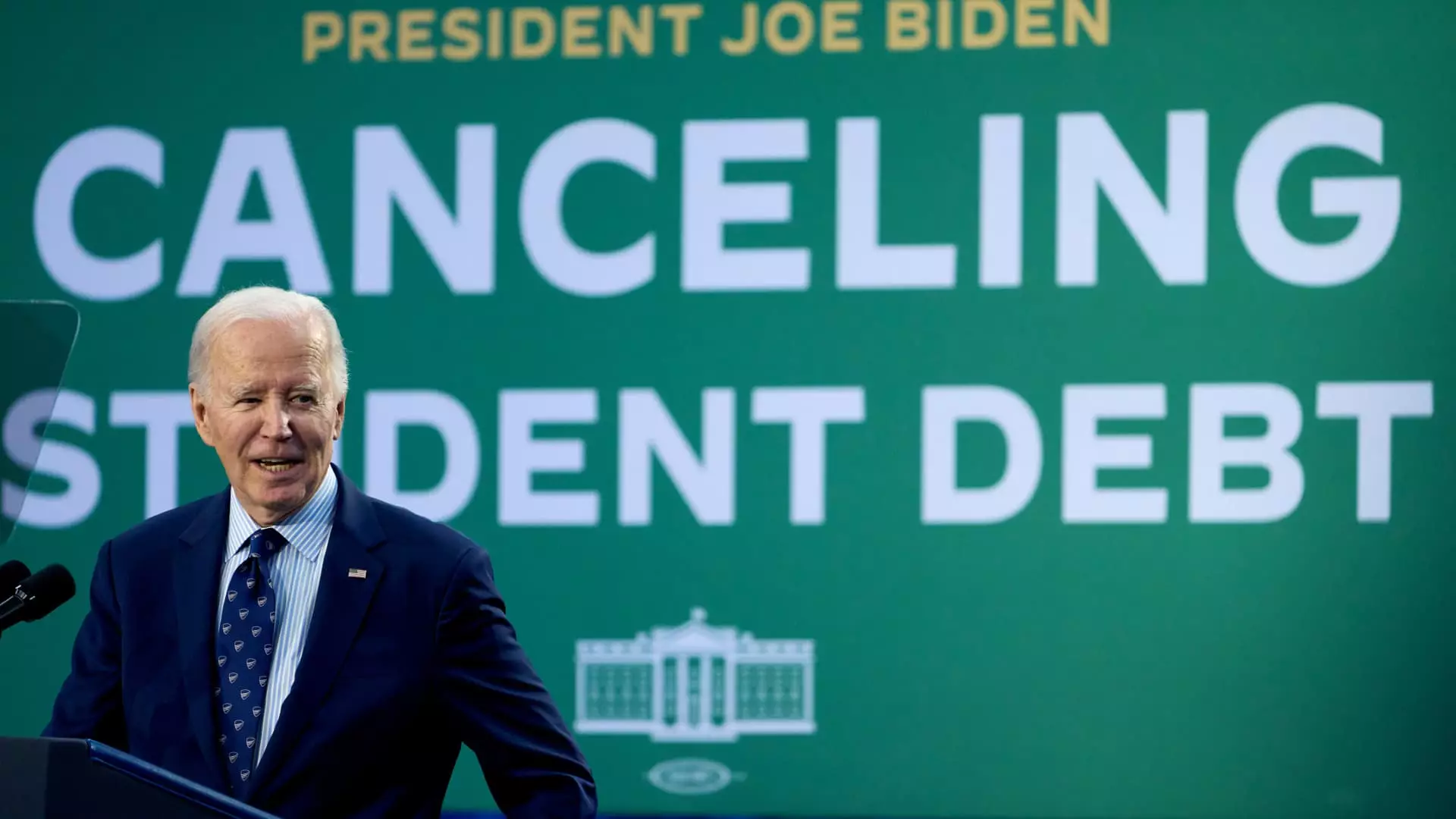

In a pivotal announcement regarding student loan forgiveness, the Biden administration has confirmed the discharge of over $600 million in debt, impacting thousands of borrowers. This decision is rooted in the administration’s commitment to address the financial burdens faced by students who relied on income-based repayment plans and who attended institutions that engaged in misleading practices, notably DeVry University. This article delves into the implications of this initiative, its socio-economic significance, and the broader context of student debt relief in the United States.

The Scope of Forgiveness

The latest relief effort will benefit 4,550 borrowers under the Income-Based Repayment (IBR) plan, alongside 4,100 individuals who previously attended DeVry University, a for-profit institution marred by allegations of dishonesty regarding its job placement rates. The U.S. Department of Education’s findings from February 2022 confirmed that DeVry’s misrepresentation had led students to invest in an education that did not deliver the promised outcomes. While the immediate relief can transform lives, questions linger regarding the effectiveness of such measures in the overall fight against the increasing tide of student debt in America.

As President Biden approaches the conclusion of his term, he is poised to leave a profound legacy concerning student debt forgiveness, with approximately $188.8 billion eradicated for around 5.3 million borrowers. Education expert Mark Kantrowitz highlighted this accomplishment, underscoring that no prior administration has matched the scale of loan forgiveness achieved under Biden. However, this announcement also coincides with the Supreme Court’s recent block of Biden’s broader student loan cancellation proposal, raising questions about the sustainability and future of student debt relief efforts.

Challenges Faced and Responses

Despite these relief measures, the administration’s journey has not been entirely smooth. Criticism has emerged regarding the execution of income-driven repayment plans, with advocates arguing that servicers have historically failed to accurately track borrowers’ payment information. In response, the administration has initiated a payment count adjustment aimed at providing borrowers with a clearer understanding of their paths toward eventual loan forgiveness. This enhancement highlights a growing recognition of the systemic flaws within the student loan framework, reinforcing the need for ongoing reform.

U.S. Secretary of Education Miguel Cardona emphasized the administration’s dedication to remedying the flaws of a “broken” student loan system. As borrowers enter a new phase of financial stability through these relief efforts, the focus must pivot toward preventing future issues within both federal and private student loan processes. Ultimately, the long-term success of any relief initiative hinges on adaptive policies that not only alleviate current burdens but also safeguard against the recurrence of such crises.

The Biden administration’s final round of student loan forgiveness represents both a direct response to systemic failings and a significant milestone in the ongoing struggle against student debt. While immediate financial relief for thousands represents a tangible victory, it is crucial to approach these developments with a critical eye, advocating for comprehensive reforms to ensure that the student loan system becomes equitable, transparent, and ultimately serves the interests of future generations. The journey does not end here—it is merely an essential chapter in the long battle for educational equity and financial justice in America.