In a move that has caught the attention of investors, Costco has expanded its inventory to include Swiss-made platinum bars. This strategic decision highlights the wholesaler’s keen interest in the lucrative precious metals market. Initially, Costco introduced gold bars to their offerings in August 2023, and the demand was overwhelming, demonstrating a clear appetite for alternative investments among consumers looking to safeguard their wealth amidst economic uncertainties.

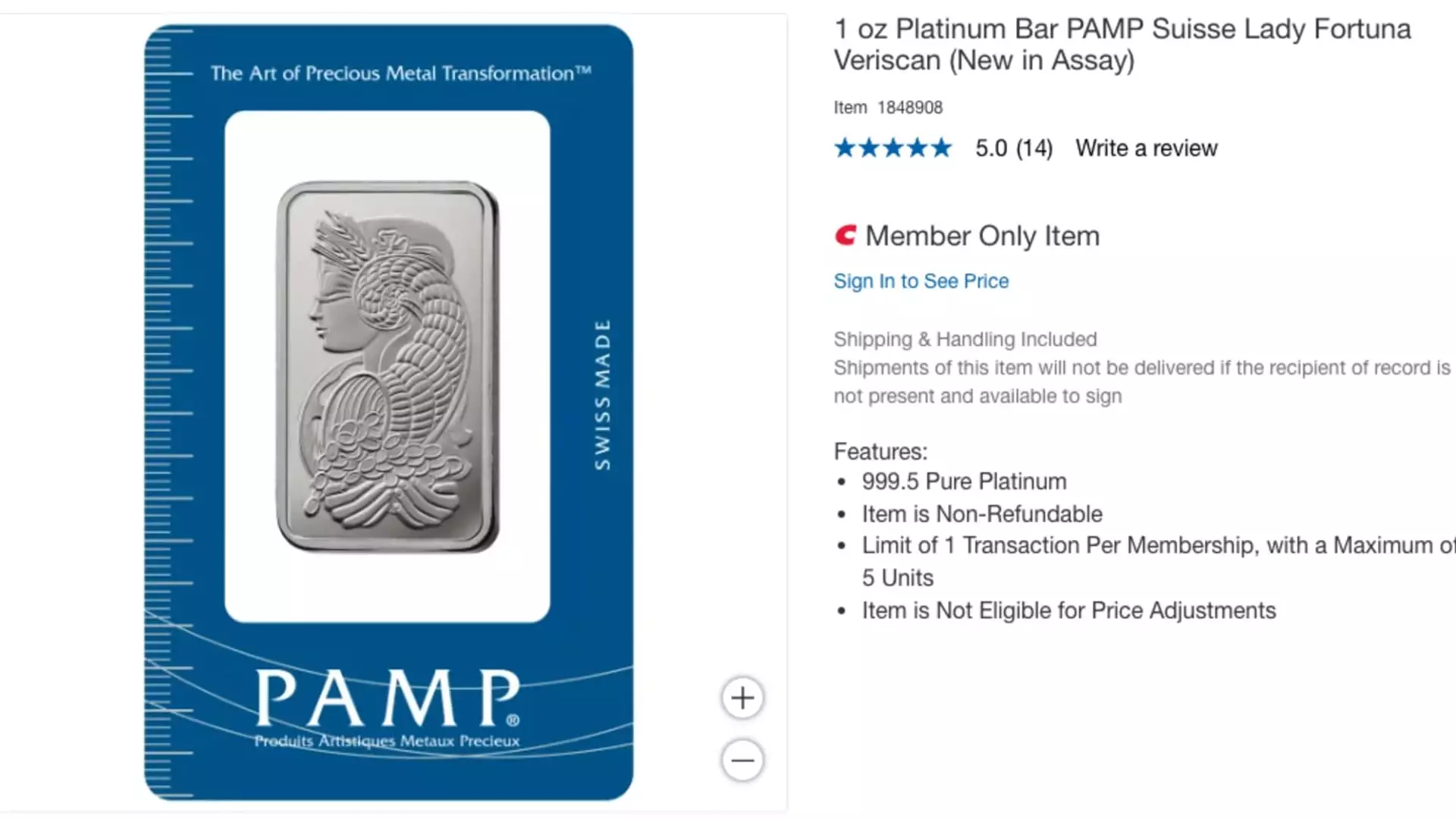

The 1-ounce platinum bars are priced at $1,089.99 and are available exclusively online. However, the purchase comes with restrictions, as these bars cannot be shipped to customers in Louisiana, Nevada, or Puerto Rico. Additionally, prospective buyers must possess a Costco membership, which ranges between $65 and $130 annually—an added barrier that indicates Costco’s intention to cater to a specific clientele willing to invest in high-value assets.

The precious metals market has seen a significant resurgence, particularly due to soaring gold prices. Reports indicate that Costco was selling an impressive $200 million worth of gold bars monthly as of April 2023, which sets the stage for a compelling narrative about consumer confidence in tangible assets. The company’s chief financial officer remarked on the rapid turnover of gold bars on the website, confirming that they are often out of stock shortly after being restocked, with a limit of two bars per member.

This high demand mirrors a broader trend—investors are increasingly turning to precious metals for portfolio diversification. Gold has demonstrated incredible resilience, with a more than 40% increase in value over the past year and an impressive 70% surge over five years. In contrast, platinum values have been more volatile, experiencing both an uptick of over 15% in the past year and a notable decline of around 8% from earlier 2024 peaks.

While Costco’s foray into precious metals appears promising, potential investors should exercise caution. The volatility inherent in platinum prices raises questions about long-term value retention compared to gold. Although gold has shown consistent growth, the fluctuating nature of platinum could deter some investors looking for stable returns.

Moreover, the limitations on shipping and the requirement for a Costco membership might also restrict access for some interested parties, impacting overall sales volume. As the market continues to evolve, it will be essential for Costco to monitor consumer trends closely and remain adaptable to shifts in the economy and investor behavior.

Costco’s move into the precious metals market is a calculated step towards providing its members with alternative investment opportunities amidst a backdrop of economic uncertainty. While the initial response to gold and platinum bars has been overwhelmingly positive, ongoing analysis and strategic adjustments will be crucial as market dynamics continue to play out. How Costco navigates these waters could very well set a precedent for other retailers considering similar expansions into precious metals.