Investors in the K-pop sector have faced a rocky start to the year, with lower fourth-quarter sales and profits contributing to a downturn in stock prices. The dating scandals involving artists from various companies have also put a dent in investor confidence. However, despite these challenges, Goldman Sachs remains optimistic about the industry’s prospects, calling the K-pop sector “misunderstood.” This optimism is based on the belief that there is a high potential for valuation re-rating, as companies continue to deliver multi-year earnings growth.

Traditionally, album sales have been considered a key proxy for the number of fans in the K-pop industry. However, Goldman Sachs challenges this mainstream mindset, arguing that offline concert attendance is a superior metric for measuring the growing reach of K-pop. The analysts point out that album sales can be inflated by wallet share, where a single fan purchases multiple albums. Additionally, the analysts note that album sales spiked during the pandemic due to the lack of offline interactions, skewing the metric in relation to actual fan numbers.

Goldman Sachs highlights substantial growth opportunities for K-pop companies in Japan, which they believe are being overlooked by the market. Japan has historically been one of the largest overseas fanbases for K-pop, with companies like Hybe, SM, and JYP holding a combined 7% share of the live music market. The recent scandals involving Japan’s top talent agency have created an opening for K-pop artists, leading to increased opportunities for K-pop groups in the country. Analysts predict that Japan concert audiences will grow at a compounded annual growth rate of 24% from 2023 to 2026, with the combined share for Hybe, JYP, and SM doubling from 7% to 14%.

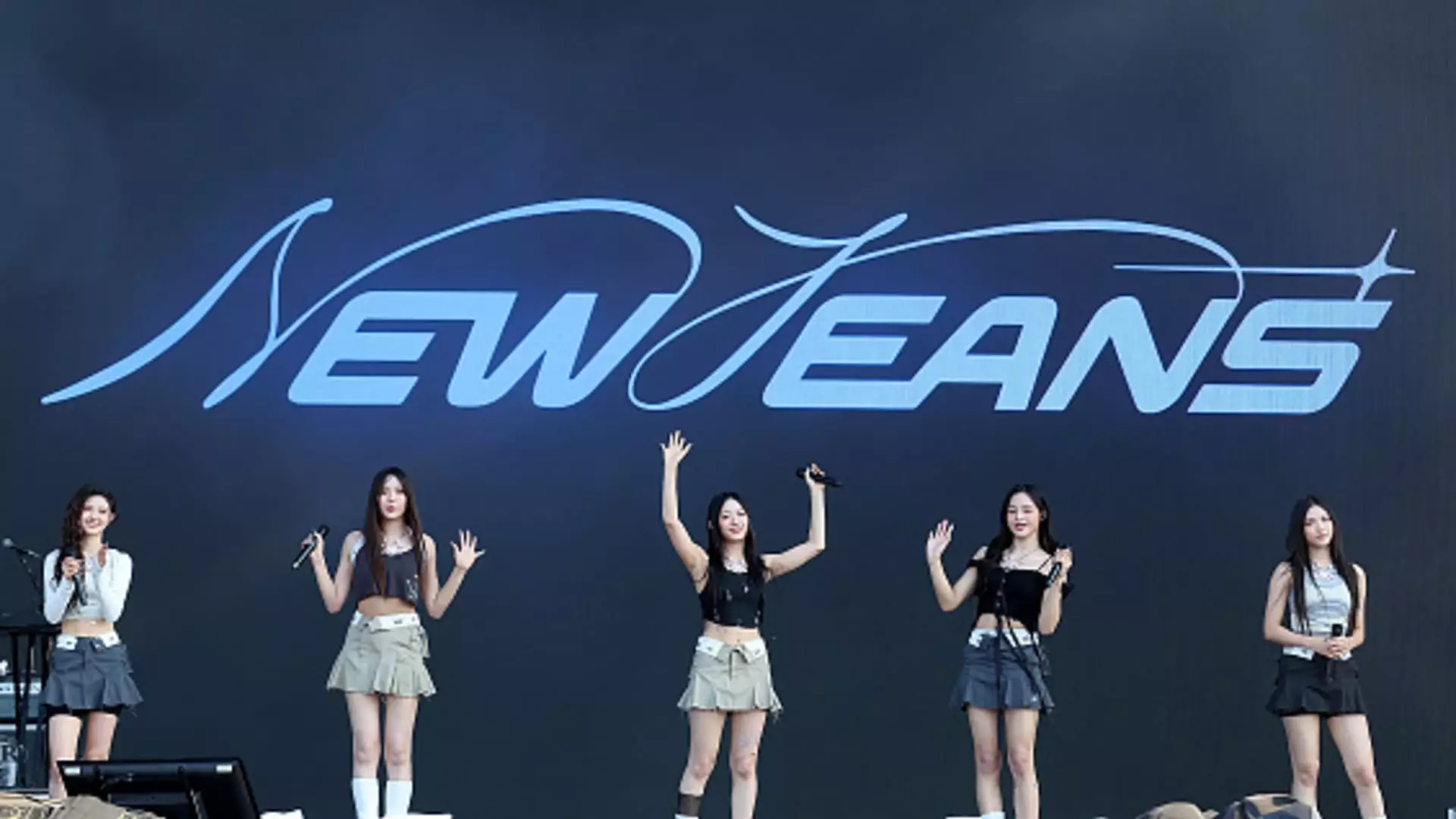

Aside from Japan, Goldman Sachs also sees significant opportunities for K-pop’s global fanbase growth, particularly in markets like the United States. The success of Hybe-managed girl group NewJeans on the U.S. charts serves as a testament to this potential. NewJeans’ recent album topped the U.S. Billboard 200, while their lead single, “Super Shy,” charted at No. 2 on the Billboard Global 200. The group also made history as the first South Korean girl group to perform at Lollapalooza, drawing a significant audience for the festival’s 5 p.m. slot. Additionally, Le Sserafim, another group managed by Hybe subsidiary Source Music, made their debut at the Coachella music festival, further solidifying K-pop’s presence on the global stage.

Hybe’s recent announcement of an expanded partnership with Universal Music Group signifies the increasing mainstream appeal of K-pop on a global scale. With exclusive distribution rights for Hybe’s artists and labels, the partnership with UMG, which boasts artists like Taylor Swift, Ariana Grande, and Justin Bieber, gives K-pop a competitive edge and stronger bargaining power in business relationships. This strategic move positions K-pop as a mainstream player in the global music industry, paving the way for further growth and collaboration.

While the K-pop sector faces challenges in the form of lower sales, profits, and scandals, the industry’s long-term outlook remains positive. By reevaluating key metrics, seizing global expansion opportunities, and forming strategic partnerships, K-pop companies can continue to thrive and expand their reach on the global stage. The future of K-pop looks bright, with new avenues for growth and engagement with audiences around the world.