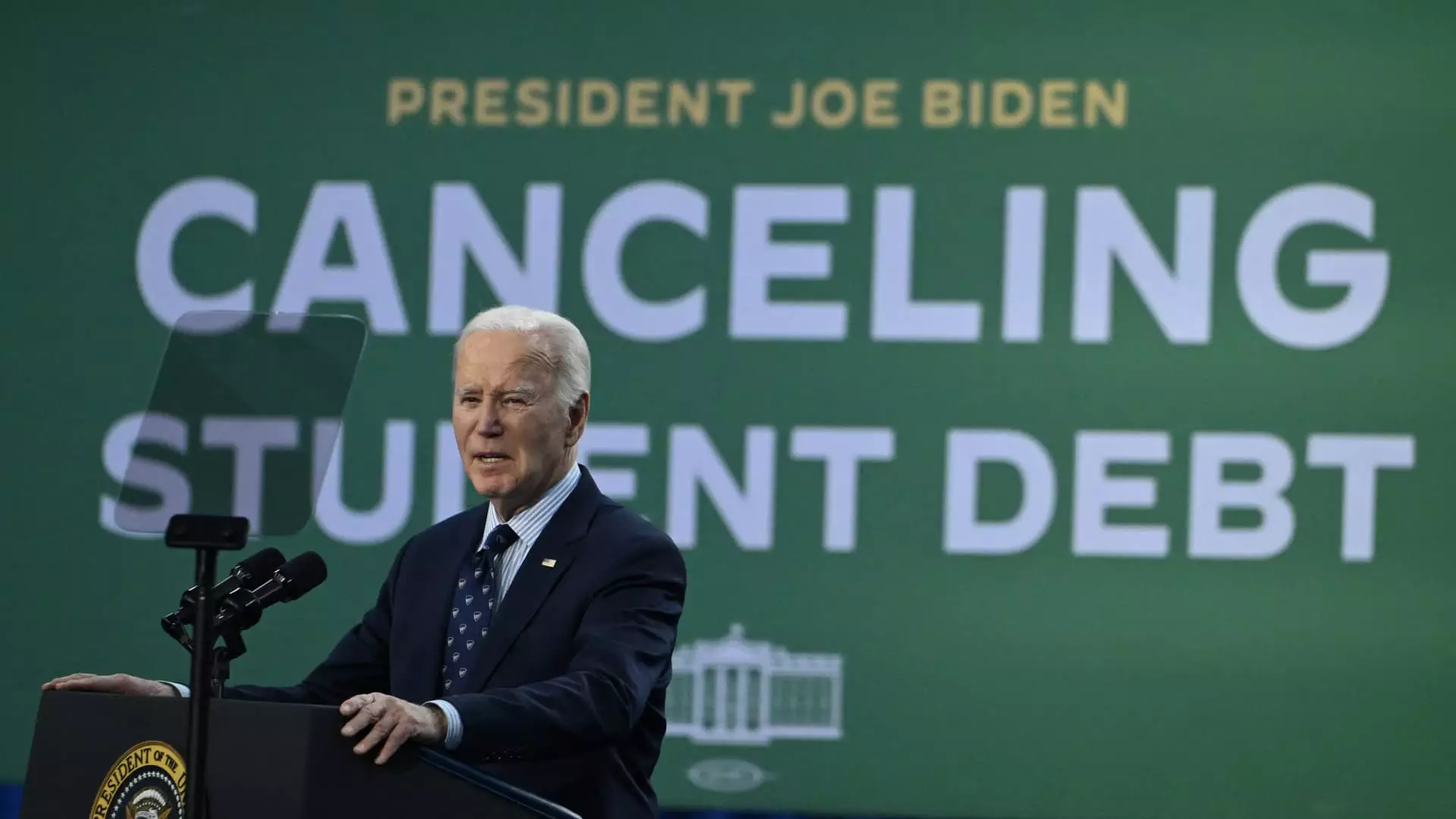

The Biden administration is making strides in addressing the issue of student loan forgiveness by implementing a new plan that aims to alleviate the burden of student debt for millions of Americans. This plan has the potential to significantly impact the upcoming presidential election and has been met with both praise and criticism from various sectors.

President Biden’s initial campaign promise to erase student loan debt was thwarted by the Supreme Court last June. The court ruled that his $400 billion loan cancellation plan was unconstitutional, leading Biden to direct the U.S. Department of Education to explore alternative options for student debt relief. While the department has made progress in relieving the debts of 4 million people, totaling $146 billion in aid, there is still a pressing need to address the debt of over 40 million individuals who were promised cancellation.

In response to the setbacks faced by his initial relief plan, President Biden announced a narrower Plan B for student loan forgiveness. This revised plan targets specific groups of people, such as those experiencing financial hardship and graduates of poor-quality schools, for loan forgiveness. Additionally, approximately 25 million individuals could have the interest on their debts cleared under this program. While this plan is not as broad as his original proposal, it still has the potential to provide relief to millions of borrowers.

Student loan forgiveness has emerged as a crucial issue in the upcoming presidential and congressional elections, with nearly half of voters citing it as an important concern. Polls have shown that young voters, in particular, view debt cancellation as a key determinant in their voting decisions. This issue presents an opportunity for Biden to differentiate himself from potential opponents, particularly in light of the opposition to debt relief expressed by former President Donald Trump.

In an effort to expedite the implementation of his new plan, President Biden has turned to the negotiated rulemaking process, which aims to make it harder for legal challenges to thwart his efforts. This process involves a series of steps, including the formulation of a rule by a committee of negotiators and a public comment period before the final rule is published. Despite the potential benefits of this approach, legal challenges to the plan could delay its implementation and impact its effectiveness.

The future of student loan forgiveness under the Biden administration is fraught with challenges and uncertainties, as legal battles and bureaucratic processes threaten to impede progress. However, the administration remains committed to addressing the issue of student debt and providing relief to millions of borrowers. The outcome of these efforts will not only impact the lives of those burdened by student loans but also shape the political landscape leading up to the 2024 presidential election.