Super Micro Computer, a prominent player in the server manufacturing sector, is experiencing unprecedented financial turmoil, as evidenced by a staggering 22% plunge in its stock price on a recent Wednesday. This decline not only marks the lowest point for the company’s shares since May of the previous year but also signifies an alarming 82% decrease from the stock’s high of March—a plummet that has resulted in a loss of approximately $57 billion in market capitalization. The associated volatility can be traced back to the company’s release of disheartening unaudited financial results, coupled with its failure to outline a clear strategy to maintain its Nasdaq listing.

The perplexing financial situation is compounded by the reciprocal resignation of Super Micro’s auditor, Ernst & Young, which marks the second notable exit from its auditing team within two years. This resignation casts a shadow over the firm’s corporate governance and raises questions about its financial integrity. The company is currently embroiled in accusations from an activist investor alleging accounting irregularities, including the illicit shipment of sensitive components to sanctioned nations, thereby potentially infringing upon established export controls. These serious accusations have put Super Micro in a precarious position, especially since it has not submitted any audited financial statements since May, thus facing the risk of delisting from Nasdaq if the requisite annual reports are not filed by mid-November.

The uncertainty surrounding Super Micro’s financial health deepens with the recent announcement of preliminary results for its first fiscal quarter, revealing net sales in the range of $5.9 billion to $6 billion. While this figure represents an impressive year-on-year growth of 181%, it falls short of analyst expectations set at $6.45 billion. Industry analysts are left questioning the sustainability of this growth, particularly given the company’s current predicament and the absence of reliable financial documentation.

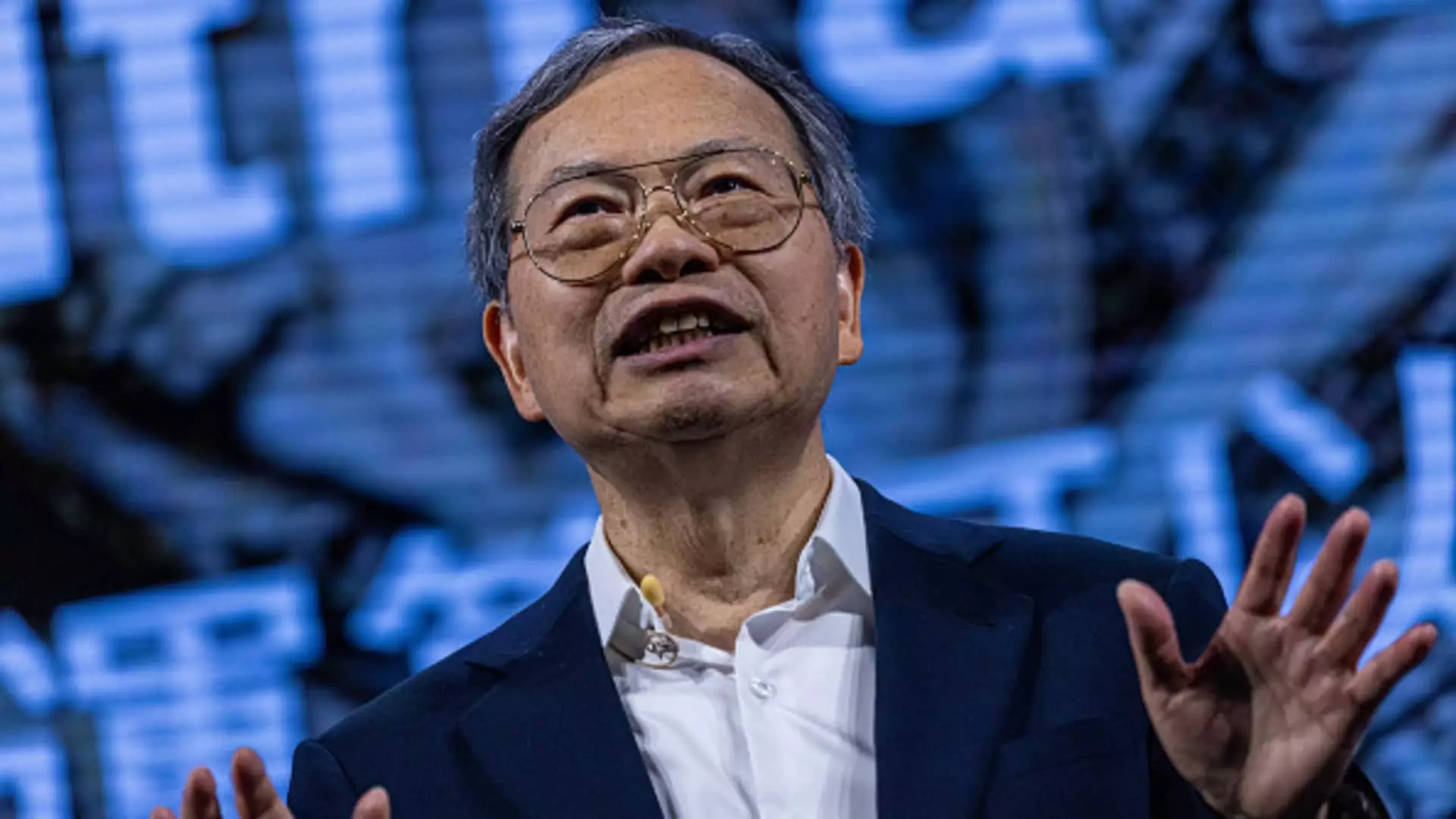

Super Micro’s Chief Executive Officer, Charles Liang, expressed urgency in resolving financial reporting issues. However, while there is a drive to address the auditor situation, analysts are skeptical. Mizuho Securities suspended coverage of the stock, citing insufficient financial clarity, while Wedbush analysts characterized the report as one that leaves “more questions than answers.” Liang and his team are seemingly focused on filling the auditor vacancy and restoring the company’s standing with Nasdaq, yet the broader implications of financial instability remain a source of concern for investors.

Despite these challenges, Super Micro has recently capitalized on a burgeoning demand within the market, fueled largely by its partnership with Nvidia, which provides cutting-edge processors for artificial intelligence applications. Super Micro reported that demand for its latest Nvidia GPU, known as Blackwell, is particularly strong. However, the realization of revenue tied to this promising product remains murky, as Liang indicated that the company is in daily communication with Nvidia for updates on chip availability.

Statements from Super Micro’s CFO, David Weigand, suggest a robust ongoing relationship with Nvidia, emphasizing that no changes have occurred regarding the allocation of processors. However, concerns linger as analysts question whether other server manufacturers may gain from Super Micro’s potential constraints in chip access. Analysts remain concerned about future prospects, especially with the company’s revenue forecast for the December quarter falling short of expectations. Anticipated revenue for that period is projected between $5.5 billion and $6.1 billion, whereas the consensus among analysts hovers around $6.86 billion.

In response to the turmoil, Super Micro has initiated a special committee to delve into the reasons behind Ernst & Young’s resignation. Preliminary findings from this investigation reportedly indicated no evidence of fraud or misconduct within management. Nonetheless, the mere presence of such an investigation emphasizes ongoing corporate governance concerns, and potential investors may hesitate without a more comprehensive understanding of the internal issues at hand.

Super Micro’s current state illustrates a multifaceted crisis marked by financial instability, corporate governance challenges, and a significant decline in market value. Even as the company grapples with operational strengths in the area of AI server manufacturing and maintains a critical relationship with Nvidia, the shadow of ongoing uncertainty looms large, raising questions about the path ahead for this once-promising enterprise. The resolution of these pressing issues will be crucial not only for the firm’s survival but also for restoring investor confidence and reclaiming its position in the competitive technology sphere.