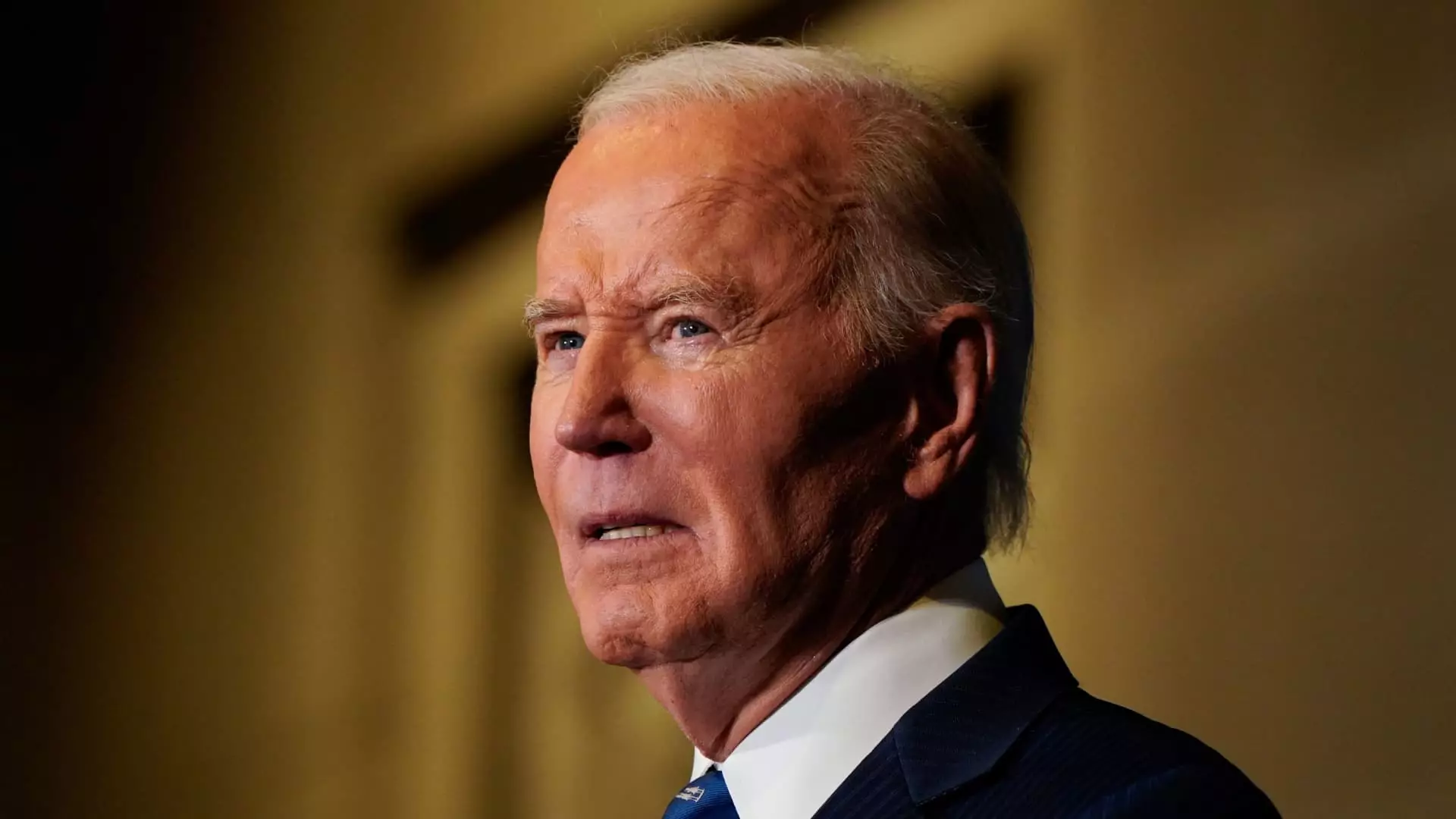

The landscape of student loan forgiveness has been a contentious issue over recent years, especially under the Biden administration. Following the Supreme Court’s rejection of a previous plan aimed at broad debt relief, the administration announced the termination of two critical initiatives designed to aid student loan borrowers. This decision not only underscores the challenges faced in implementing sweeping reforms but also highlights the uncertain road ahead for millions burdened by educational debt.

The recent withdrawal of proposed regulations by the Biden administration that could have relieved debts for various borrower groups signifies a significant setback in efforts to reform student loan forgiveness. These plans were intended to allow the Secretary of the U.S. Department of Education to cancel loans for borrowers who had been repaying their loans for decades or who were experiencing acute financial distress. According to the Education Department’s announcement, the withdrawal was attributed to “operational challenges” in integrating these proposals effectively.

This announcement came just weeks before the strengthening of a potential transition to a Trump administration, which is historically characterized by its opposition to student loan forgiveness programs. Experts like Mark Kantrowitz have suggested that the Biden administration’s expectations for these reforms may have been miscalculated, as they would likely face staunch opposition under the incoming administration. The thwarted plans brought forth questions regarding the Biden administration’s strategy and foresight in handling the complexities surrounding student debt relief.

The actions of the Education Department have drawn considerable dismay from consumer advocates and policy experts alike. Persis Yu, a prominent figure in the Student Borrower Protection Center, emphasized the detrimental effects these cancellations would have on millions of borrowers. By not moving forward with the plans, a significant opportunity to enhance economic mobility and reduce financial burdens was lost. This sentiment is echoed by various financial experts who express concern over how these developments will affect individuals transitioning back into repayment after a moratorium on payments during the pandemic.

Moreover, Elaine Rubin from Edvisors articulated the fear among borrowers about the future of their loans under an administration that may not prioritize debt relief. The sentiment among borrowers is one of anxiety, as for many, student loans are a significant impediment to financial stability and prosperity.

Despite the cancellation of new initiatives for broad loan forgiveness, the Department of Education has reaffirmed its commitment to existing programs such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF). Under PSLF, individuals working in public service organizations qualify for relief after making ten years of consistent payments, while TLF offers up to $17,500 in forgiveness for educators serving in low-income schools.

However, reliance on these programs alone raises questions about their reach and effectiveness. Experts warn that while these programs are legally grounded, their scope is limited compared to the potential of newly proposed regulations. Rubin has noted that doubts linger regarding the durability of PSLF, emphasizing that any efforts to eliminate such provisions would necessitate congressional action.

As the Biden administration winds down, advocates for student loan forgiveness must remain vigilant. The existing relief options continue to offer some respite, but many argue for the need for comprehensive reform that addresses the systemic issues underpinning the national student debt crisis. Tools like Studentaid.gov and state-specific databases compiled by the Institute of Student Loan Advisors provide borrowers with resources to navigate their options, yet the pathway to substantive reform remains fraught with political obstacles.

As discussions about student debt persist, it is crucial for future administrations and lawmakers to recognize education as a fundamental right, rather than a financial burden, and to underscore the impact of these debts on entire generations. The cancellation of the two major plans signals not just a pause in presidential efforts, but potentially a turning tide that could influence the direction of student loan policy for years to come. Advocates must continue to rally support, calling for policies that prioritize borrower relief, and ensuring that the conversation about student debt does not dissolve with the change of administration.