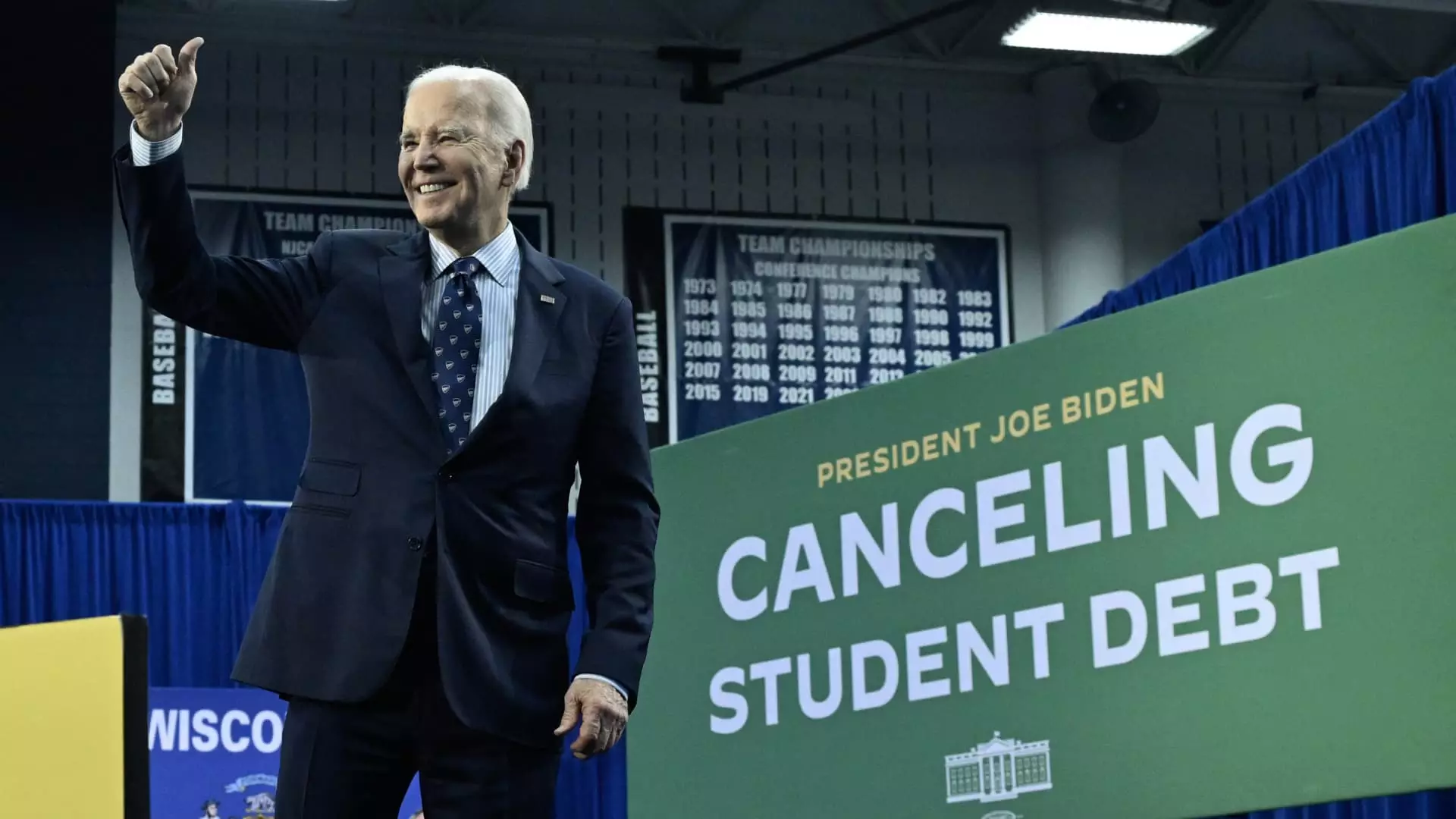

The 10th Circuit U.S. Court of Appeals has granted the Biden administration’s request to stay an order that temporarily blocked a provision of its Saving on a Valuable Education (SAVE) plan last week. This decision comes as a major win for President Biden and his efforts to deliver relief to student loan borrowers. The SAVE plan has been hailed as his biggest accomplishment in this regard, with approximately 8 million borrowers already signed up for the new income-driven repayment plan.

Under the SAVE plan, many borrowers only pay 5% of their discretionary income towards their debt each month, with those making $32,800 or less having a $0 monthly payment. This is a significant reduction compared to other income-driven repayment plans where borrowers pay 10% or more of their discretionary income. The recent appeals court ruling will now allow the Biden administration to move forward with lowering borrowers’ monthly payments, providing much-needed relief to those struggling with student loan debt.

Despite this positive development, the SAVE plan has faced legal challenges from Republican-led states, resulting in preliminary injunctions from federal judges in Kansas and Missouri. These states have argued that the Biden administration is overstepping its authority with the plan, accusing it of trying to forgive student debt through a roundabout way after a previous sweeping plan was struck down by the Supreme Court. While the decision from Kansas has been overturned, the injunction from Missouri remains in effect, preventing the administration from forgiving student debt at this time.

The legal battles surrounding the SAVE plan highlight the complexities and challenges of implementing comprehensive student loan relief measures. As the Biden administration continues to navigate these hurdles, it is crucial for policymakers to find solutions that balance the needs of borrowers with legal requirements and political opposition. Moving forward, the Justice Department is expected to appeal Missouri’s decision, seeking to overcome the remaining obstacles in the path towards providing significant relief to student loan borrowers.

Overall, the recent developments in the legal challenges against the Biden administration’s student loan relief plan demonstrate the ongoing struggles and controversies surrounding efforts to address the nation’s student debt crisis. Despite the setbacks and opposition faced, the Biden administration remains committed to providing relief to millions of borrowers burdened by student loan debt.