The recent nomination of Donald Trump for former Missouri congressman Billy Long to lead the Internal Revenue Service (IRS) has stirred a pot of complexities and controversies within the political and financial arenas. This appointment could signify a radical pivot for the agency, which is in the process of an extensive overhaul, although it raises questions about the ethical implications and operational capabilities of the IRS moving forward.

With a hefty congressional budget of nearly $80 billion recently allocated for the IRS, which was sanctioned to enhance customer service, technology, and taxpayer assistance programs, the nomination of Long points toward a potential reevaluation of priorities within the agency. Trump’s plan to potentially displace current IRS Commissioner Daniel Werfel, appointed by President Biden, showcases a willingness to disrupt the status quo in favor of a leadership that reflects Trump’s personal and political ideologies. Under the previous leadership, the mission of the IRS concentrated heavily on enforcing compliance among wealthier taxpayers and complex corporate structures. Whether Long can maintain this focus amidst criticism is a pivotal query for many stakeholders.

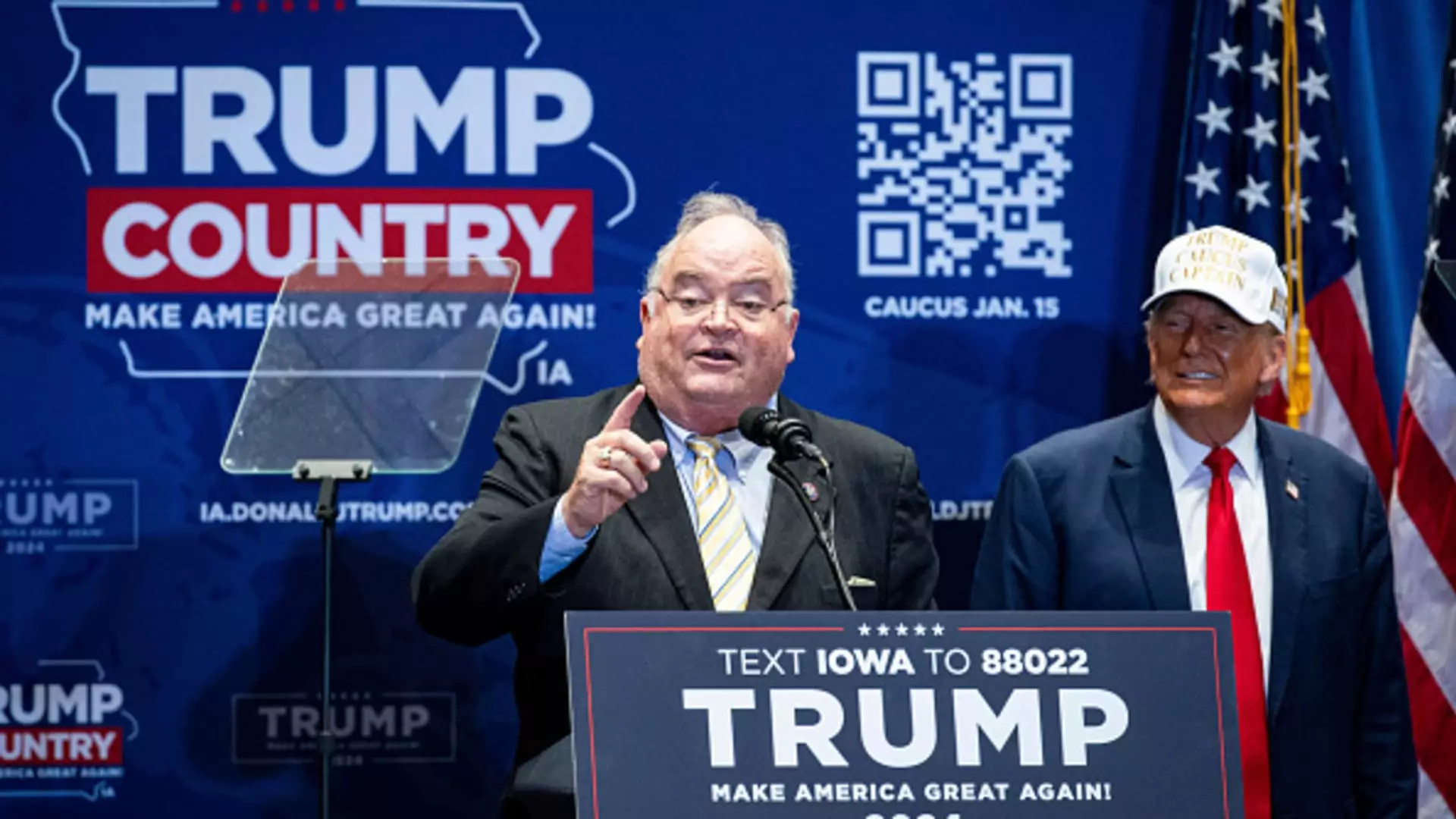

Long, having transitioned from his role as an auctioneer to becoming a six-term member of Congress, is characterized by his supporters as possessing a diverse set of experiences that may lend themselves to this new role. Trump emphasized Long’s business background and experience in navigating tax compliance, but the intricate nature of the IRS’s functions may require more than just legislative familiarity.

Many expressed concern regarding Long’s previous engagement in industries alleged to have exploitative ties, particularly concerning the Employee Retention Tax Credit (ERTC). Critics argue that his involvement in this area reflects poorly on his suitability for the IRS role, citing the notable scrutiny surrounding improper claims linked to the ERTC—a pandemic-era initiative meant to bolster struggling businesses. In a statement, Senate Finance Committee Chair Ron Wyden remarked on the “bizarre” nature of Long’s candidacy, stating that his notion to jump straight from Congress into a field riddled with allegations of scams raises alarm bells.

This narrative is underscored by the historical context of the IRS’s mission, which has faced challenges in rebuilding trust and respect since previous administrations. Long’s ability to foster a credible and constructive relationship with both the public and the agency’s employees will not only impact IRS operations but also its image in the broader scope of government agencies.

Across the aisle, reactions within the Senate highlight a palpable schism regarding the confidence placed in Long. While some Republicans, including Sen. Mike Crapo, express optimism about Long’s potential to mitigate IRS overreach and inefficiencies, Democrats remain apprehensive. This divided sentiment suggests that Long’s leadership will be scrutinized intensely from both sides, making it a high-stakes position fraught with political ramifications.

Previously installed leaders, both Democratic and Republican, have grappled with operational challenges that include taxpayer privacy issues and bureaucratic inefficiency. Reforming the agency’s internal dynamics will require a delicate balance of adhering to legislation while cultivating a workplace culture that prioritizes taxpayer rights and service efficiency—a task that is decidedly diminished under a wave of partisan politics.

The Future of the IRS Under Long’s Leadership

If confirmed, Long’s leadership will emerge amidst this backdrop of tension and expectation, bearing the weight of comprehensive changes yet to unfold. The prospects for innovation in customer service and technological enhancements within the IRS hinge on his ability to marry his legislative acumen with the needs of a complex federal agency. Whether Long can transcend the immediate partisan critiques and align himself with the IRS’s goal of integrity, transparency, and taxpayer service remains to be seen.

As conversations surrounding tax reform and enforcement intensify, the IRS’s trajectory under the direction of Billy Long could serve as a bellwether for how governmental agencies adapt in an increasingly polarized environment. In a country where trust in public service is waning, Long’s role could either bolster confidence in the IRS as a necessary apparatus of democracy or reinforce skepticism surrounding governmental complicity in economic injustice. The unfolding saga invites scrutiny, with implications that extend far beyond the walls of Washington.