Oracle Corporation recently demonstrated substantial growth in the tech market with its shares experiencing a remarkable 6% increase during extended trading hours. This rise was sparked by the company’s announcement of an upgraded revenue guidance for fiscal 2026, setting expectations at a minimum of $66 billion—outpacing analysts’ estimates of $64.5 billion. Notably, Oracle’s stock has soared by approximately 15% over the past three trading sessions, achieving record levels following the release of quarterly results that exceeded market expectations.

This impressive performance places Oracle in a strong position within the competitive landscape of large-cap technology stocks, with a year-to-date surge of 55%. While the company has largely flown under the radar compared to giants like Nvidia, its recent achievements signal a promising trajectory fueled by strategic investments and partnerships.

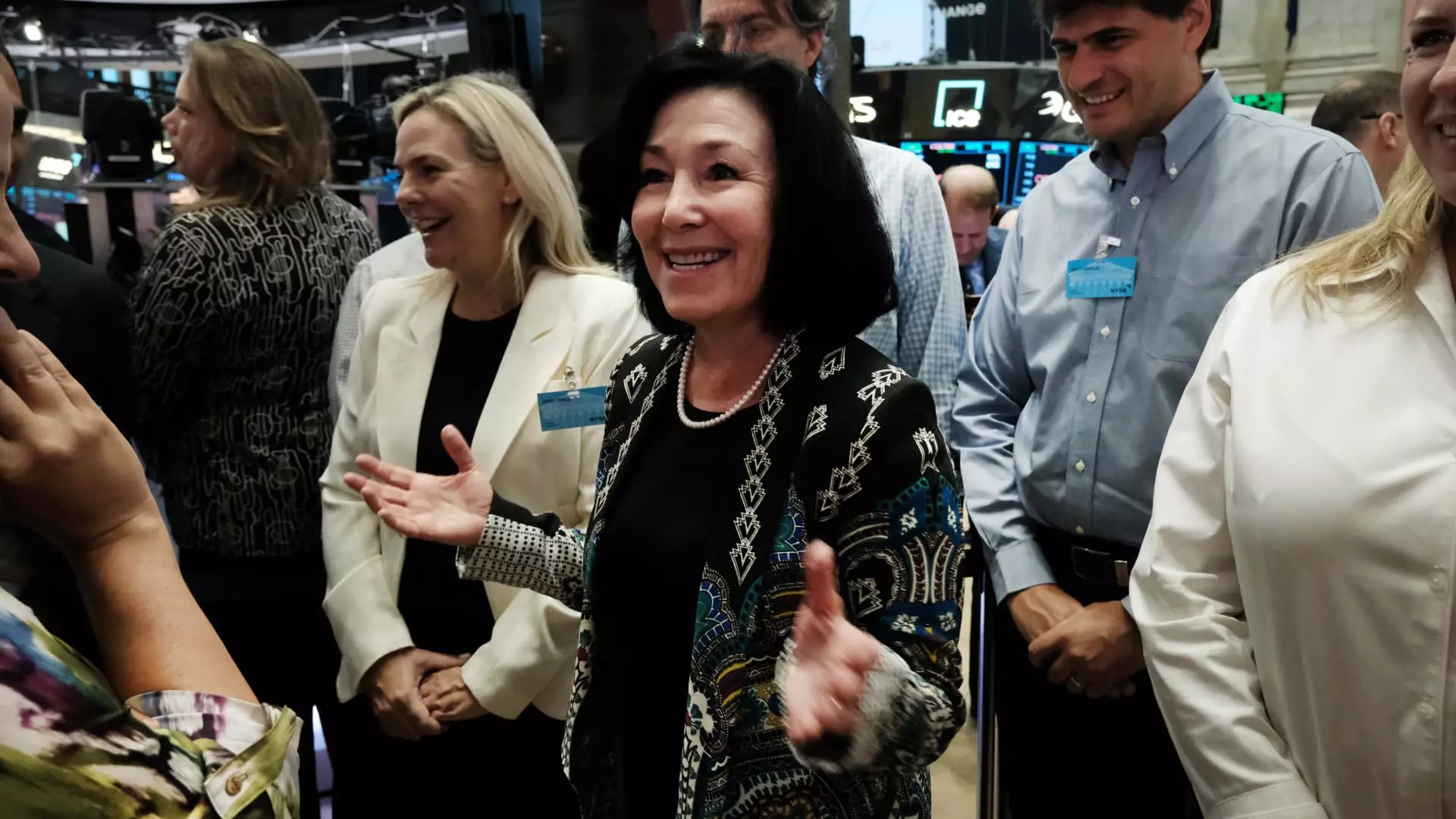

At an analyst meeting held concurrently with the Oracle CloudWorld conference in Las Vegas, CEO Safra Catz unveiled a bold vision for the company’s future. Looking ahead, Oracle projects that by fiscal 2029, it will generate over $104 billion in revenue, with a commendable year-over-year growth rate for earnings per share of 20%. Catz’s confident assertion, “Those numbers should not be a problem. At all,” underscores her belief in the company’s operational capabilities and market position.

A crucial element of Oracle’s strategy lies in its relationships with leading cloud providers, such as Amazon, Google, and Microsoft. These partnerships facilitate the seamless integration of Oracle’s database software across high-tier platforms, significantly expanding its market reach. The recent announcement of collaboration with Amazon further emphasizes this commitment, positioning Oracle to harness the growing demand for cloud services.

Cloud Infrastructure and AI Growth Potential

As enterprises increasingly migrate workloads from on-premises data centers to the cloud, Oracle’s cloud infrastructure revenue has surged by an impressive 45% in the last quarter, a growth rate that surpasses that of its major competitors—Amazon, Google, and Microsoft. This growth is not merely a reflection of shifting market trends but also highlights Oracle’s effectiveness in capitalizing on the ongoing digital transformation.

Additionally, Oracle’s foray into artificial intelligence (AI) marks a critical step in its evolution. The company has begun accepting orders for a cluster of over 131,000 next-generation “Blackwell” graphics processing units (GPUs) from Nvidia, positioning itself to play a pivotal role in the burgeoning AI sector. This strategic investment not only augments Oracle’s technological capabilities but also enhances its competitiveness in an industry where AI is rapidly becoming a cornerstone of innovation.

In conjunction with its ambitious revenue goals, Oracle is poised to double its capital expenditures in the current fiscal year. This commitment to significant investment reflects a proactive approach to fostering growth and ensuring that the company remains ahead of its competitors. By focusing on infrastructure expansion and technological innovation, Oracle is set to enhance its cloud offerings and further solidify its position in the tech ecosystem.

Oracle’s recent financial advancements and projections reveal a company on the brink of significant expansion. With robust partnerships, a focus on AI, and considerable planned investments, Oracle appears to be well-equipped to navigate the evolving landscape of technology and continue its impressive growth trajectory.