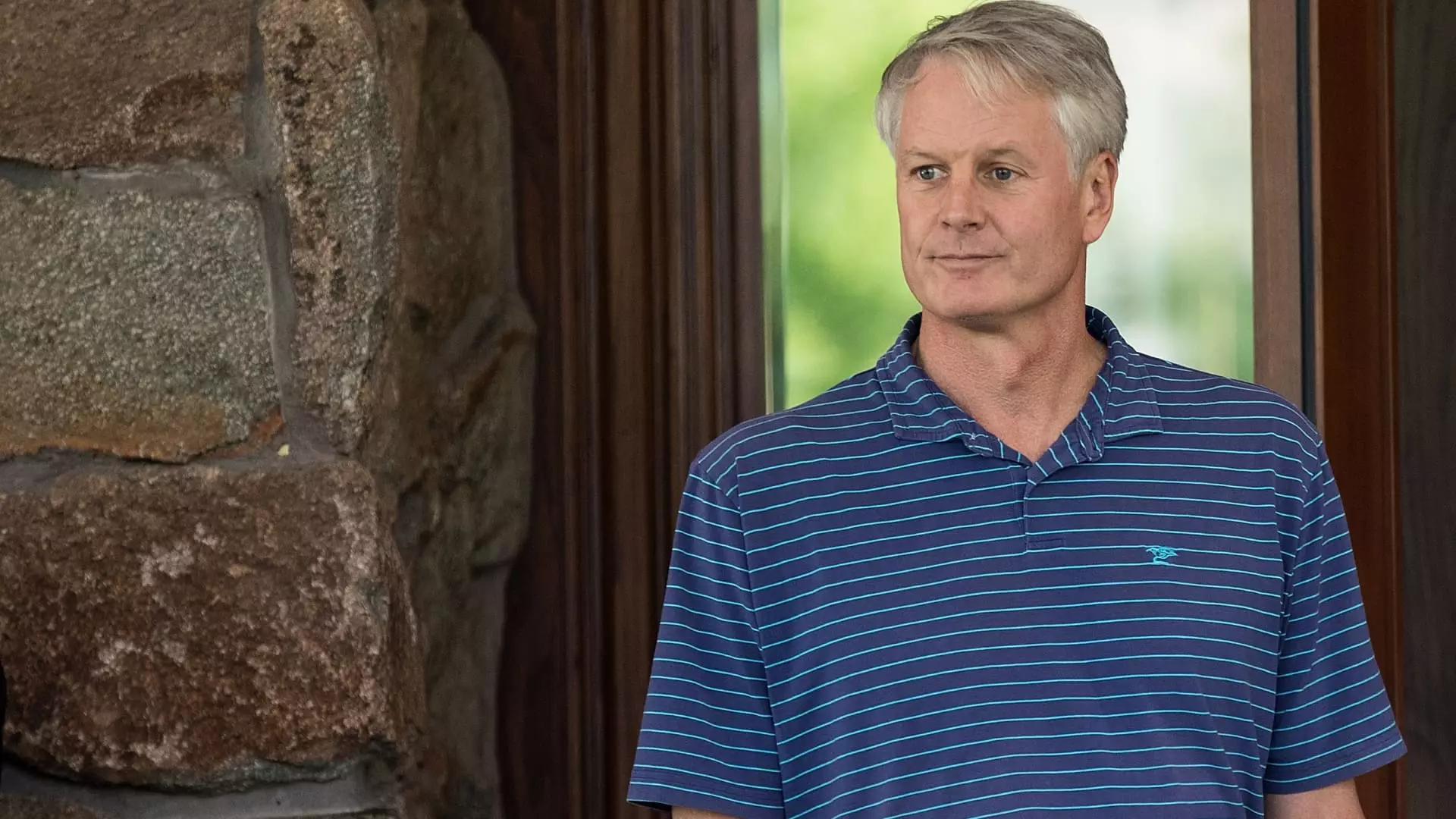

Nike’s CEO, John Donahoe, is currently facing a significant loss of confidence from Wall Street after a less than stellar fiscal year. The company recently warned of a 10% decline in sales for the current quarter, which was much worse than anticipated by LSEG. This bad news comes on the heels of Nike posting its slowest annual sales gain in 14 years, excluding the impact of the Covid-19 pandemic. The sharp 20% drop in Nike’s stock value following the quarterly report has prompted at least six investment banks to downgrade the stock, with some questioning the credibility of the company’s management team.

Since Donahoe took over as Nike’s CEO, the company’s stock has plummeted by approximately 25%, vastly underperforming both the S&P 500 and the XRT retail-focused ETF. While some external factors like softness in China and forex headwinds contributed to the guidance cut, others were the result of internal issues created under Donahoe’s leadership. Nike’s decision to scale new styles, diminish classic franchises, and alienate key retail partners in favor of a direct-selling strategy has negatively impacted wholesale orders and alienated loyal customers, particularly in the sneaker market.

Nike now faces the challenge of winning back essential customers, particularly runners, who have turned to competitors like On Running and Hoka for fresh styles and innovations. The company’s focus on direct-selling at the expense of innovation has cost them market share in this crucial segment. Furthermore, the failure to adapt to changing consumer preferences post-pandemic has left Nike lagging behind its competitors. Analysts suggest that a change in management is necessary for the company to regain its competitive edge in the market.

Several analysts have speculated on the need for a change in Nike’s leadership, with suggestions that Donahoe’s contract may be up for renewal soon. Internal candidates within the company, as well as external candidates and competitors, are being considered for the CEO role. The consensus among analysts is that a change in leadership is required to address the company’s current challenges and align its strategies with evolving market trends.

In all fairness to Donahoe, he assumed the role of CEO during the early stages of the Covid-19 pandemic, dealing with store closures and remote work arrangements. Despite the decline in Nike’s stock value, the company has seen a significant increase in annual sales under Donahoe’s leadership. However, the overall sentiment on Wall Street and among analysts highlights the need for a more strategic and visionary leader to navigate Nike through its current challenges.

As the pressure mounts on John Donahoe to address the concerns raised by investors and analysts, the future of his leadership at Nike remains uncertain. The company’s ability to adapt, innovate, and regain market share will depend heavily on the strategic decisions made by its CEO and management team. Only time will tell if Nike can reclaim its position as a market leader in the sportswear industry under new leadership.