On a remarkable Thursday, AppLovin’s stock experienced a dramatic spike of 45%, marking a significant moment for the online gaming and advertising juggernaut. Following an announcement of guidance that soared past market expectations alongside robust earnings and revenue figures, the company’s stock surged beyond $245 in midday trading. This remarkable performance reflects the firm’s overall reward to its investors, with shares showing an outstanding increase of 515% throughout the year, considerably outperforming other tech companies valued over $5 billion, as highlighted by FactSet data. What lies at the core of this ascent, and how does it reflect broader trends in the tech industry?

In its third quarter, AppLovin showcased revenue growth of 39%, reaching $1.2 billion, significantly exceeding the average estimate of $1.13 billion set by analysts at LSEG. With earnings per share also surpassing expectations at $1.25 versus the anticipated $0.92, it is clear that AppLovin is navigating through competitive markets with impressive agility. The company’s forward-looking estimates for the fourth quarter further exhibit this upward trajectory, projecting revenues between $1.24 billion and $1.26 billion—indicating a growth potential of around 31%. Unlike other firms that may stumble under pressure, AppLovin appears to be leveraging its strength in both gaming and advertising to maintain its momentum.

A significant portion of AppLovin’s recent windfall can be attributed to its advancements in AI technology, particularly through its AXON advertising engine. Launched last year, AXON’s updated 2.0 version has propelled targeted advertising to new heights, allowing more effective ad placements on the diverse mobile gaming platforms the company runs. This technological prowess does not merely serve internal applications; it has empowered outside studios as well, showcasing AppLovin’s capacity not just as a game maker but as an essential software provider in the advertising realm. A reported 66% rise in software platform revenue to $835 million showcases the potency of these innovations, further underpinning the company’s strong market position.

While revenue growth paints a picture of success, it is the profitability metrics that have captured Wall Street’s attention. AppLovin’s net income for the quarter soared by 300% to an astonishing $434.4 million, translating to earnings of $1.25 per share—a substantial leap from just $0.30 a year ago. The software platform achieving an adjusted profit margin of 78% is another indicator of the financial health and operational efficiency that investors crave. Analysts at Wedbush have taken note of these accomplishments, recommending the stock as a solid buy and bumping their price target from $170 to an ambitious $270.

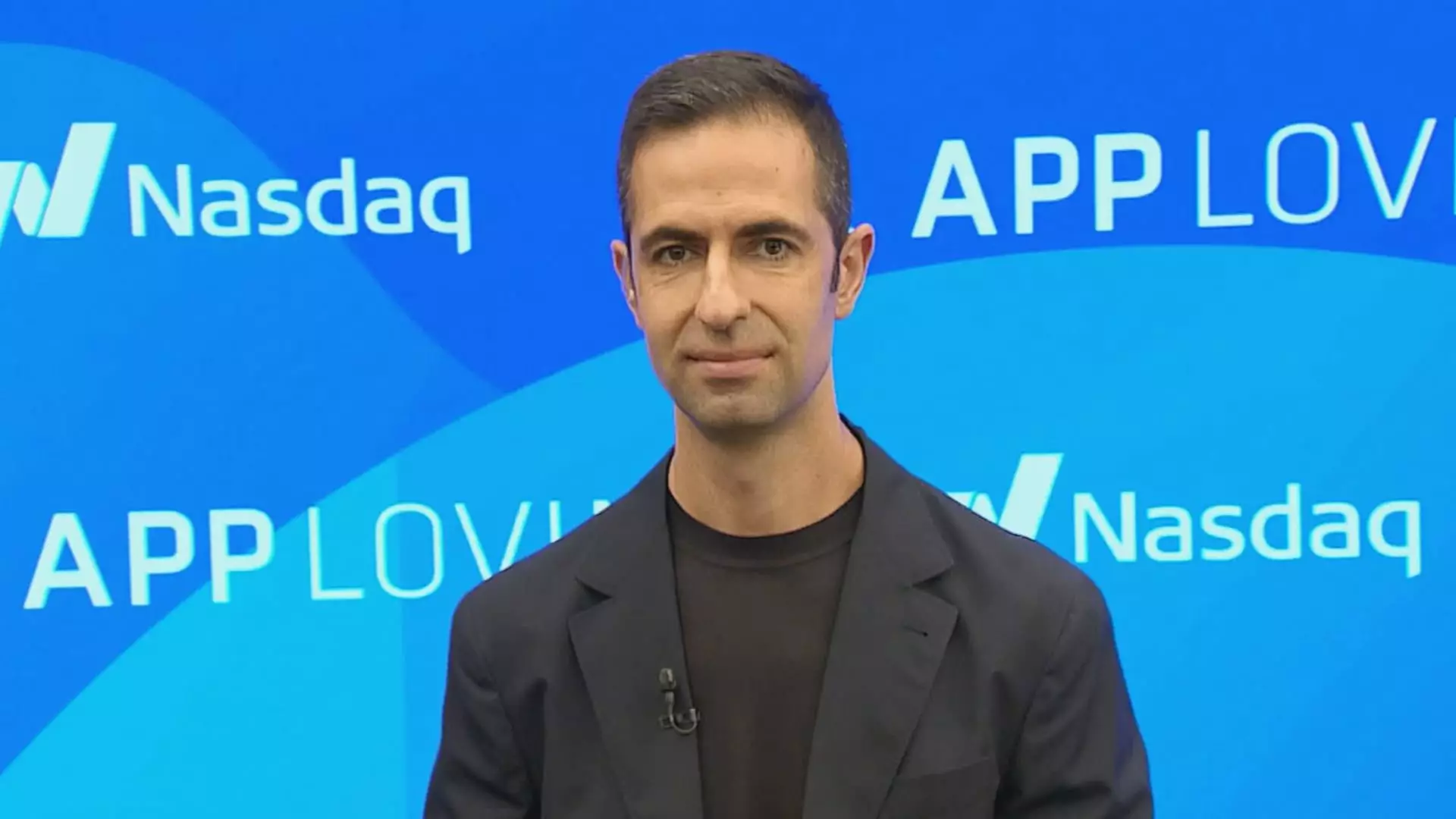

Moving forward, AppLovin remains committed to exploring new avenues for growth, including its pilot e-commerce project. This initiative aims to provide businesses with tailored advertising solutions within games—a development that CEO Adam Foroughi regards as one of the most innovative offerings the company has ever launched. His confidence in the project reflects AppLovin’s spirit of continuous improvement and adaptation in a landscape that is always evolving.

AppLovin emerges not just as a fleeting player in the tech space but as a solid foundation for continued growth and innovation. With abundant financial backing, a strong focus on AI-driven solutions, and an aspiration to expand into new markets, the company is poised for an exciting future. As it navigates the shifting tides of the technology industry, its performance will be one to watch—not just for its stakeholders but for the entire tech ecosystem.