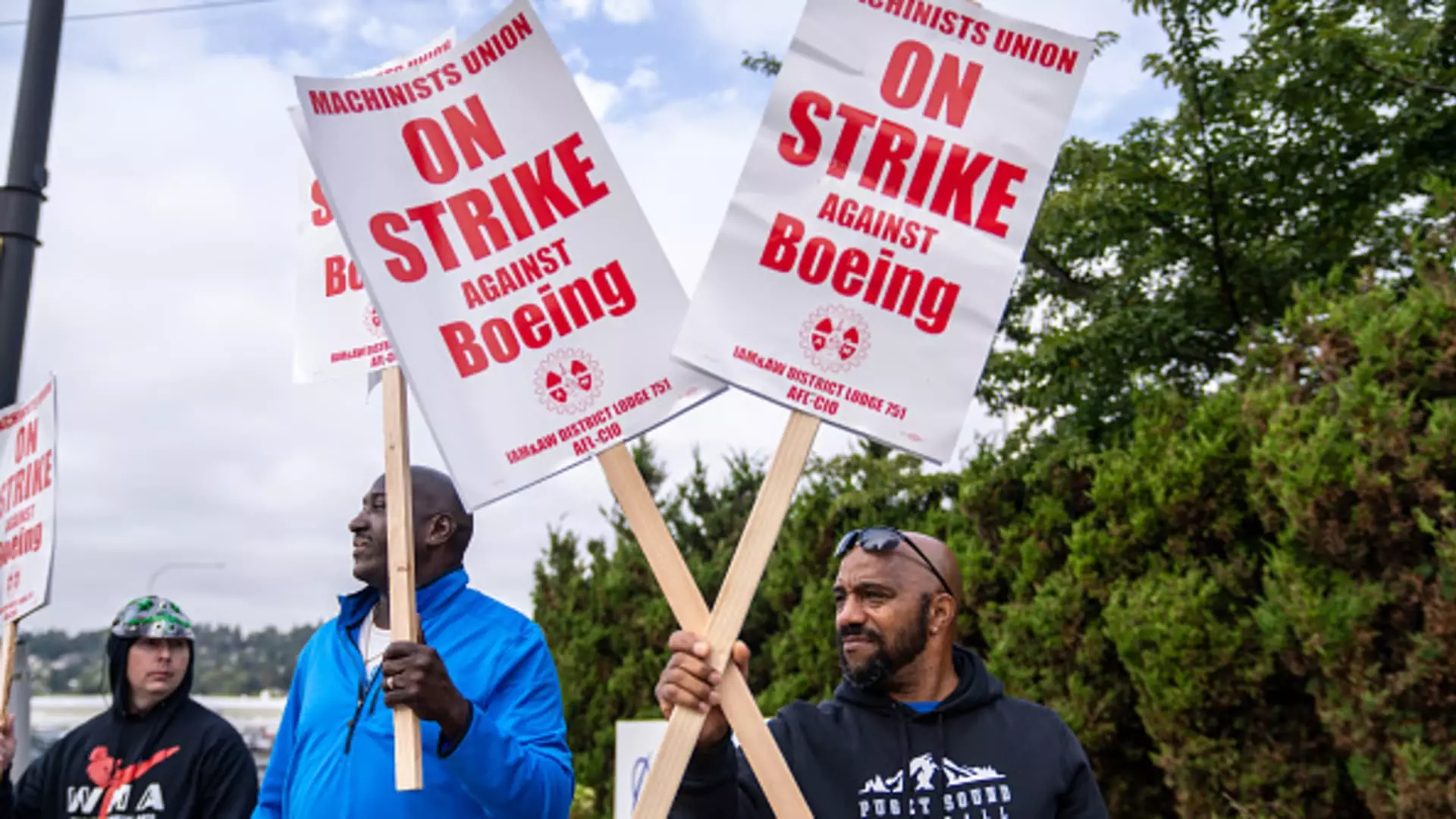

In recent weeks, Boeing has been reeling from the impact of a major labor strike involving over 30,000 machinists who opted to walk off the job following a resounding rejection of a proposed contract. This action has not only intensified cost pressures but also exacerbated an array of ongoing problems the aerospace giant has faced, especially under the newly appointed CEO, Kelly Ortberg. The company’s recent difficulties began with significant technical mishaps, including a near-catastrophic incident with a 737 Max door plug, and are compounded by the fallout from two tragic accidents linked to the Max model. As Boeing navigates this tumultuous phase, the ramifications of the labor dispute loom large, raising concerns about its ability to recover financially and operationally.

Estimates from S&P Global Ratings suggest that the ongoing strike is costing Boeing upwards of $1 billion each month. This staggering figure underscores the urgent need for a resolution as halted production disrupts cash flow and puts additional strains on an already beleaguered company. With multiple plant locations across the Seattle area and beyond idled, the production lines for vital aircraft models have ground to a halt. Just when optimism seemed to be building towards reaching an agreement with union negotiators, the situation took a downturn when employees voted overwhelmingly—95% against—an initial labor deal. The company was caught off guard, especially considering its hopeful communication with airline customers prior to the vote.

The negotiations have reached a critical and challenging impasse. Recent federal mediations have stalled, and Boeing accuses the International Association of Machinists and Aerospace Workers of negotiating in bad faith. These accusations further cloud the prospect for fruitful discussions and may prolong the strike, as union representative Jon Holden called for a need to foster a constructive dialogue rather than threaten workers with intimidation tactics. This tension in negotiations reflects not only the severity of the current economic climate for Boeing but also the workers’ steadfast demand for their rights and the need for increased benefits.

For the striking machinists, the financial toll is harsh: without paychecks, many confront mounting difficulties as company-backed health insurance ceased at the end of September. However, the landscape of job opportunities is somewhat less daunting than during the last major strike in 2008, as various alternative jobs in the Seattle area have emerged, providing some relief for affected workers. Union communication channels have begun advertising available positions in sectors like food delivery, indicating a willingness to adapt to immediate economic challenges.

Boeing has announced plans to significantly reduce its workforce by around 10% in the coming months, which includes job cuts across various levels, from executives to entry-level employees. Moreover, the company has suspended the production of commercial 767 freighters and pushed back the much-anticipated delivery time of the 777X by an additional year. This decision comes as preliminary financial reports indicated deepening losses, with an expectation of nearly $10 losses per share for the third quarter. Boeing has not seen a profit since 2018, highlighting the severity of the situation.

As Ortberg gears up for his first earnings call, the pressure mounts to assuage investors who have seen Boeing’s stock plunge by approximately 42% this year—the most serious decline since the 2008 financial crisis. Industry experts suggest that a resolution to the strike combined with stabilization in 737 production could potentially restore some financial health to the company. Yet, the current layoffs jeopardize this very stability. Unless productive negotiations can resume and technological competencies realign swiftly, the challenges ahead for Boeing will not only ripple through its ranks but could also severely affect its suppliers such as Spirit AeroSystems.

The company now grapples with the daunting task of regaining its footing while addressing broad operational issues, labor disputes, and restoring investor confidence. The stakes could not be higher: as the aerospace sector moves forward from pandemic-induced upheaval, Boeing’s ability to emerge from this crisis will likely determine its future in an increasingly competitive marketplace. The resilience of the company’s workforce and its leadership will be key in navigating this tumultuous era while working toward a sustainable recovery.