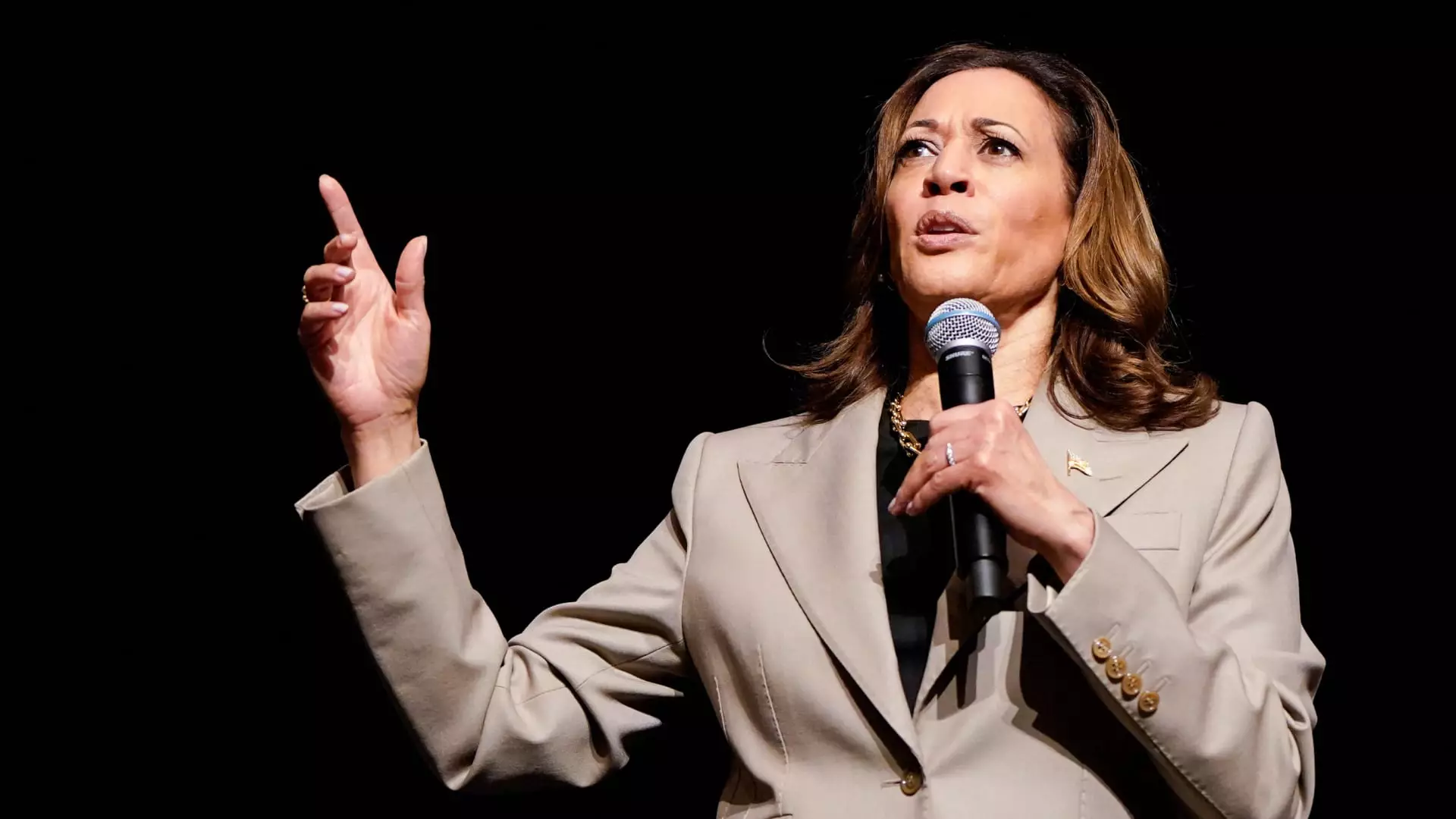

Vice President Kamala Harris recently announced an economic plan that includes an expanded child tax credit offering up to $6,000 in total tax relief for families with newborn children. This proposal aims to build on the child tax credit implemented through the American Rescue Plan in 2021, which provided families with a maximum credit of $3,600 per child. The plan will particularly benefit middle- to lower-income families during the first year of a child’s life. This tax relief proposal was revealed during a policy speech in Raleigh, North Carolina, where Harris emphasized the importance of supporting families with young children.

Harris’ push for an expanded child tax credit comes as a response to the $5,000 child tax credit floated by Sen. JD Vance of Ohio, a former ally of President Donald Trump. The unveiling of this proposal signifies Harris’ alignment with President Joe Biden’s initiatives while also attempting to distinguish herself from potential political rivals. However, the Senate Republicans’ recent blockage of the expanded child tax credit raises questions about the overall feasibility of such proposals. It is clear that there may be challenges in gaining bipartisan support for this initiative, especially as lawmakers are grappling with competing demands and complex budget considerations.

Potential Implications and Fiscal Concerns

While the expanded child tax credit has shown potential benefits in reducing child poverty rates, there are growing concerns about the financial implications of such a significant tax break. The cost of expanding the child tax credit to $3,000 or $3,600 could reach an estimated $1.1 trillion over a decade, posing a significant financial burden on the government. Furthermore, the proposed $6,000 tax relief for newborns could potentially cost $100 billion, adding to the already strained federal budget. As a result, there is a pressing need for policymakers to carefully balance the benefits of these tax credits with their overall impact on the economy and government finances.

The fate of Harris’ economic plan and the expanded child tax credit hinges on the political landscape and future legislative action. The upcoming elections will play a crucial role in determining the feasibility of such proposals, as they may face resistance from lawmakers concerned about budget deficits and fiscal responsibility. Harris’ commitment to fiscal responsibility, as outlined in her economic plan fact sheet, highlights the need for comprehensive and sustainable solutions to address economic challenges. It remains to be seen whether Harris’ proposed tax credits will gain traction in Congress and receive the necessary support to become law.

Overall, Vice President Kamala Harris’ economic plan presents an ambitious vision for expanding the child tax credit to provide much-needed support to families with young children. While the proposal aims to address pressing economic issues and reduce child poverty rates, it also raises important questions about the financial feasibility and long-term sustainability of such tax relief measures. As policymakers continue to debate these proposals and navigate the complexities of fiscal policy, it is essential to consider the broader implications of these initiatives on the economy and government finances.