As the dynamics of wealth distribution continue to evolve globally, a significant trend has emerged: an increasing number of women now occupy the ranks of the world’s billionaires. According to the Altrata Billionaire Census, women constitute 13% of the total billionaire population, a noteworthy step towards gender parity. Although this percentage may seem minimal, it reflects a gradual increase over the past decade, highlighting the impact of changing societal norms and the growth of female entrepreneurship. Women are not only accumulating wealth but are also redefining what it means to be part of this elite class, both in business and philanthropy.

Inheritance: The Backbone of Female Billionaires

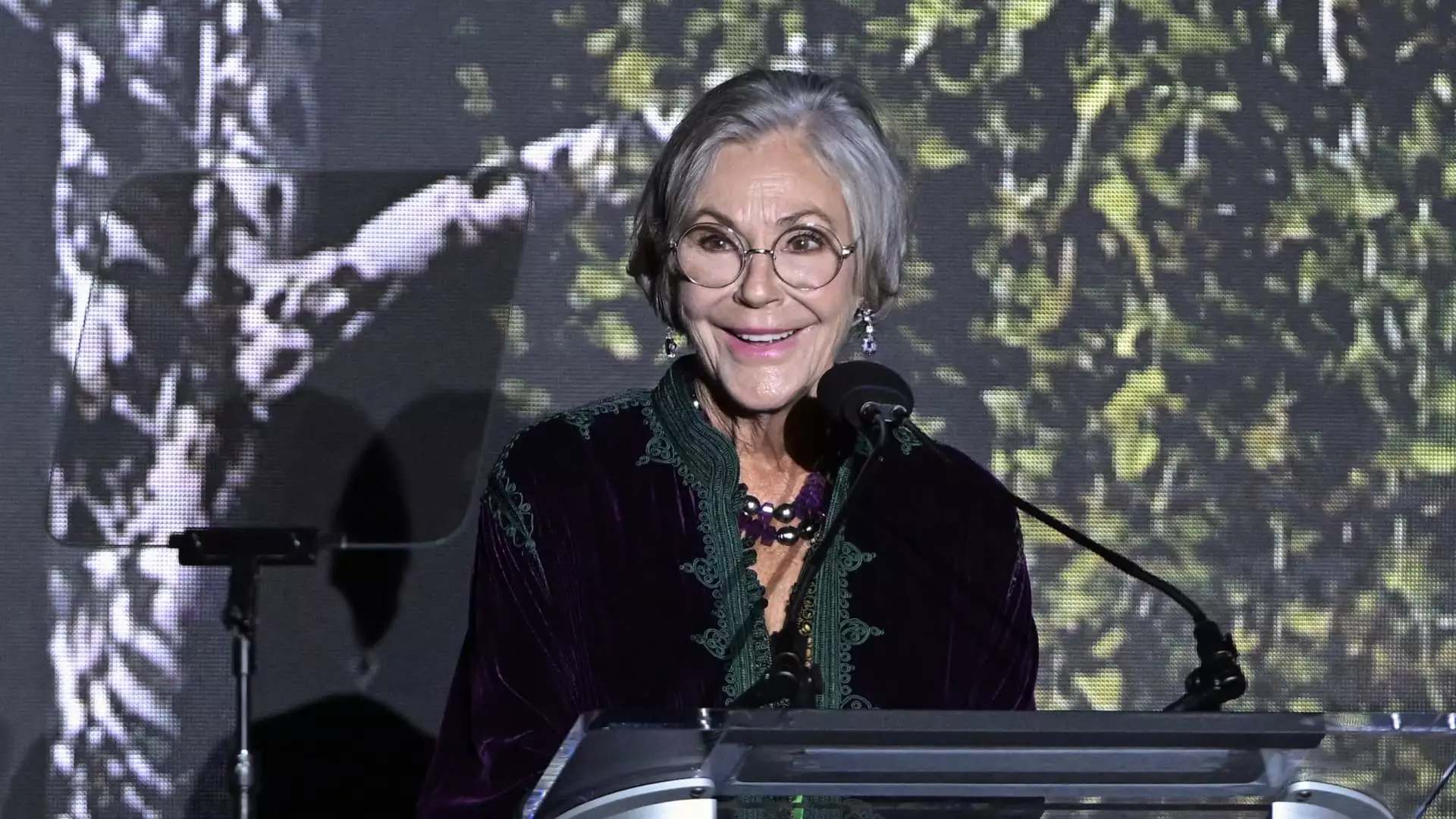

A striking finding from the report indicates that inheritance plays a pivotal role in the wealth of female billionaires. Approximately 75% of female billionaires have obtained part of their fortune through inheritance, with 38% inheriting their entire wealth. This stands in stark contrast to their male counterparts, where only 5% rely solely on inherited wealth. Prominent figures such as Alice Walton and Françoise Bettencourt Meyers exemplify this trend. While inherited wealth continues to be a significant source of income for women, it raises questions about the sustainability of wealth creation within this demographic. As the impending Great Wealth Transfer is projected to result in women inheriting up to $30 trillion, the ability to translate this wealth into active business ventures remains to be seen.

The approach to philanthropy illuminates essential differences between female and male billionaires. Women are distinctly more inclined to prioritize charitable contributions and social organizations. Reports indicate that nearly 20% of female billionaires allocate most of their professional time to nonprofit efforts, compared to just 5% of their male counterparts. This disparity suggests that inherited wealth may foster a stronger inclination towards charitable engagement. The focus on philanthropy not only reflects personal values but also highlights a potential shift in priorities for future generations of wealthy individuals.

Distinct Financial Portfolios

Another significant divergence can be seen in the financial portfolios of female versus male billionaires. Women are more likely to possess wealth in private holdings and liquid assets, which comprise 35% and 39% of their portfolios, respectively. In contrast, men exhibit a tendency to invest more heavily in stocks, largely attributed to the surge of tech billionaires and public company founders. Furthermore, female billionaires invest more in luxury real estate and art, with a notable probability of owning properties exceeding $10 million. Such investment behavior hints at a broader tendency for women to favor aesthetic and long-term asset appreciation over the high-risk, high-reward investments more frequently pursued by men.

When it comes to personal interests and hobbies, the contrast between billionaire men and women becomes even more pronounced. Philanthropy stands out as the most favored pastime among 71% of female billionaires, whereas 71% of male billionaires cite sports as their primary interest. This divergence underscores different life experiences and values shaped by gender dynamics. Women’s affinity for areas like education and the arts suggest a focus on community and culture, while men gravitate towards traditionally masculine pursuits such as aviation and politics, revealing deeper societal constructs at play.

As more women ascend to billionaire status, their impact on wealth distribution, investment strategies, and societal contributions cannot be overstated. The increasing presence of female billionaires heralds a new era of philanthropy, shifting financial portfolios, and distinctive lifestyle choices that challenge longstanding stereotypes. As the landscape of wealth evolves, so too will the ways in which it is used to address societal issues and encourage further female participation in wealth creation. This ongoing transformation offers promising implications for future generations aiming to break through glass ceilings and redefine success in the realm of high-net-worth individuals.