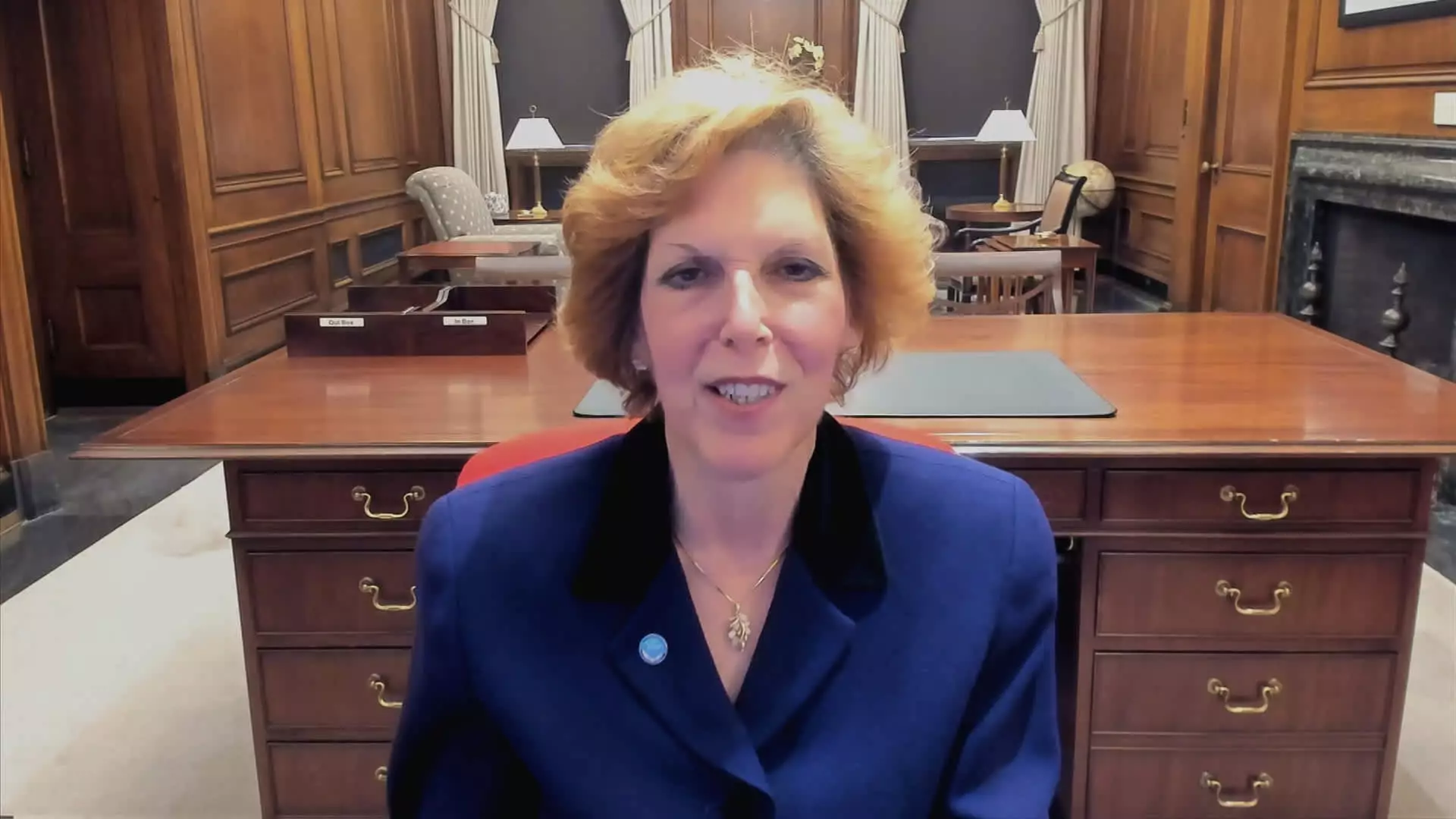

Cleveland Federal Reserve President Loretta Mester expressed her belief in the possibility of interest rate cuts later in the year, indicating a higher long-run path than previously anticipated by policymakers. Despite the progress in inflation and continuous economic growth, Mester refrained from offering specific guidance on the timing or extent of the expected rate cuts. She emphasized the need for further data to strengthen her confidence in the downward trajectory of inflation towards the 2% target over time.

Market Speculations and Projections

Mester’s comments, which exclude the upcoming policy meeting in May, align with the market’s anticipation of future rate cuts. While the Federal Open Market Committee had recently voted to maintain the key overnight borrowing rate, futures traders are projecting a reduction of three-quarters of a percentage point by the end of the year, with expectations of easing to begin in June. San Francisco Fed President Mary Daly also supports the notion of three rate cuts this year, highlighting it as a plausible baseline projection.

Mester’s foresight on the long-run federal funds rate above the traditional expectation of 2.5% reflects a cautious approach to policy calibration amidst economic fluctuations. She identified the neutral rate at 3%, emphasizing the necessity for policy adjustments that neither constrain nor exaggerate economic activities. This strategic stance aims to provide the Federal Reserve with the flexibility to respond effectively to changes in the economic landscape without resorting to drastic measures.

As a voting member of the Federal Open Market Committee set to depart in June, Mester’s perspectives on inflation progress and the overarching monetary policy framework serve as crucial considerations for future policy decisions. While the prospect of rate cuts remains a possibility, contingent upon inflation data and economic trends, Mester’s emphasis on informed decision-making underscores the importance of data-driven policies aimed at sustaining economic stability and growth.

Cleveland Federal Reserve President Loretta Mester’s outlook on interest rate cuts, inflation dynamics, and long-run policy rates reflect a nuanced approach to monetary policy formulation. By prioritizing data accuracy and economic indicators, Mester’s projections align with market expectations while emphasizing the need for flexibility and prudence in policy adjustments. As the Federal Reserve navigates through evolving economic conditions and policy considerations, Mester’s insights offer valuable perspectives for informed decision-making and forward-looking monetary policy strategies.