDP growth set for 2024, China remains focused on sustaining economic growth amid changing market conditions. The EU Chamber of Commerce in China emphasized the importance of increasing domestic demand for foreign businesses operating in the country.

China’s economic data for April presents a complex scenario with both positive and negative indicators. While challenges in the real estate sector persist, robust industrial production and initiatives like ultra-long bond issuance offer hope for economic stability in the future. It is essential for policymakers to address the underlying issues affecting various sectors of the economy and implement measures to support sustainable growth and development.