The pharmaceutical landscape is undergoing a significant transformation, particularly concerning obesity treatment. Eli Lilly has recently made headlines by introducing higher doses of its groundbreaking weight loss drug, Zepbound, within a new pricing strategy intended to expand access for patients who may not be covered by insurance. This initiative reflects a calculated response to soaring demand while simultaneously addressing the challenge of affordability in a sector often criticized for high drug prices. As we dissect Eli Lilly’s latest strategies and their implications, it becomes clear that the pharmaceutical industry is navigating a complex interplay of supply, demand, and regulatory barriers that shape treatment accessibility.

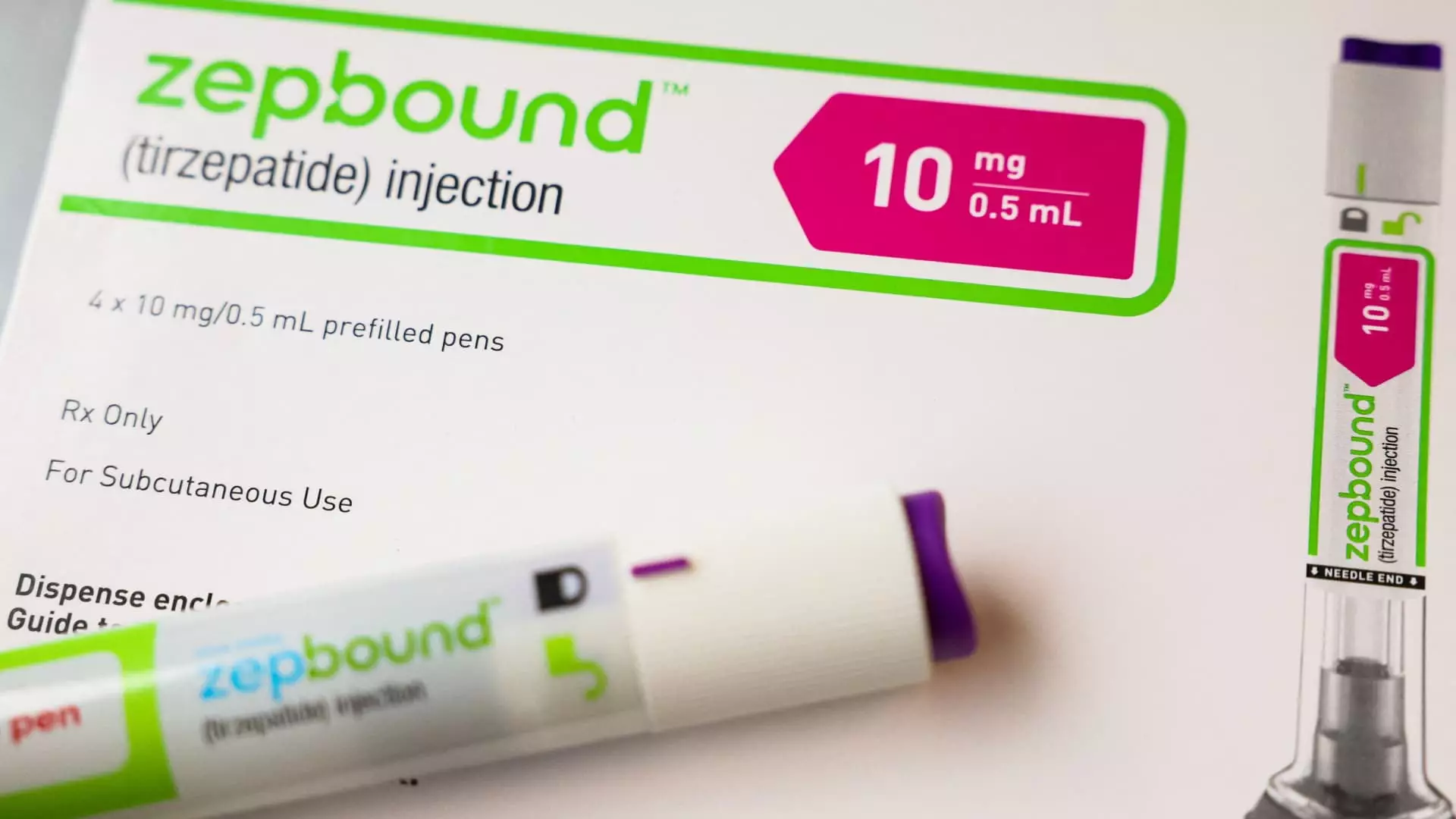

Eli Lilly’s release of higher doses of Zepbound in single-dose vials is noteworthy not just for the drug itself, but for the innovative pricing model it adopts. From $499 for the first month for the 7.5 mg and 10 mg vials, to $599 and $699 for subsequent refills, the cost structure has relatively adjusted to attract patients who may struggle to afford obesity treatment. The implementation of a self-pay pharmacy option on Lilly’s direct-to-consumer website, LillyDirect, simplifies the ordering and purchasing processes, allowing eligible patients diagnosed with obesity or related conditions to buy the medication directly. The initiative targets demographics often overlooked in healthcare discussions—specifically those under Medicare or employer-sponsored plans that do not include obesity treatments in their coverage.

Another salient aspect of this update is the introduction of lower-cost alternatives, with a $50 reduction for the existing lower-dose vials of Zepbound. With these adjustments, Eli Lilly is essentially striving to fill a void created by insufficient insurance coverage for obesity treatments—a gap that has historically pushed patients toward less safe alternatives, including illegal compounded versions of the drug.

A critical issue surrounding obesity medication lies in the safety and efficacy of treatments that patients might opt for due to cost constraints. With the U.S. Food and Drug Administration (FDA) declaring an end to the Zepbound shortage, Eli Lilly is now positioned to discourage patients from turning to unregulated compounding pharmacies that provide knockoff versions of their drug. The emphasis on securing FDA-approved treatments is paramount, ensuring that patients receive effective therapies backed by rigorous safety protocols. Eli Lilly’s leadership has been quoted as being highly aware of this matter, asserting that their strategies aim to protect patients from the risks associated with using ineffective or unsafe alternatives.

Eli Lilly’s proactive stance is a welcome shift, especially as there have been heightening concerns regarding government skepticism of weight loss drugs’ general effectiveness and potential safety risks. The widening conversation around the need for updated regulations on drug accessibility brings into focus the ever-challenging relationship between pharmaceutical companies, healthcare providers, and regulatory bodies.

Strategic Vision for Future Market Penetration

As Eli Lilly expands its presence in the obesity treatment market through innovative distribution and pricing strategies, questions remain regarding the long-term sustainability of these changes. The company’s president of diabetes and obesity, Patrik Jonsson, has indicated that their objectives are intricately aligned with the goal of amplifying the number of patients who can safely access Zepbound. However, the pharmaceutical giant is well aware that short-term pricing models can only work if they are backed by a robust infrastructure that supports education, prescription, and patient engagement.

To this end, LillyDirect has partnered with independent telehealth services that will evaluate and assess patients’ eligibility for treatment. This integration not only simplifies access to healthcare services for patients but also aligns with current trends in healthcare delivery, emphasizing convenience and engagement.

Additionally, Eli Lilly does not view the compounded markets as a direct competitor anymore, hinting at a belief that the introduction of vials will make the economic case for using a traditional, FDA-approved formulation stronger. The future of obesity treatment through pharmaceutical interventions may very well depend on companies like Eli Lilly taking bold steps to enhance patient access while prioritizing safety and efficacy.

Eli Lilly’s strategic pivot with Zepbound underscores a critical moment in the pharmaceutical industry, especially as it addresses a growing public health crisis. By prioritizing accessibility through innovative pricing and distribution methods while affirmatively combating the rise of unsafe alternatives, the company may set a precedent that redefines how pharmaceutical products are marketed and sold in the context of chronic illnesses. As healthcare systems evolve, the collaboration between drug manufacturers, patients, and regulators will become increasingly vital in navigating future challenges surrounding treatment access and affordability.